AI Resistance Consumer Sentiment Report: The Control Paradox and User Divides

Estimated reading time: 7 minutes

Key Takeaways

- The ai resistance consumer sentiment report uncovers a “Control Paradox”: consumers demand control over AI decisions, while brands prioritize transparency.

- 83% of consumers accept AI influencing decisions, but 65% reject AI overriding their agency, revealing measured openness with firm resistance.

- Growing preference no ai devices stems from privacy risks, reliability doubts, and digital well-being concerns.

- Split market perception ai features forces brands to balance innovation with trust erosion and feature fatigue.

- User preference divides segment consumers into personas like Optimists, Skeptics, Pragmatists, and Rejectors, shaping product adoption.

- Future AI adoption hinges on transparency, user controls, and clear value, with trust as a scaling constraint per Morning Consult.

Table of contents

- AI Resistance Consumer Sentiment Report: The Control Paradox and User Divides

- Key Takeaways

- Introduction: The AI Skepticism Landscape

- The AI Resistance Consumer Sentiment Report: Key Findings

- The Rise of Preference for No-AI Devices

- Market Perception of AI Features: Brands vs. Consumers

- Mapping User Preference Divides

- Future Trends and Forecasts

- Frequently Asked Questions

Introduction: The AI Skepticism Landscape

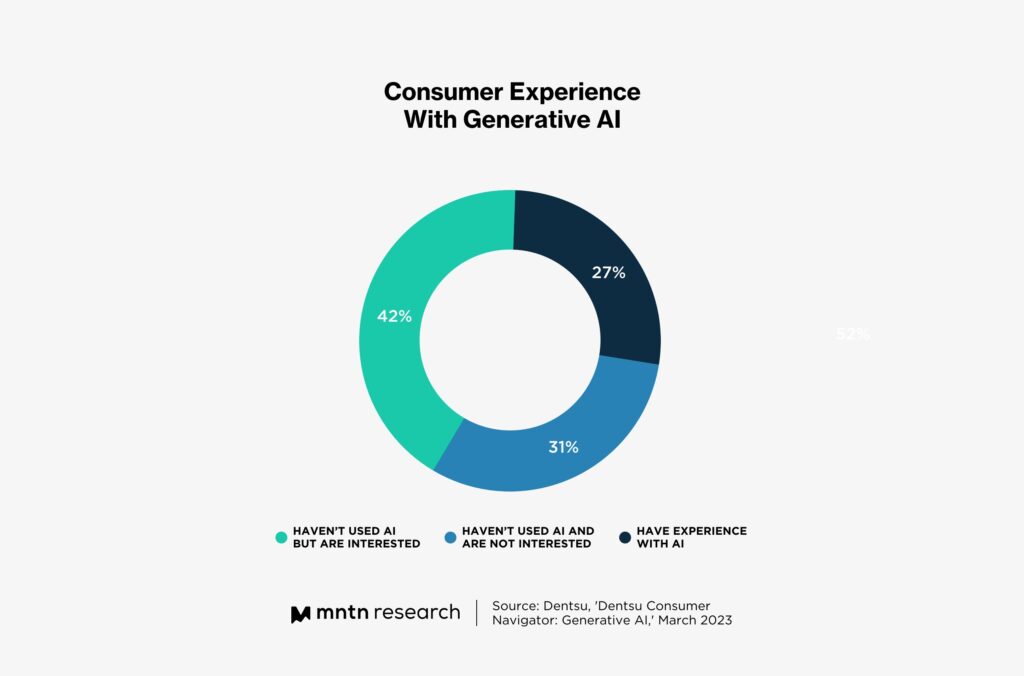

As AI features become ubiquitous in everyday products like smartphones and home assistants, how are consumers really reacting amid growing skepticism? The ai resistance consumer sentiment report—Acxiom’s 2026 CX Trends Report that surveyed 4,000 consumers and 600 business leaders—reveals critical gaps between brand AI investments and consumer demands for control. Initial signs show divided reactions: market perception ai features is mixed, with user preference divides evident as 83% accept AI influencing decisions but 65% reject AI that decides for them, showing measured openness alongside firm resistance.

This post dissects key findings from the ai resistance consumer sentiment report, explores rising preference no ai devices, analyzes market perception ai features, maps user preference divides, and forecasts future trends to satisfy informational intent on AI adoption skepticism. It captures a pivotal shift in consumer trends toward AI resistance.

The AI Resistance Consumer Sentiment Report: Key Findings

The ai resistance consumer sentiment report, detailed as Acxiom’s 2026 CX Trends Report, highlights the “Control Paradox”: consumers prioritize retaining control over AI-guided decisions (their top concern), while brands rank it lowest and emphasize transparency instead. Key statistics show:

- 83% of consumers accept AI influencing decisions but 65% reject AI overriding their agency.

- Only 27% are comfortable with AI analyzing emotions from words, and 38% oppose it entirely, creating an “Empathy Gap” fueled by privacy and agency fears.

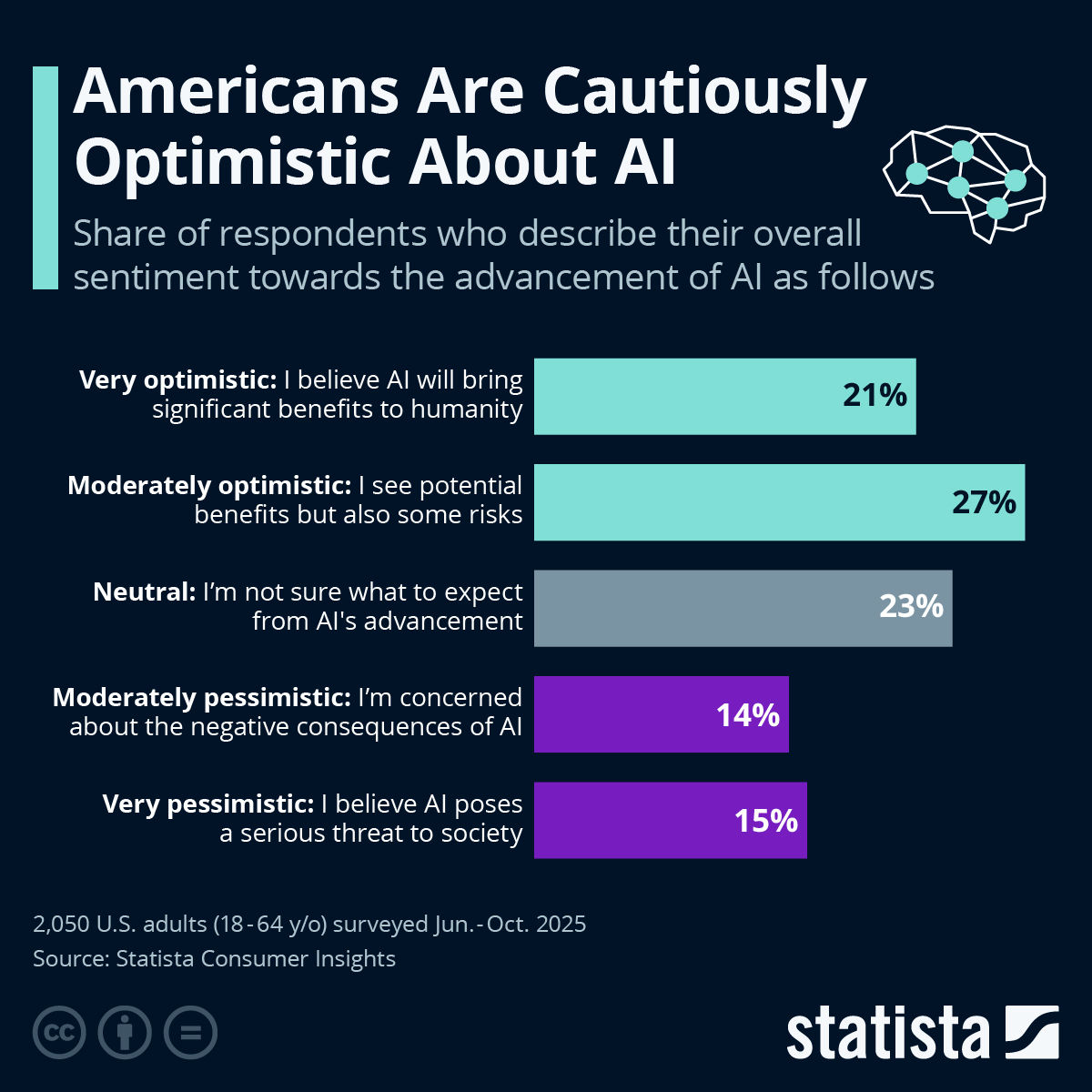

Broader context reveals even AI power users now worry “too much technology can be a bad thing,” a reversal from 15 months prior per Morning Consult’s 2026 analysis; resistance also ties to data privacy and job concerns. This data reveals emerging behaviors like seeking non-AI options and a split in user attitudes, encapsulated by preference no ai devices and user preference divides.

A table compares brand vs. consumer views on control (brands: lowest priority, focus on transparency), effort (74% of brands fear frictionless is forgettable; 73% of consumers want minimal effort), and empathy (81% of brands bet on emotional AI; only 27% of consumers comfortable with emotion-reading).

The Rise of Preference for No-AI Devices

The preference no ai devices is a direct outcome of the ai resistance consumer sentiment report, where consumers favor simplicity to avoid:

- Privacy risks: Fear of data exploitation and surveillance.

- Reliability doubts: Concerns over AI errors and glitches.

- Digital well-being needs: Desire to reduce screen time and tech dependency.

- Extra costs: Avoidance of premium pricing for AI features.

Amid growing wariness of tech excess, specific examples include:

- Smartphones: Demand for basic models without AI bloat, as seen in the resurgence of “dumb” phones for battery life and peace of mind.

- Home assistants: Opt-out options for privacy to prevent constant listening.

- Children’s toys: Prioritizing non-surveilled, simple play over AI features.

This preference signals a niche market rejecting pervasive AI, forcing brands to reconsider feature-heavy designs, as highlighted in preference no ai devices. Readers can relate to scenarios like choosing a “dumb” phone for its longevity and mental clarity, underscoring a broader trend toward controllable tech.

Market Perception of AI Features: Brands vs. Consumers

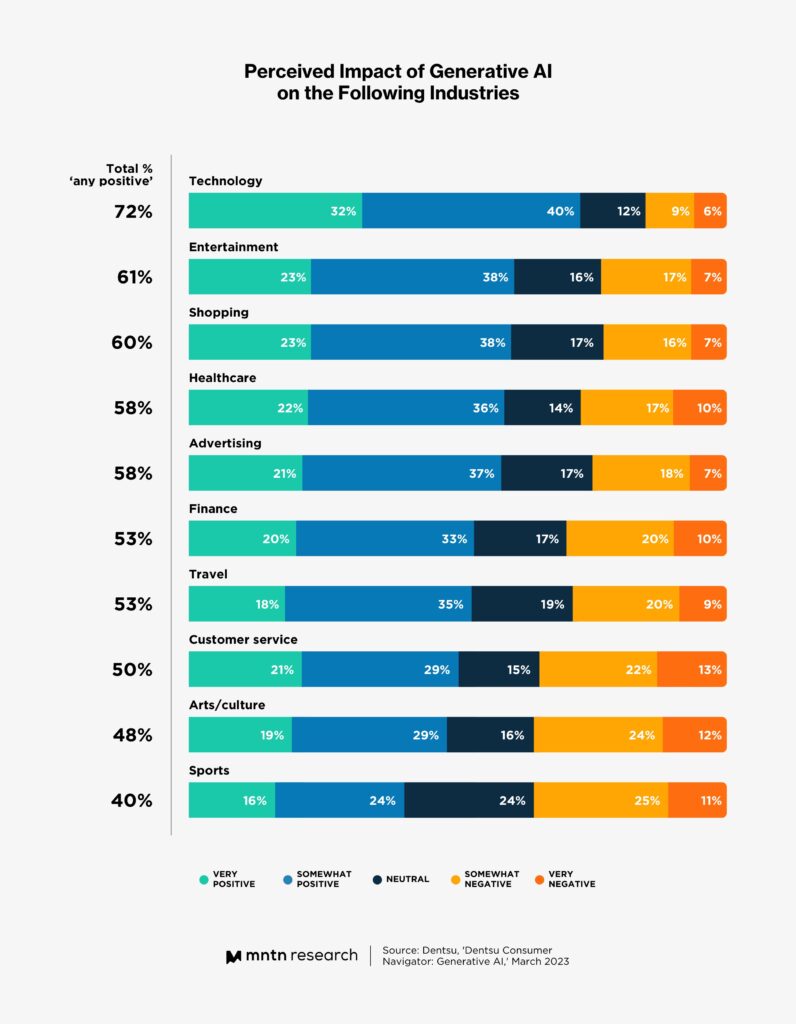

Analyzing market perception ai features, brands navigate split views: downplaying AI in trust-sensitive segments while doubling down on efficiency for others. Consider these points:

- 79% of brands expect AI-curated experiences to transform sectors, but face an “Effort Disconnect” where consumers prefer minimal interaction.

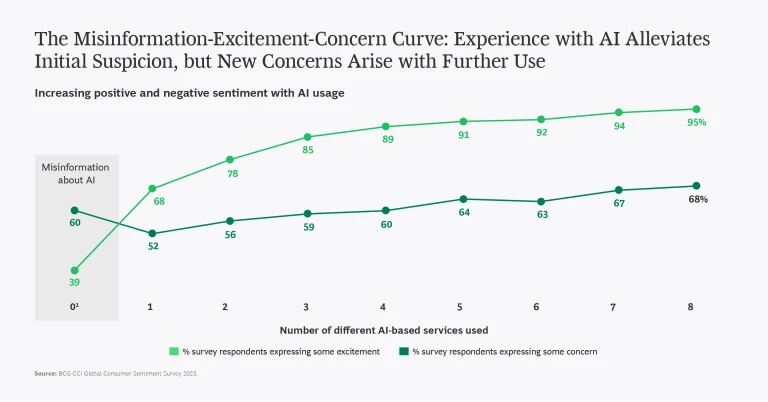

- Challenges include balancing innovation with trust erosion and feature fatigue; BCG’s Consumer AI Disruption Index warns AI could disintermediate brands unless they embed first-party data and human touchpoints.

The earlier table reinforces perception gaps. The ai resistance consumer sentiment report shows how mismatched perceptions amplify skepticism. Strategies include brands marketing “AI optional” modes or hybrid products to address divides. For instance, offering devices with toggleable AI functions can cater to both enthusiasts and skeptics, aligning with market perception ai features that emphasize flexibility.

Mapping User Preference Divides

Mapping user preference divides by psychographics and demographics reveals distinct segments:

- AI enthusiasts (66% novelty-seekers, 75% convenience-driven) over-index on optimism but cool on tech excess.

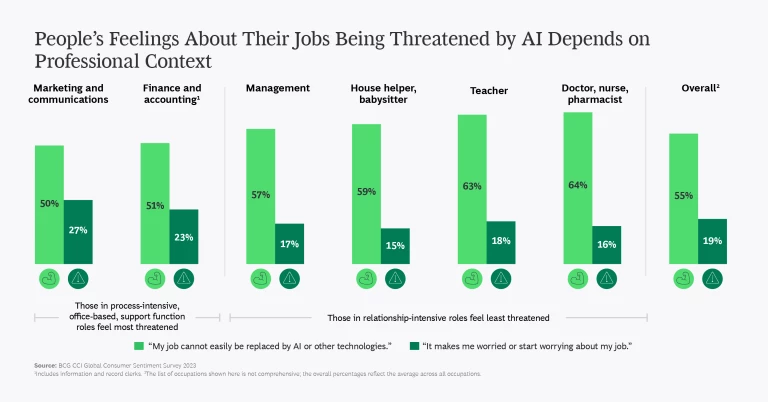

- Skeptics prioritize privacy/control, often older or less tech-savvy.

The divide isn’t pro- vs. anti-tech but about appropriate, controllable AI use; 70% of consumers feel AI’s pace outstrips readiness. Statista identifies four AI personas reshaping loyalty:

- Optimists: Embrace AI for speed and efficiency in tasks like gaming.

- Skeptics: Demand off-switches and transparency, common in parental controls.

- Pragmatists: Accept AI only if it proves useful, avoiding gimmicks.

- Rejectors: Firmly prefer no-AI options, driving demand for simple devices.

Connecting to preference no ai devices and market perception ai features segments product preferences—e.g., young users okay with AI in gaming, parents rejecting it in toys, as explored in user preference divides.

Future Trends and Forecasts

Synthesizing trends, future AI adoption hinges on transparency, user controls, and clear value beyond “smart for smart’s sake”; trust is a “scaling constraint” per Morning Consult. BCG urges optimizing AI discovery while fortifying irreplaceable relationships. Revisiting keywords predicts growth in no-AI niches, tailored marketing, and bridging divides via customizable tech.

Forward-looking questions: Will AI evolve to earn trust, or will “dumb” devices make a comeback? The ai resistance consumer sentiment report suggests that ethical AI integration, as discussed in choices between AI-powered and “dumb” devices, will be crucial. Core insights reiterate that consumer sentiment resists uniform positivity via control paradoxes, empathy gaps, and tech wariness—a major market force.

Frequently Asked Questions

What is the AI Resistance Consumer Sentiment Report?

It’s Acxiom’s 2026 CX Trends Report based on surveys of 4,000 consumers and 600 business leaders, revealing gaps between brand AI investments and consumer demands for control, highlighting the “Control Paradox” and “Empathy Gap.”

Why are consumers preferring no-AI devices?

Due to privacy risks, reliability doubts, digital well-being needs, and extra costs, as seen in the trend toward basic smartphones and opt-out home assistants, driven by the preference no ai devices movement.

How are brands responding to market perception of AI features?

By balancing innovation with trust, offering “AI optional” modes, and focusing on transparency, as strategies outlined in the market perception ai features analysis.

What are the main user preference divides?

Segmented into personas like Optimists, Skeptics, Pragmatists, and Rejectors, based on psychographics and demographics, influencing product adoption in areas like gaming and toys, per user preference divides.

What does the future hold for AI adoption?

It depends on transparency, user controls, and ethical integration, with growth in no-AI niches and customizable tech, as forecasted in trends linking to ethical AI integration.