This is the enhanced blog post with 9 relevant and visually engaging images strategically placed to improve flow and reader engagement.

Decoding the Future: Why 2025 is the Key Year for UK Smartphone Upgrades

Estimated reading time: 8 minutes

Key Takeaways

- UK consumers are holding onto their smartphones longer, with an average retention period nearing three years, requiring a substantial leap to justify a new purchase.

- The UK generative AI smartphone upgrade cycle 2025 is predicted to be catalyzed by new, powerful on-device AI silicon rather than just camera improvements.

- Flagship chips must deliver performance measured in on-device AI performance benchmarks tens of TOPS, driven by advanced process nodes like the TSMC N3E 3nm AI SoC efficiency gains.

- Consumer willingness to pay more is tied to tangible benefits like enhanced privacy and instant local processing, directly impacting the impact of gen AI chips on UK handset market segmentation.

Table of Contents

- Decoding the Future: Why 2025 is the Key Year for UK Smartphone Upgrades

- The Engine Room: Technical Leaps Powering On-Device AI

- The UK Landscape: How New AI Chips Shape Handset Market Strategy

- Consumer Value: Assessing Generative AI Capability in the UK

- Making the Purchase Decision: Your 2025 AI Upgrade Checklist

- Frequently Asked Questions

Decoding the Future: Why 2025 is the Key Year for UK Smartphone Upgrades (Introduction)

The modern UK consumer faces a genuine dilemma when considering a premium smartphone upgrade. Incremental improvements in screen quality or battery size are no longer enough to overcome the significant financial outlay required for a new flagship device. Recent data suggests that users are increasingly reluctant to upgrade annually; in fact, many are holding onto their current handsets for approximately three years now (Source, Source). This extended retention cycle means that any new device *must* offer a paradigm shift to be considered worthwhile.

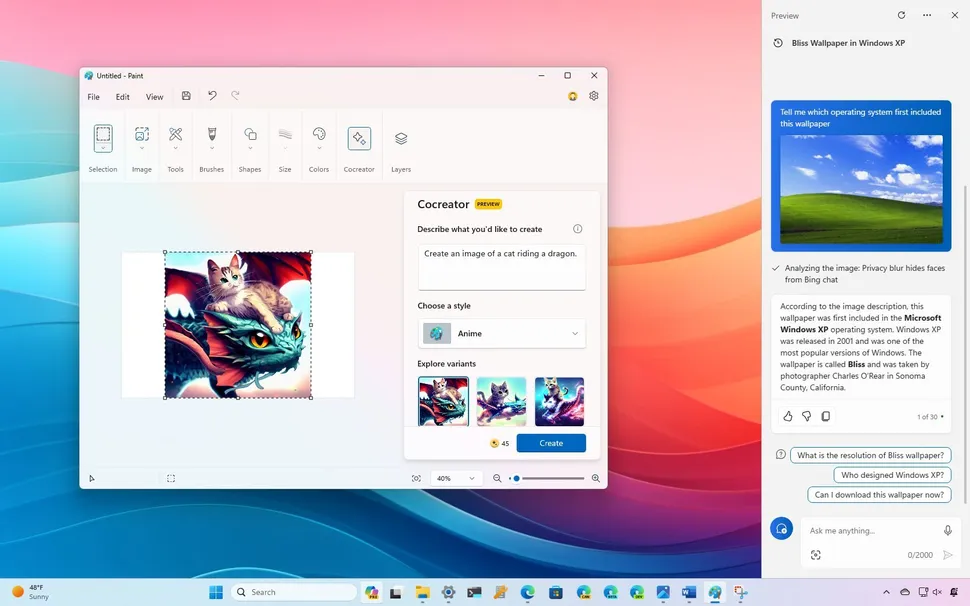

This is why 2025 is shaping up to be the critical inflection point: the start of the UK generative AI smartphone upgrade cycle 2025. For years, manufacturers have relied on camera hardware as the primary justification for yearly refreshes. However, the silicon arriving in 2025 handsets is introducing something fundamentally different: the capability for complex, powerful Generative AI tasks to run locally, on the device itself, without relying on cloud servers.

“The next leap won’t be measured in megapixels, but in model parameters run locally,” is the sentiment echoed across the industry.

To understand this market shift, we must examine three core drivers:

- The unprecedented AI hardware advancements unlocking *local* processing power.

- Specific pressures and trends within the competitive UK market behaviour.

- The evolving consumer valuation of *GenAI features* over traditional hardware updates.

The Engine Room: Technical Leaps Powering On-Device AI

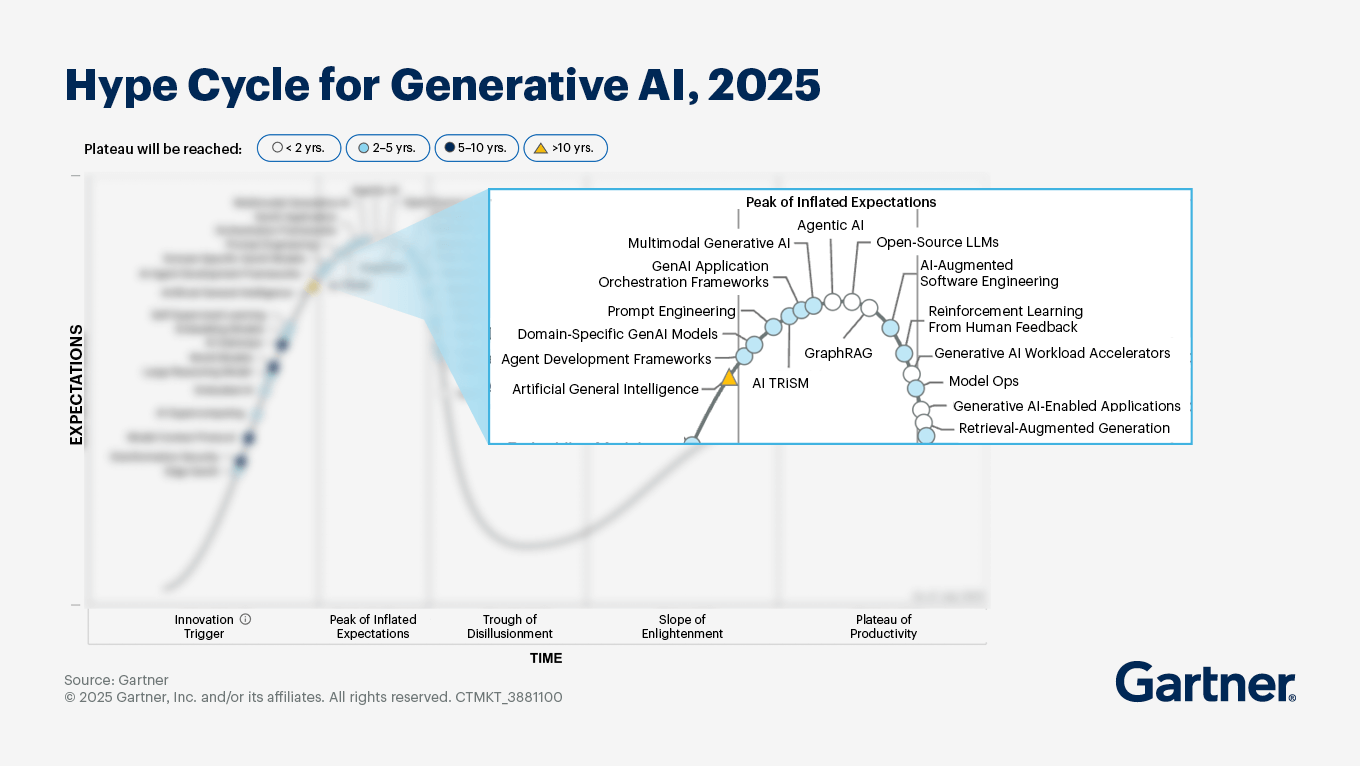

To appreciate the significance of the 2025 upgrade cycle, one must look under the hood at the dedicated processing units powering these new capabilities.

Understanding AI Performance Metrics (TOPS)

When discussing on-device AI, the technical metric that matters most is **TOPS (Tera Operations Per Second)**. This is the industry standard for measuring a chip’s raw AI processing capacity—essentially, how many trillions of calculations the Neural Processing Unit (NPU) can execute per second.

Flagship NPUs destined for 2025 devices are achieving truly remarkable figures, with many expected to hit on-device AI performance benchmarks tens of TOPS. This shift from single-digit TOPS (which handled basic voice commands) to double-digit TOPS is what enables true generative models to run locally.

Practical Value of High TOPS

What does tens of TOPS actually translate to for the user? It means:

-

Instant, lag-free real-time photo and video enhancements applied during capture.

-

Immediate on-device Generative AI assistant summaries of lengthy documents or calls, without the latency associated with sending data to the cloud.

-

Flawless, real-time language translation during video calls.

Crucially, this high processing power must be sustained. This brings us to efficiency.

Efficiency through Manufacturing (3nm)

The ability to run these intensive tasks smoothly depends heavily on the manufacturing process. The move toward smaller nodes is paramount. We are seeing the maturation of processes like the TSMC N3E 3nm AI SoC efficiency gains.

A smaller process node means higher transistor density and, critically, superior performance per watt. This directly translates to better sustained performance; high-demand AI tasks can now run for longer periods without causing thermal throttling (slowing down) or catastrophically draining the battery. For the user, this means AI assistance is always available, not just in short bursts.

Buyer Checklist

When assessing a 2025 flagship device, savvy buyers should look for marketing materials that explicitly reference performance benchmarks above 30 TOPS and confirm the chipset is utilizing advanced fabrication. Look for confirmation of advertised 3 nm AI SoC efficiency gains paired with NPU performance that clearly exceeds 30 TOPS—these are the signals indicating readiness for genuinely powerful, true on-device generative AI experiences.

The UK Landscape: How New AI Chips Shape Handset Market Strategy

The technical leaps described above do not exist in a vacuum; they are being leveraged within the specific economic and competitive structure of the United Kingdom mobile market.

Market Concentration and Premium Focus

The UK remains heavily dominated by a tight Apple–Samsung duopoly, often accounting for over 75% of the market share (Source). Furthermore, the premium segment (devices priced above £800) is remarkably robust, often representing around 45% of total sales volume (Source). This concentration means that manufacturers must use differentiation—and price justification—very carefully.

The new AI hardware, with its high R&D cost, serves the primary purpose of cementing the justification for these premium price tags.

Impact of Gen AI Chips on UK Handset Market Segmentation

The introduction of leading-edge silicon creates a distinct segmentation effect: the impact of gen AI chips on UK handset market segmentation becomes pronounced. The newest phones, sporting the top-tier AI capabilities, drive the highest profit margins. However, the previous generation’s chips, which are still highly capable, trickle down into the competitive mid-range (£400–£600). This can paradoxically slow the upgrade impulse for consumers who already possess a capable mid-range phone, as the local AI features they desire might arrive in the next tier down in 12–18 months.

Upgrade Cycle Pressure

As established, the average UK renewal cycle is stretching towards three years (Source). To compel users to break this pattern sooner, brands must position on-device generative AI not as a niche feature but as a foundational necessity that significantly alters daily efficiency—something incremental camera upgrades simply cannot achieve.

Channel Strategy

In the UK, telecommunications carriers remain a significant force, responsible for approximately 39% of sales, though online direct-to-consumer channels account for nearly 50% (Source, Source). This dual reality means marketing must be powerful online but also heavily supported through carrier subsidy models. Carriers will heavily promote AI-branded service plans and aggressive trade-in offers specifically tailored to accelerate the UK generative AI smartphone upgrade cycle 2025.

Consumer Value: Assessing Generative AI Capability in the UK

Technical specifications are only half the battle; the true catalyst for a purchase decision lies in perceived consumer value. Encouragingly, research indicates that over 40% of UK consumers are willing to pay a premium for AI enhancements, such as personalised editing workflows (Source). This willingness is strongest among the 25–44 demographic, the prime market for flagship purchases (Source).

However, there is a significant gap between manufacturer messaging (TOPS, 3nm nodes) and user priorities. Consumers value tangible outcomes: faster battery charging, superior low-light photography, and, increasingly, data security.

How UK Consumers View Generative AI Capability

The local, on-device execution of GenAI features taps directly into key consumer concerns. For many UK buyers, running models locally offers two major advantages:

- Privacy and Control: Data, especially sensitive personal information or corporate communications, stays off the cloud server. This local processing is highly appealing.

- Responsiveness: Tasks execute instantly, irrespective of network congestion or spotty 4G/5G coverage, which remains a practical reality outside major metropolitan areas.

This perceived benefit is crucial for adoption. The user doesn’t need to understand on-device AI performance benchmarks tens of TOPS; they just need to know their translation works instantly on the train, or their document summary is secure.

The Value Proposition Shift

The market is also becoming more discerning. The trend towards SIM-only plans, now favoured by around 40% of UK purchasers, suggests consumers are decoupling handset cost from service plans, forcing manufacturers to make a clearer value case for the hardware itself (Source). Furthermore, the growth of the refurbished market (around 15% growth) proves that older, non-AI-centric phones still hold significant residual value, meaning a new AI purchase must justify its price premium against a perfectly functional, high-spec used device (Source).

Therefore, the key drivers for sealing the deal in 2025 will be:

-

Offline generative assistants capable of summarisation.

-

Truly robust, real-time translation capabilities.

-

Advanced, instant photo and video editing tools that leverage local processing power.

Making the Purchase Decision: Your 2025 AI Upgrade Checklist

The convergence of cutting-edge engineering and maturing consumer expectations means the upgrade decision in 2025 hinges on specific technical proof points tied to practical utility. We know that the success of the UK generative AI smartphone upgrade cycle 2025 relies on the fusion of powerful, efficient silicon, specifically leveraging TSMC N3E 3nm AI SoC efficiency gains, with proven, privacy-focused on-device applications.

If you are considering replacing your device in the next 12 months, use this checklist to ensure your investment is future-proofed for the AI era:

Buyer Checklist for AI Flagships

- Verify NPU Capability: Do not accept vague marketing. Look for specifications claiming NPU performance consistently exceeding tens of TOPS.

- Confirm Fabrication Node: Ensure the chipset is built on a leading, efficient node (3 nm class). This guarantees the AI features won’t drain your battery during sustained, high-demand use.

- Identify Local Features: Clearly distinguish between cloud-dependent AI and on-device AI. Does the flagship promise offline generative assistants, local translation, or on-device image processing? These local features are the core justification for the upgrade.

- Assess Total Cost of Ownership: Given the strong retention rates, calculate the benefit of high trade-in values for your current premium phone, often boosted by manufacturers attempting to capture early adopters (Source).

Ultimately, the next flagship purchase should be framed less as a hardware refresh and more as an investment in a platform ready for smarter, faster, and significantly more private interaction over the coming three years. This investment is only sound if the device demonstrably delivers on the promise of leading the impact of gen AI chips on UK handset market innovation.

Frequently Asked Questions

Q: If my current phone is only two years old, is on-device AI enough to justify an upgrade in 2025?

A: It depends on your usage. If your current device handles cloud-based AI tasks adequately, the upgrade is only justified if you require instantaneous processing, significantly enhanced privacy, or features requiring multi-core NPU capacity beyond 20 TOPS, which older chips cannot sustain.

Q: What is the biggest risk associated with waiting for the next wave of AI phones?

A: The biggest risk is that the new, powerful on-device features become essential productivity tools. Waiting means continuing to rely on slower, cloud-dependent processing, potentially missing out on efficiency gains that could save considerable time over a year.

Q: How do carriers in the UK view the move to AI-centric phones?

A: Carriers view them as essential sales drivers. They are actively promoting plans and subsidized contracts that align perfectly with the UK generative AI smartphone upgrade cycle 2025, aiming to shorten the current three-year retention period.

Q: Does the 3nm process only affect AI performance?

A: No. While critical for AI, the TSMC N3E 3nm AI SoC efficiency gains also result in better overall system efficiency, leading to tangible improvements in standard application performance and overall battery longevity.