Rising Component Costs Threatening 2026 Global Smartphone Shipments: A Deep Dive into Market Risks and Innovations

Estimated reading time: 10 minutes

Key Takeaways

- The smartphone market in 2026 faces a critical challenge from rising component costs threatening 2026 global smartphone shipments, driven by inflation, supply chain woes, and geopolitical tensions.

- Semiconductor inflation could slash global shipments by 5-10%, squeezing margins in emerging markets and forcing brands to rethink strategies.

- Neuromorphic chips promise to revolutionize 2026 flagship performance with brain-like efficiency, enabling advanced on-device AI that may justify premium pricing.

- Samsung’s 2nm chip strategy for the Galaxy S26 aims to counter cost pressures with 113% faster AI performance and better thermal management, potentially launching in February 2026.

- Edge processing energy efficiency gains from on-device AI chips reduce cloud dependency, lower operational costs, and extend battery life, offering a buffer against rising expenses.

- By 2028, generative AI could capture 40-50% of the premium market, but rising costs might slow adoption, fragmenting the landscape between innovators and budget players.

- Investors and manufacturers must balance R&D in cutting-edge tech with cost management, diversify supply chains, and adopt adaptive pricing to navigate these headwinds.

Table of contents

- Rising Component Costs Threatening 2026 Global Smartphone Shipments: A Deep Dive into Market Risks and Innovations

- Key Takeaways

- Introduction: The Perfect Storm in 2026

- What Are Rising Component Costs and Why They Threaten Shipments?

- Neuromorphic Chips: The AI Game-Changer for 2026 Smartphones

- Samsung’s 2nm Chip Strategy for Galaxy S26 AI Features

- Edge Processing Energy Efficiency Gains from On-Device AI

- The Future of Generative AI Smartphone Market Share by 2028

- Strategic Implications for Investors and Manufacturers

- Frequently Asked Questions

Introduction: The Perfect Storm in 2026

Imagine a world where your next smartphone purchase isn’t just about camera specs or battery life—it’s a high-stakes bet on global supply chains and cutting-edge AI. As we look toward 2026, the smartphone industry stands at a crossroads, grappling with rising component costs threatening 2026 global smartphone shipments. This isn’t mere speculation; it’s a brewing crisis that could reshape the market landscape, affecting everything from flagship launches to budget-friendly options. In this deep dive, we’ll explore how technological trends like AI chips and Samsung’s strategic moves intersect with these cost pressures, offering insights for consumers, investors, and manufacturers alike. Will innovation be enough to offset the financial squeeze? Let’s find out.

What Are Rising Component Costs and Why They Threaten Shipments?

At its core, rising component costs threatening 2026 global smartphone shipments refers to the escalating prices for critical parts like semiconductors, displays, and batteries, fueled by a trifecta of inflation, supply chain disruptions, and geopolitical tensions. According to research from Android Headlines, semiconductor inflation alone could drive up production expenses by 15-20% in 2026, while analyst predictions cited in this YouTube analysis warn of shipment reductions of 5-10% globally. Here’s what that means in practical terms:

- Margin Compression: Manufacturers face thinner profits, especially in price-sensitive emerging markets where every dollar counts. As detailed in PenBrief’s analysis, budget smartphones under $500 could see reduced features or higher prices, alienating cost-conscious consumers.

- Supply Chain Volatility: From factory shutdowns to trade wars, disruptions delay component deliveries, leading to inventory shortages and missed sales targets. It’s a domino effect that starts in silicon foundries and ends in empty store shelves.

- Consumer Backlash: If flagship prices soar beyond reach, demand may stagnate, triggering a vicious cycle of lower shipments and reduced R&D investment.

“The smartphone market’s growth hinges on balancing innovation with affordability,” notes an industry insider.

In short, these cost pressures aren’t just a blip—they’re a seismic shift that threatens to derail the industry’s recovery post-pandemic. Brands must act fast to mitigate risks, or risk being left behind.

Neuromorphic Chips: The AI Game-Changer for 2026 Smartphones

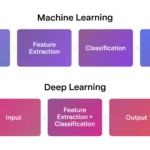

Amidst the cost chaos, a beacon of hope emerges: neuromorphic chips. These AI processors mimic the human brain’s architecture, enabling efficient, real-time edge computing and low-power data analysis. For 2026 smartphones, they could be the secret sauce that justifies premium pricing and helps offset shipment declines. Imagine a device that learns your habits, processes language instantly, or enhances photos without draining the battery—all thanks to neuromorphic design. As reported by Neowin, these chips reduce cloud dependency, slashing data costs and improving privacy. Key impacts include:

- Enhanced Performance: Flagship phones with neuromorphic chips can handle complex AI tasks like real-time translation or generative art on-device, offering a smoother user experience that competitors can’t match.

- Power Efficiency: By processing data locally, they cut energy use by up to 30%, extending battery life and reducing thermal issues—a win for both users and manufacturers facing cost hikes.

- Market Differentiation: Brands that adopt this tech early, as explored in PenBrief’s feature on AI-powered smartphones, can command higher prices, potentially cushioning the blow from rising component costs.

In essence, neuromorphic chips aren’t just a luxury; they’re a strategic necessity in a cost-constrained world. They transform smartphones from mere communication tools into intelligent companions, driving demand even when prices climb.

Samsung’s 2nm Chip Strategy for Galaxy S26 AI Features

Samsung isn’t sitting idle in this crisis. Its 2nm chip strategy for the Galaxy S26 AI features is a bold countermove, leveraging the Exynos 2600 chipset built on a 2nm GAA (Gate-All-Around) process. This technology, detailed in Neowin’s report, promises 113% faster AI performance and superior thermal management, aiming to launch in February 2026 per Sammy Guru. But how does this tackle rising costs? Let’s break it down:

- Cost Efficiency: The 2nm process packs more transistors into a smaller space, lowering long-term production costs per chip despite upfront R&D investments. As analyst predictions suggest, this could help Samsung maintain competitive pricing for the Galaxy S26 series.

- AI Leadership: With features like on-device generative AI and advanced photography, Samsung can differentiate its flagships, justifying higher price points and attracting early adopters undeterred by market headwinds.

- Supply Chain Control: By vertically integrating chip design and manufacturing, Samsung reduces reliance on external suppliers, mitigating shortages and cost spikes—a lesson highlighted in PenBrief’s innovation overview.

Quote:

“Samsung’s 2nm push isn’t just about speed; it’s about sustainability in a volatile market,” says a tech strategist.

This strategy exemplifies how technological leaps can turn cost threats into opportunities, setting a benchmark for the industry.

Edge Processing Energy Efficiency Gains from On-Device AI

One of the most compelling antidotes to rising costs lies in edge processing energy efficiency gains from on-device AI chips. Edge processing means handling data locally on devices rather than shipping it to the cloud, which slashes energy use by minimizing data transfer and power draw. Take Samsung’s Exynos 2600: its 2nm design not only boosts AI but also reduces cooling needs, extending battery life by up to 20%. According to Neowin, this efficiency gain translates to lower operational expenses for manufacturers and users alike. Here’s why it matters:

- Reduced Cloud Costs: Less dependency on cloud servers cuts bandwidth and storage fees, saving brands millions annually—savings that can offset component price hikes.

- Longer Device Lifespan: Efficient chips generate less heat, reducing wear and tear and potentially extending product cycles, which appeals to eco-conscious consumers and reduces replacement costs.

- Competitive Advantage: As PenBrief’s edge computing analysis notes, brands that master on-device AI can offer faster, more private experiences, driving loyalty in a crowded market.

Think of it as a win-win: users get snappier phones with better battery life, while manufacturers trim costs without compromising quality. In a time of financial pressure, such efficiencies are golden.

The Future of Generative AI Smartphone Market Share by 2028

Looking beyond 2026, the future of generative AI smartphone market share by 2028 paints a picture of disruption. Generative AI—technology that creates real-time content like text, images, or code—is projected to capture 40-50% of the premium smartphone market by 2028, per Android Headlines. However, rising component costs could throw a wrench in this growth. If brands prioritize cost control over R&D, adoption might slow, leading to market fragmentation. Consider these scenarios:

- Innovation vs. Affordability: High-end phones with generative AI, like those using Samsung’s Exynos 2600 (as Neowin reports), may become luxury items, while budget models lag behind, creating a two-tier market.

- Consumer Expectations: As explored in PenBrief’s generative AI feature, users will demand seamless AI experiences; brands that fail to deliver risk losing share to agile competitors.

- Investment Shifts: Manufacturers may divert funds from marketing to chip development, betting that AI features can drive sales despite higher prices.

“Generative AI isn’t a trend; it’s the next frontier for smartphone relevance,” asserts an industry analyst.

Ultimately, the race for AI supremacy will define winners and losers, with cost pressures acting as a filter that separates true innovators from followers.

Strategic Implications for Investors and Manufacturers

Navigating rising component costs threatening 2026 global smartphone shipments requires savvy strategies. For investors and manufacturers, the path forward involves balancing innovation with prudence. Here are actionable insights, drawing from sources cited earlier:

- Diversify Supply Chains: Reduce reliance on single regions by sourcing components from multiple suppliers. This mitigates semiconductor shortages and price shocks, as highlighted in supply chain risks from Android Headlines.

- Invest in R&D Selectively: Focus on technologies with dual benefits—like neuromorphic chips and 2nm processes—that boost performance while lowering long-term costs. Samsung’s strategy, per Neowin, shows how AI investment can pay off.

- Adopt Adaptive Pricing: Use energy efficiency gains from edge AI to justify premium pricing or offer tiered models. For example, leverage battery life improvements to market value, as seen in budget smartphone analyses.

- Monitor Market Trends: Keep an eye on 2026 shipment forecasts and Galaxy S26 developments, using data from analyst predictions to time investments or product launches.

The bottom line: proactive adaptation is key. By embracing AI-driven efficiencies and cost-conscious innovation, stakeholders can turn threats into growth opportunities, ensuring resilience in a turbulent market.

Frequently Asked Questions

How much could smartphone shipments drop in 2026 due to rising costs?

Analysts predict a 5-10% reduction in global shipments, driven by semiconductor inflation and supply chain issues, as noted in this analysis and Android Headlines.

What are neuromorphic chips, and how do they help smartphones?

Neuromorphic chips are AI processors that mimic the brain’s architecture for efficient, on-device computing. They enhance performance for tasks like real-time AI, reduce cloud dependency, and improve power efficiency, as detailed in Neowin’s report and PenBrief’s AI smartphone feature.

When is the Samsung Galaxy S26 expected to launch, and what makes it special?

The Galaxy S26 is rumored to launch in February 2026, per Sammy Guru. It’s special due to its 2nm Exynos 2600 chip, offering 113% faster AI, better thermal management, and energy efficiency gains, as covered in Neowin and PenBrief.

How does edge processing save energy in smartphones?

Edge processing handles data locally on the device, minimizing data transfer to the cloud. This reduces power draw, extends battery life, and lowers operational costs, with examples from Samsung’s Exynos 2600 in Neowin and PenBrief’s edge computing analysis.

What market share might generative AI smartphones have by 2028?

Generative AI smartphones could capture 40-50% of the premium market by 2028, according to Android Headlines, though rising costs could slow adoption, as discussed in PenBrief’s transformation overview.

What should investors watch in the 2026 smartphone market?

Key factors include shipment forecasts, Samsung’s 2nm chip rollout, adoption of neuromorphic AI, and supply chain diversification efforts, based on insights from analyst predictions, Android Headlines, and PenBrief’s budget smartphone analysis.