The Unprecedented Rise of Nvidia: How AI Fueled a $3.92 Trillion Market Cap

Estimated reading time: 8 minutes

Key Takeaways

- On July 3, 2025, Nvidia achieved a historic market capitalization exceeding $3.92 trillion, briefly becoming the most valuable company in history.

- This monumental `Nvidia market cap record breaking` event signals a profound transformation and a significant shift in the tech landscape towards AI infrastructure.

- The core reason for Nvidia’s unprecedented success is the explosive `AI chip demand driving Nvidia value`, particularly for their advanced GPUs essential for AI training and deployment.

- Nvidia’s strategic ecosystem, including its proprietary CUDA platform and comprehensive software stack, creates a powerful “lock-in” effect, making its integrated solutions indispensable for AI development.

- Positioned as the “picks and shovels” provider in the “AI gold rush,” Nvidia benefits from supplying the fundamental infrastructure needed by the entire AI industry.

- Wall Street’s strong optimism, despite some valuation concerns, reflects a widespread belief in Nvidia’s central role and continued growth potential within the burgeoning AI landscape.

- Looking ahead, Nvidia anticipates expansion into emerging markets like robotics and digital twins, while also navigating challenges from intensifying competition and potential regulatory changes.

Table of Contents

- The Unprecedented Rise of Nvidia: How AI Fueled a $3.92 Trillion Market Cap

- Key Takeaways

- Introduction: The Unprecedented Rise of Nvidia

- Nvidia’s Historic Ascent: A Market Cap Record Breaking Event

- The Engine of Growth: AI Chip Demand Driving Nvidia Value

- Decoding the Valuation: Nvidia Becomes Most Valuable Company Explanation

- The Profound Link: Impact of AI Boom on Nvidia’s Valuation

- Looking Ahead: The Future of Nvidia Stock and AI

- Conclusion: Sustaining the AI-Powered Surge

- Frequently Asked Questions

Introduction: The Unprecedented Rise of Nvidia

On a historic day, July 3, 2025, Nvidia achieved a monumental market capitalization exceeding $3.92 trillion, briefly becoming the most valuable company in history. This staggering feat, widely reported by Seeking Alpha and PYMNTS, signals a profound transformation and a significant shift in the global tech landscape. It’s a clear declaration: AI is not just the future; it’s the present, and Nvidia is at its core.

This `Nvidia market cap record breaking` event is directly fueled by one critical factor: the explosive `AI chip demand driving Nvidia value`. The world’s insatiable hunger for sophisticated AI capabilities has created an unprecedented need for the processing power that only advanced chips can provide. Nvidia, with its specialized hardware, has positioned itself as the indispensable supplier for this burgeoning market.

This article aims to provide a comprehensive `Nvidia becomes most valuable company explanation`. We will delve into its pivotal role as the backbone of the AI revolution, dissecting how it reached this extraordinary summit and what its ascent means for the future of technology and global markets.

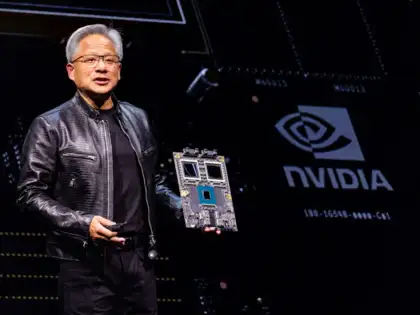

Nvidia’s Historic Ascent: A Market Cap Record Breaking Event

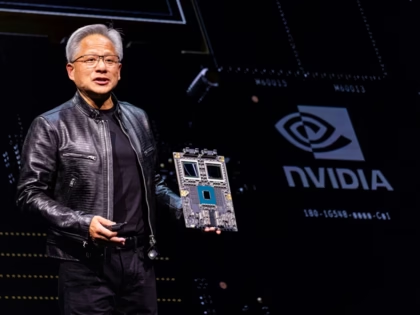

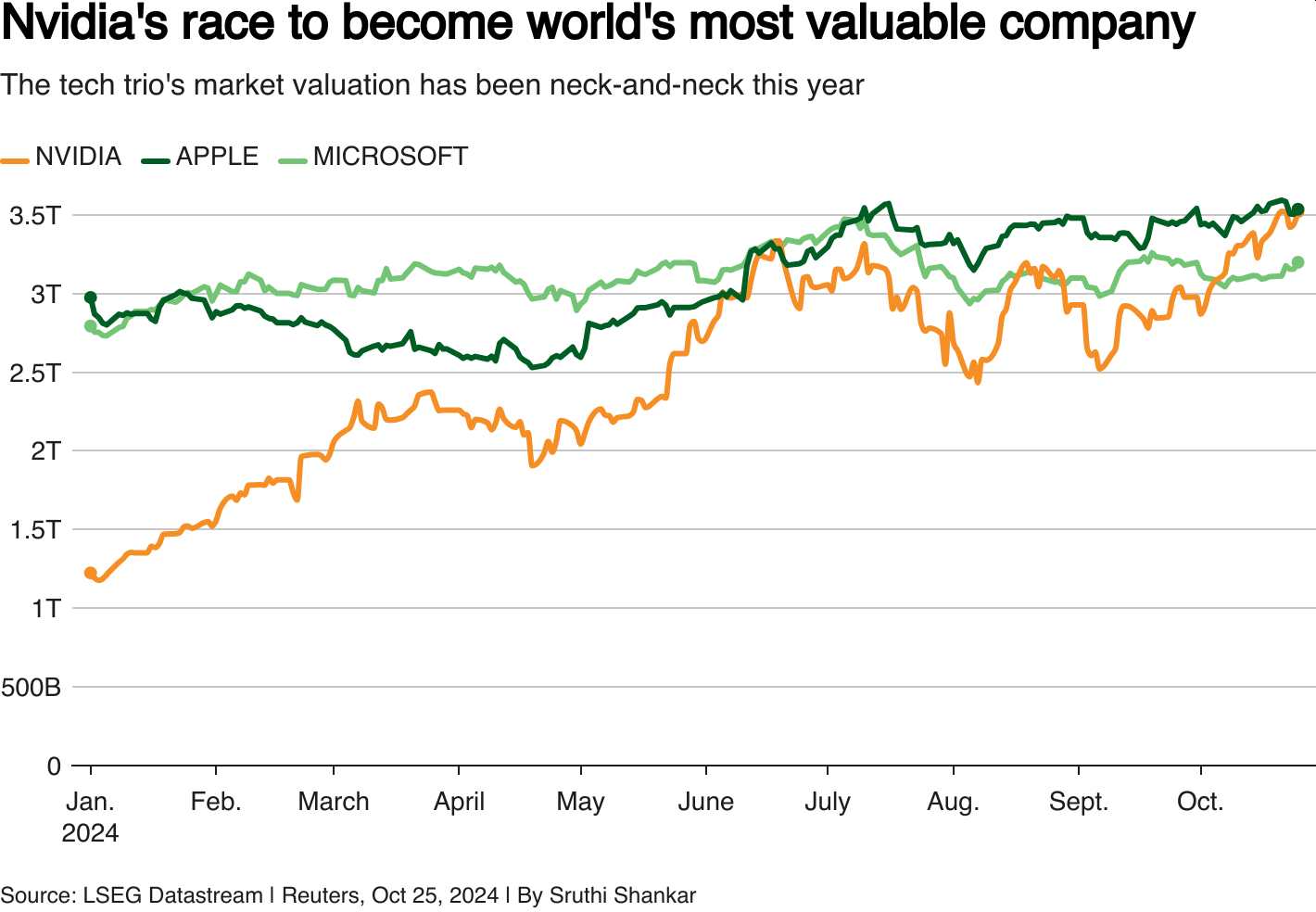

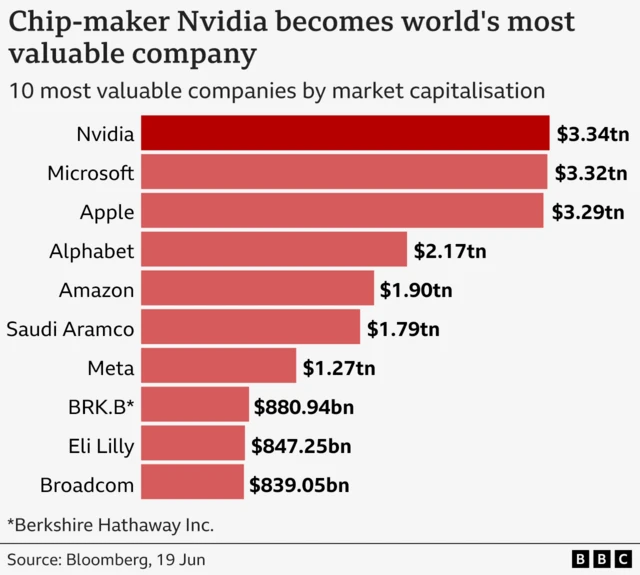

On July 3, 2025, Nvidia’s market value momentarily peaked at an astounding $3.92 trillion. This `Nvidia market cap record breaking` achievement wasn’t just a record for the company; it briefly surpassed the valuations of other tech giants, including Microsoft, which held a $3.7 trillion market value, and Apple, at $3.19 trillion at the time, as noted by PYMNTS.

This comparison highlights Nvidia’s rapid and exceptional growth, underscoring a significant shift in global tech leadership. The focus has undeniably moved towards AI hardware and its underlying infrastructure as the primary competitive frontier. Nvidia’s milestone reflects the market’s profound recognition of its irreplaceable role in powering this new era of innovation. The message is clear: AI compute power is the new gold standard in technology.

The Engine of Growth: AI Chip Demand Driving Nvidia Value

The defining narrative for Nvidia, and the true engine behind its valuation surge, is the insatiable global `AI chip demand driving Nvidia value`. Specifically, it’s the demand for their advanced GPUs (Graphics Processing Units), which are utterly essential for both the intensive training of complex AI models and their efficient deployment in real-world applications. This core requirement has propelled Nvidia to the forefront of the technological landscape, as detailed by Bitget News.

Nvidia’s dominance extends beyond mere hardware. Its proprietary CUDA platform and comprehensive software stack create a powerful ecosystem that effectively “locks in” its clientele. This integrated approach makes Nvidia’s solutions indispensable for enterprises aiming to build and scale AI at a significant level. The synergy between high-performance GPUs, such as the Nvidia GeForce RTX 40 series, and a robust software environment, solidifies its market position.

The need for these specialized chips is exponential and spans across a multitude of sectors:

- Vast cloud computing data centers: The foundational infrastructure for most AI services, like those supported by government supercomputer funding.

- Cutting-edge healthcare applications: Fueling revolutionary AI medical breakthroughs in diagnostics and drug discovery.

- Complex scientific research: Powering simulations and data analysis for climate modeling, physics, and more.

This broad, expanding demand across industries underscores Nvidia’s critical role in powering the global AI revolution.

Decoding the Valuation: Nvidia Becomes Most Valuable Company Explanation

To truly understand the `Nvidia becomes most valuable company explanation`, it’s crucial to recognize that its value isn’t solely derived from hardware sales, but from its profound strategic positioning. Nvidia is not just a component supplier; it’s the foundational enabler of the AI industry.

The company’s deep value stems from its comprehensive strategic ecosystem, which encompasses proprietary software platforms, extensive developer tools, and robust data center solutions. This integrated approach makes Nvidia the indispensable supplier for virtually every entity looking to build and scale AI. Its profound “lock-in” effect ensures sustained demand and recurring revenue streams.

Think of Nvidia as the “picks and shovels” provider in the ongoing “AI gold rush.” While countless companies are striving to strike “gold” by developing groundbreaking AI applications, Nvidia profits from selling the essential infrastructure—the powerful GPUs and supporting software—that everyone needs to participate. Regardless of individual application success, Nvidia provides the foundational tools, guaranteeing its profit from the overall industry growth, as described by AINVEST.

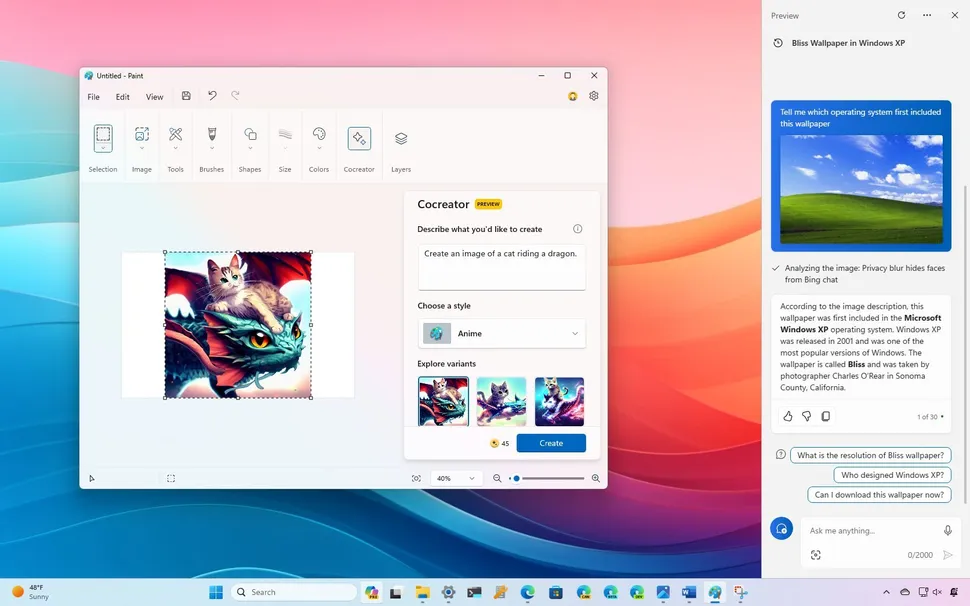

Critical to this dominance are Nvidia’s powerful software platforms, particularly CUDA and Omniverse. These platforms are more than just add-ons; they generate recurring revenues and deeply embed Nvidia into global AI innovation. By fostering a vast and loyal developer community, Nvidia ensures continuous demand for its integrated solutions, making its ecosystem difficult for competitors to replicate.

The Profound Link: Impact of AI Boom on Nvidia’s Valuation

The overarching `Impact of AI boom on Nvidia’s valuation` is undeniably the primary macroeconomic force behind its soaring market cap. Major tech giants and countless other enterprises are increasingly reliant on Nvidia chips to build, expand, and power their burgeoning AI data centers. Without these chips, the ambitious scale of modern AI initiatives would be simply unattainable.

The rapid acceleration of AI adoption across diverse sectors directly translates into escalating demand for Nvidia’s products:

- Autonomous Vehicles: Requiring immense real-time processing power.

- Generative AI: The explosion of models demanding colossal training and inference capabilities.

- Advanced Robotics: Powering intelligent and adaptable machines.

- Healthcare: Revolutionizing diagnostics and treatment.

- Scientific Computing: Accelerating breakthroughs in complex research fields.

This pervasive reliance on high-performance computing, as reflected in PYMNTS’ observations, boosts investor confidence and propels share prices.

Wall Street’s strong optimism towards Nvidia is evident in substantial trading activity and numerous analyst upgrades, even amidst concerns regarding high price-to-earnings ratios. This indicates a widespread belief in Nvidia’s crucial role and continued growth potential within the burgeoning AI landscape. Despite analyses like Nvidia insider stock sales, institutional sentiment remains robust, affirming Nvidia’s indispensable position, as highlighted by Seeking Alpha and AINVEST.

Looking Ahead: The Future of Nvidia Stock and AI

Considering the `Future of Nvidia stock AI` involves anticipating continued growth trajectories alongside potential challenges. Nvidia is strategically expanding into emerging markets that promise significant sustained growth. These include:

- Robotics: Powering increasingly autonomous systems.

- Digital Twins: Enabling virtual representations for simulation and optimization, with platforms like Omniverse leading the way.

- Industrial Automation: Extending intelligent capabilities to diverse industrial processes, as supported by AINVEST.

These sectors represent vast new opportunities for Nvidia’s high-performance computing solutions.

However, the path forward isn’t without hurdles. Nvidia must navigate intensifying competition from major players like AMD and Intel, who are aggressively pursuing the AI chip market. The rise of custom silicon initiatives, such as Google’s TPUs for OpenAI and ChatGPT, also presents a competitive dynamic.

Potential regulatory changes, particularly those impacting chip sales or technology development and broader AI regulation, could introduce uncertainties. Additionally, ongoing supply chain pressures within the semiconductor industry could affect production and delivery.

Despite strong institutional sentiment, valuation concerns persist among some analysts who view Nvidia’s current market capitalization as potentially stretched relative to traditional financial metrics, as detailed by AINVEST. Nevertheless, Nvidia’s long-term outlook remains robust, solidifying its role as an indispensable player in the evolving AI landscape despite these acknowledged headwinds.

Conclusion: Sustaining the AI-Powered Surge

Nvidia’s `Nvidia market cap record breaking` achievement, soaring past $3.92 trillion, is a direct result of its undisputed leadership in AI chip technology and its comprehensive, indispensable ecosystem. As confirmed by sources like Bitget News and AINVEST, its market position is a testament to its pivotal role.

The relentless `AI chip demand driving Nvidia value` remains the fundamental force behind its ascent, underscoring its essential role in powering the global AI revolution. This sustained demand profoundly impacts Nvidia’s valuation, demonstrating the deep link between the burgeoning AI market and the company’s success.

Nvidia has cemented its centrality to the ongoing technological shift towards artificial intelligence, solidifying its continued relevance and immense influence. This provides the clearest `Nvidia becomes most valuable company explanation`: it is the foundational supplier for the entire AI industry.

Ultimately, Nvidia has established a lasting legacy as the foundational pillar of the new AI-driven economy, having provided the essential infrastructure for this transformative era.

Frequently Asked Questions

What exactly are AI chips and why are they so crucial?

AI chips, predominantly Nvidia’s GPUs, are specialized semiconductors designed for parallel processing, crucial for artificial intelligence. They accelerate the vast computations needed for training complex AI models and efficiently running them. This makes them significantly more effective than traditional CPUs for AI workloads, establishing them as the indispensable core of modern AI development.

How does Nvidia’s CUDA platform contribute to its market dominance?

Nvidia’s CUDA platform is a parallel computing platform and programming model that allows developers to leverage Nvidia GPUs for general-purpose computing. This robust software layer, coupled with extensive libraries and developer support, creates a powerful ecosystem. CUDA’s widespread adoption has effectively “locked in” developers and industries, making it difficult for competitors to offer a comparable integrated hardware-software solution, thus solidifying Nvidia’s market dominance.

What are the main challenges Nvidia faces despite its high valuation?

Despite its high valuation, Nvidia faces challenges including intensifying competition from rivals like AMD and Intel, who are developing their own AI chips. Potential regulatory changes impacting chip sales or technology development, such as broader AI regulations, could also introduce uncertainties. Furthermore, ongoing global supply chain pressures might affect production and delivery. Lastly, some analysts express concerns that Nvidia’s current market capitalization might be stretched relative to traditional valuation metrics.

How does Nvidia’s “picks and shovels” analogy apply to the AI industry?

In the “AI gold rush,” many companies seek to develop groundbreaking AI applications. Nvidia, akin to a supplier during a gold rush, provides the fundamental “picks and shovels”—its advanced GPUs and software—that everyone needs to participate. Regardless of individual AI application success, Nvidia profits from supplying these indispensable tools for building, training, and deploying AI models, benefiting from the overall growth of the industry rather than specific outcomes.

What other sectors besides cloud computing are driving demand for Nvidia’s GPUs?

Beyond cloud computing, significant demand for Nvidia’s GPUs comes from sectors like autonomous vehicles (for real-time decision-making), healthcare (for drug discovery and medical imaging), scientific research (for complex simulations), advanced robotics (for intelligent automation), and generative AI applications (for content creation). Each of these fields relies heavily on the immense parallel processing power that Nvidia’s GPUs provide, making them crucial components across diverse industries.