The Apple Vision Pro: Beyond the Hype, Facing Production Cuts and Market Realities

Estimated reading time: 15 minutes

Key Takeaways

- The initial excitement surrounding Apple Vision Pro and the promise of *spatial computing* has been met with news of significant **Apple Vision Pro production cuts demand**.

- Reports indicate Apple is drastically reducing production and may cease it entirely by the end of 2024, signaling a major slowdown after the initial launch buzz. (Sources: techloy.com, macrumors.com, appleinsider.com)

- The **Apple Vision Pro sales decline** is attributed to a high price point, a limited software ecosystem, and a lack of compelling use cases for the average consumer.

- The **impact of high price on tech adoption** is a critical factor, with the $3,500 price tag proving to be a major barrier to mainstream adoption.

- **Apple spatial computing challenges** include ergonomic issues, battery life, and the absence of a “killer app.”

- Current **VR headset market trends** show a strong consumer preference for more affordable devices, with mixed-reality headset demand still largely confined to niche segments.

- Apple’s production cuts may signal a strategic shift towards a more affordable model, influencing future pricing strategies across the VR/AR industry.

- Long-term success for spatial computing hinges on lower prices, robust software, and clearly defined value propositions.

Table of contents

- The Apple Vision Pro: Beyond the Hype, Facing Production Cuts and Market Realities

- Key Takeaways

- The Reality of Apple Vision Pro Sales Decline

- Unpacking Apple Spatial Computing Challenges

- Navigating the VR Headset Market Trends

- The Impact of High Price on Tech Adoption

- Future Outlook and Implications

- Final Thought/Call to Action

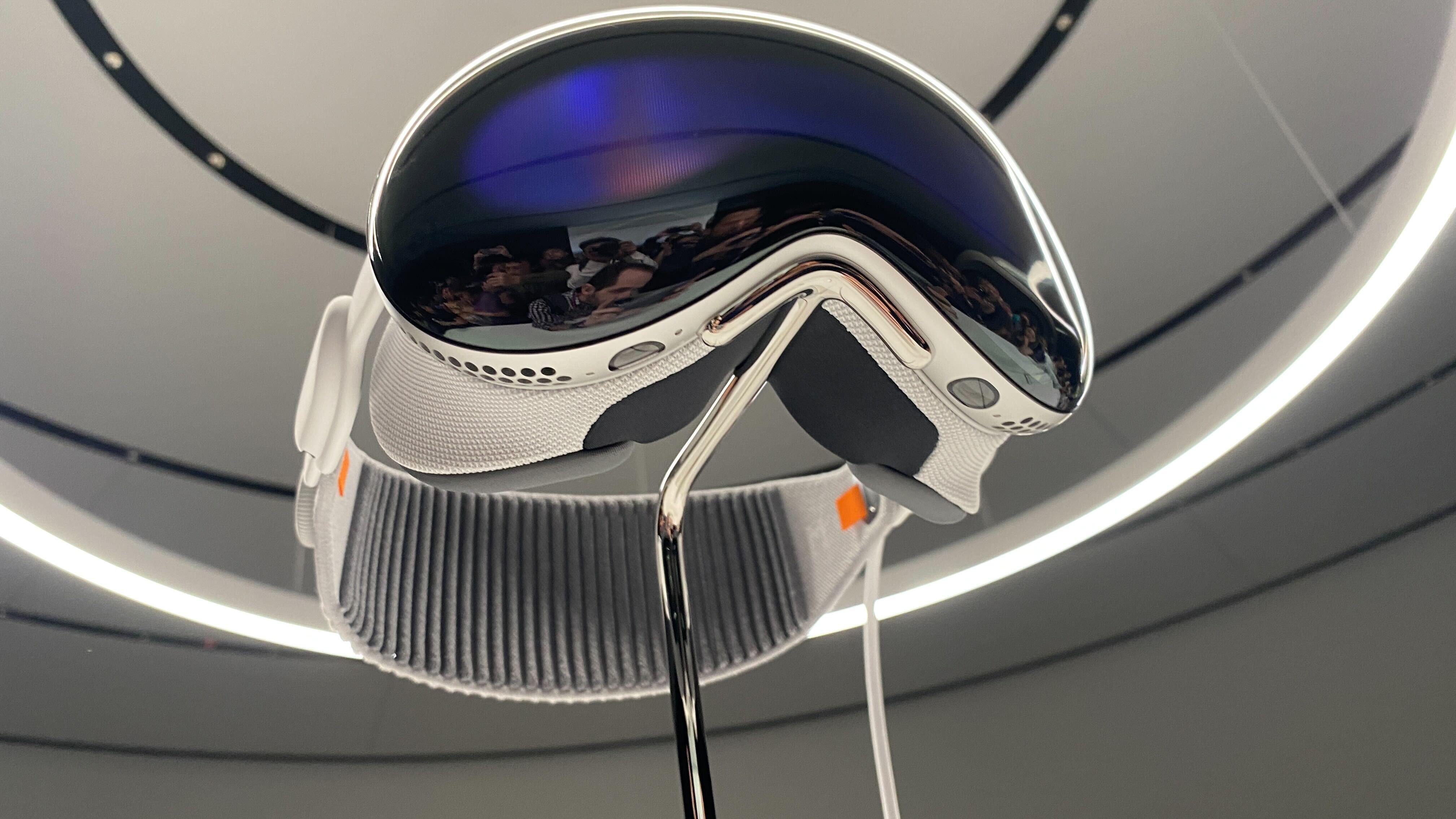

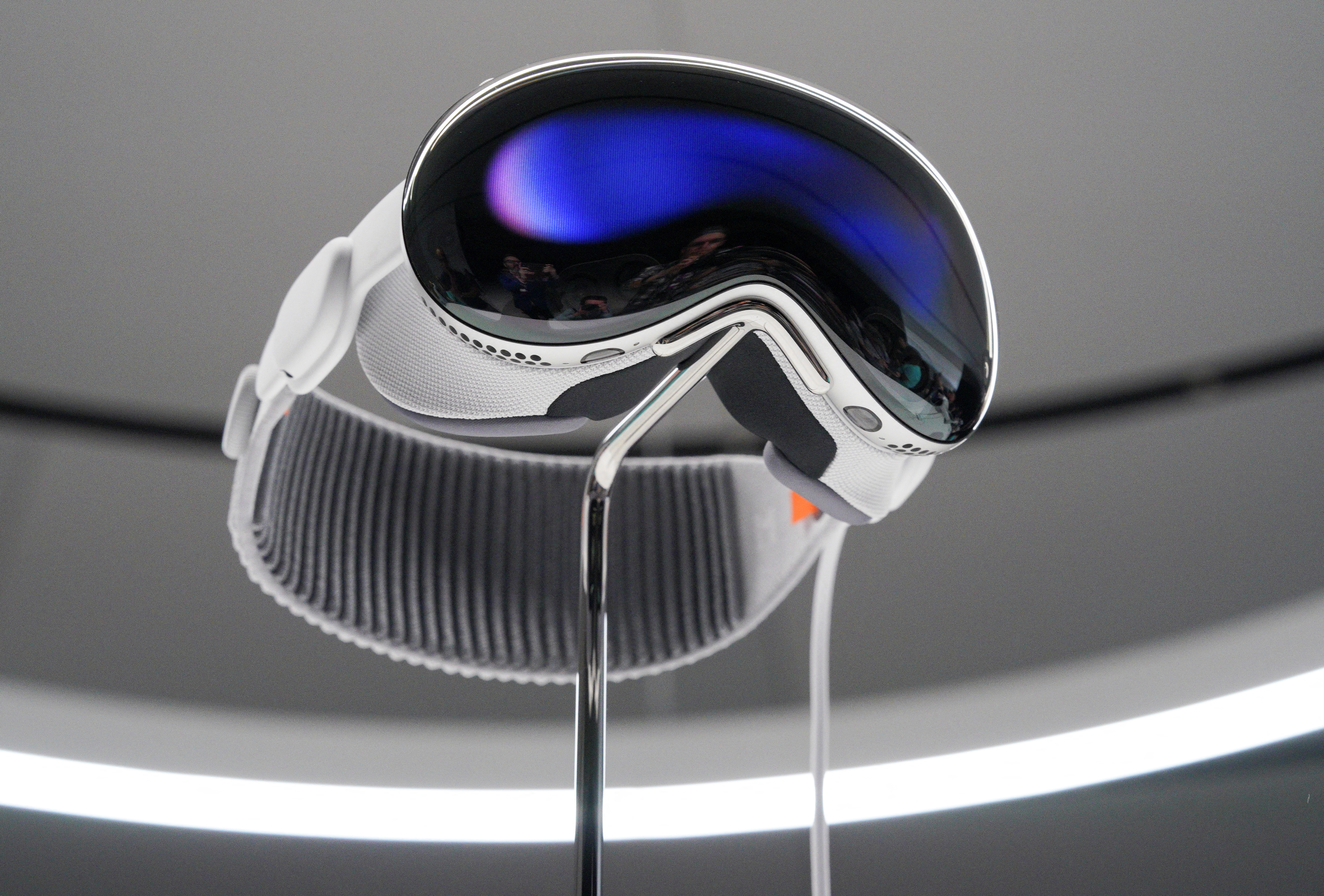

The launch of the Apple Vision Pro was heralded as a groundbreaking moment, a leap into the future of *spatial computing*. Apple, with its unparalleled brand loyalty and ecosystem, promised a device that would redefine how we interact with digital content and the physical world. The initial buzz was electric, fueled by sleek design, impressive technology, and the tantalizing prospect of a new computing paradigm. However, the narrative has shifted dramatically. Recent reports paint a starkly different picture, one of **Apple Vision Pro production cuts demand**, indicating that the revolutionary device is not flying off the shelves as perhaps anticipated. This significant slowdown, with projections of production winding down entirely by the end of 2024, raises crucial questions about the future of this ambitious product and the broader VR/AR market.

The Reality of Apple Vision Pro Sales Decline

The initial fanfare surrounding the Apple Vision Pro has been significantly tempered by reality. Reports from various sources paint a clear picture of an **Apple Vision Pro sales decline**. Production, which was initially set at a substantial daily rate, has reportedly been halved, with projections suggesting that manufacturing might cease altogether by the close of 2024. This drastic scaling back is a direct response to weaker-than-expected demand.

To put this into perspective, estimates suggest that only around 370,000 units were sold in the first three quarters following its launch. While this number might seem large in isolation, it pales in comparison to the sales volumes achieved by more accessible competitors in the VR and mixed-reality space. This stark contrast highlights a fundamental issue: the **impact of high price on tech adoption**.

At a staggering $3,499, the Apple Vision Pro positioned itself as a premium, first-of-its-kind device. However, this price point proved to be a significant barrier for mainstream consumers. For a technology that is still in its nascent stages, the cost of entry is simply too high for most, especially when the value proposition is not immediately obvious or compelling. This prohibitive price immediately restricted the Vision Pro to a very small, affluent segment of the market, rather than capturing the broader consumer base Apple typically aims for.

Beyond the price, another critical factor contributing to the sales decline is the limited software ecosystem and developer adoption. For any new platform to thrive, it needs a robust library of compelling applications and experiences. With a relatively small user base and an uncertain future for the device, developers have been hesitant to invest heavily in creating content for the Vision Pro. This scarcity of engaging apps, in turn, feeds into tepid user feedback. Without a clear “killer app” or a multitude of practical, everyday uses that justify the high cost, potential buyers are left wondering what exactly they would do with the device regularly.

This creates a challenging psychological and economic barrier. Consumers are naturally hesitant to spend a significant amount of money on a new, unproven technology, especially one that lacks established practical use cases or a clear, transformative benefit over existing devices. The Vision Pro, despite its technological marvels, has struggled to overcome this hurdle, leading directly to the production cuts and the current slump in sales.

Unpacking Apple Spatial Computing Challenges

The dream of *spatial computing* as envisioned by Apple faces several inherent **Apple spatial computing challenges** that are hindering widespread adoption. While the Vision Pro showcases impressive technological prowess, its practical usability for the average consumer is hampered by a number of factors.

Ergonomic concerns are frequently cited. Wearing a device on one’s head for extended periods can be uncomfortable, and the Vision Pro, despite Apple’s design efforts, is no exception. The weight and fit can become an issue for longer sessions. Battery life, a perennial challenge for portable electronics, also presents a limitation. The external battery pack, while necessary for performance, adds to the overall bulk and reduces the seamlessness of the experience.

Perhaps the most significant challenge is the absence of a clear “killer app” or a must-have use case for the average consumer. While developers are exploring various applications, from immersive entertainment to productivity tools, no single application has emerged that universally compels users to purchase the Vision Pro. This lack of a standout experience means that for many, the device remains an expensive novelty rather than an essential tool.

The weakness of the content ecosystem is intrinsically linked to this. Developers are understandably cautious about dedicating resources to building applications for a platform with a relatively small user base and an uncertain market trajectory. This hesitancy creates a vicious cycle: fewer compelling apps lead to less consumer interest, which in turn discourages further developer investment. The utility and appeal of the Vision Pro are consequently diminished.

Collectively, these challenges significantly weaken the value proposition of spatial computing, at least in its current high-end iteration. It becomes exceedingly difficult for consumers to justify the high cost when the practical benefits, the comfort of use, and the breadth of available content are not yet fully realized or universally appealing. The Vision Pro, in its current form, appears to be a product ahead of its time, or at least ahead of the market’s readiness and willingness to embrace such a significant investment in a nascent technology.

Navigating the VR Headset Market Trends

The situation with the Apple Vision Pro cannot be viewed in isolation. It is crucial to analyze it within the broader context of **VR headset market trends**. Competitors in the VR space, most notably Meta with its Quest series, have achieved significantly greater sales volume not through revolutionary leaps in technology (though advancements are constant), but by focusing on accessibility and affordability. The Quest headsets offer a gateway into VR and mixed reality at a fraction of the Vision Pro’s price, underscoring a fundamental consumer truth: price sensitivity remains a dominant factor in the VR and mixed-reality sector.

Current **VR headset market trends** indicate that demand for sophisticated mixed-reality devices has not yet transitioned beyond the early-adopter and enthusiast segments. While there’s a growing interest in immersive technologies, the mass market is still hesitant, requiring more compelling reasons and lower entry costs to fully embrace them. The Vision Pro’s performance, with its production cuts, unfortunately reinforces this general market hesitation.

Apple’s strategic decision to cut production and potentially reassess its approach could have a ripple effect across the industry. It might prompt other companies to double down on their strategies for more affordable, mass-appeal devices. Conversely, it could accelerate a focus on developing less expensive versions of premium hardware. Indeed, rumors suggest that Apple itself is considering a more budget-friendly model, a potential pivot spurred by the market’s reaction to the high-priced Vision Pro.

This situation highlights a critical juncture for the VR/AR industry. The Vision Pro’s struggles serve as a powerful case study, suggesting that while technological innovation is essential, it must be coupled with a viable market strategy that considers price, accessibility, and clear value propositions. The path to mass adoption for mixed-reality headsets will likely be paved with devices that balance advanced features with affordability and demonstrable benefits for a wider audience.

The Impact of High Price on Tech Adoption

The Apple Vision Pro’s journey offers a compelling, real-world illustration of the **impact of high price on tech adoption**. The device’s $3,499 price tag is not merely a number; it’s a significant barrier that restricts its potential user base to an extremely small segment of the population – primarily affluent tech enthusiasts and early adopters. This price point makes mass-market penetration virtually unviable at present.

Consumer psychology plays a crucial role here. For a first-generation product, especially one as revolutionary and potentially disruptive as spatial computing, a prohibitive price tag discourages experimentation. Potential buyers are faced with a difficult decision: is this device truly worth such a substantial investment when its long-term utility, durability, and place in their lives are not yet established? Many consumers are understandably risk-averse, unwilling to part with thousands of dollars for technology that may become obsolete quickly or may not deliver on its promised transformative experience. The lack of clear, universally accepted use cases amplifies this apprehension.

This contrasts sharply with the success of more affordable competitors. Meta’s Quest line, for instance, has captured a larger market share by offering VR experiences at price points that are far more accessible to the average consumer. These devices provide a tangible entry into immersive technologies without the overwhelming financial commitment required by the Vision Pro.

In essence, Apple’s current pricing strategy for the Vision Pro appears to be significantly misaligned with the current state of mainstream VR/AR adoption readiness. While Apple often succeeds by introducing premium products, the Vision Pro’s current market performance suggests that the willingness to pay a premium for nascent technology, particularly in the headset form factor, is limited. The market is not yet convinced that the Vision Pro’s capabilities justify its price, leading to the observed sales decline and subsequent production cuts. This serves as a potent reminder that even for a company like Apple, price remains a critical determinant of consumer adoption, especially for entirely new product categories.

Future Outlook and Implications

The **Apple Vision Pro production cuts demand** and the associated sales figures offer significant insights into the future trajectory of spatial computing and the broader VR/AR industry. Reports suggesting that Apple may be pausing development on a second-generation Vision Pro to focus on a more affordable model are particularly telling. This potential strategic pivot signals a recognition that accessibility is key to achieving mass-market adoption. It suggests a move away from the ultra-premium, bleeding-edge approach towards a more mainstream-friendly device that can appeal to a wider audience.

This shift by Apple could have a profound impact on the pricing strategies of other companies. Seeing Apple potentially recalibrate its approach might encourage competitors to either maintain their focus on affordable devices or to reconsider their own premium offerings. The market may see an acceleration in the development of more competitive and accessible mixed-reality hardware across the board. It’s a strong indicator that the high-end, experimental phase might be giving way to a more practical, consumer-focused era for VR and AR.

Ultimately, for spatial computing and VR/AR technologies to truly break through into the mainstream consciousness, several crucial elements must align. Firstly, lower prices are indispensable. The current cost of high-end devices like the Vision Pro is simply too prohibitive for widespread adoption. Secondly, the development of robust software ecosystems is paramount. Users need a diverse range of compelling applications that demonstrate clear value and utility. Finally, clearly defined use cases are essential. Consumers need to understand *why* they need these devices and how they will meaningfully integrate into their lives beyond novelty.

The ongoing evolution of **VR headset market trends** will continue to be shaped by these factors – price, software availability, and consumer expectations. Both Apple and its competitors must pay close attention to these dynamics to navigate the future successfully. The Vision Pro’s initial reception is a valuable lesson: innovation must be paired with market understanding to achieve true technological adoption.

Final Thought/Call to Action

The **Apple Vision Pro sales decline** and the subsequent production cuts are not a sign of the death of spatial computing, but rather a stark reality check. They are largely attributable to a combination of factors: a prohibitive price point that priced out the majority of consumers, a nascent content library that failed to provide a compelling reason to buy, and unmet expectations for a truly revolutionary, must-have device. The Vision Pro serves as a significant case study in the challenges of introducing premium mixed-reality hardware to a market that may not yet be ready for its cost and current limitations.

Looking ahead, the long-term success of spatial computing and the growth of **mixed-reality headset demand** will undeniably depend on achieving more accessible pricing structures. Furthermore, demonstrating clear and compelling value propositions, supported by robust software ecosystems, will be critical. This balanced approach, integrating technological advancement with market realities, will be key to shaping the future innovation and adoption of immersive technologies. It’s a delicate balance between pushing boundaries and meeting consumers where they are, both financially and functionally.

So, what do you believe is the single most crucial factor for the mass adoption of spatial computing technology? Share your thoughts in the comments below!