The AI Divide of 2026: Unpacking the Cautious Optimism in the Latest AI Resistance Consumer Sentiment Report

Estimated reading time: 12 minutes

Key Takeaways

- The latest aggregated ai resistance consumer sentiment report data reveals a society of cautious optimists: overall sentiment is rising, but so is the demand for human control.

- A significant preference for no AI devices is emerging as a direct backlash to perceived intrusiveness and “technology excess,” even among early adopters.

- There’s a stark clash in market perception of AI features; brands see innovation, but many consumers see unnecessary gimmicks that complicate rather than simplify.

- Understanding the spectrum of user preference divides—from enthusiastic adopters to resistant avoiders—is critical for businesses to tailor products and messaging effectively.

- The future points not to a wholesale rejection of AI, but to a balanced ecosystem where utility, transparency, and selective adoption win over generic hype.

Table of contents

- The AI Divide of 2026: Unpacking the Cautious Optimism in the Latest AI Resistance Consumer Sentiment Report

- Key Takeaways

- The Rise of the Cautious Optimist

- The “No AI” Preference: Simplicity as a Luxury

- The Perception Gap: Brands vs. Consumers

- Mapping the User Preference Divides

- Synthesizing the Trends: What’s Next for AI and Consumers?

- Frequently Asked Questions

The conversation around artificial intelligence has reached a fever pitch. As AI weaves itself into the fabric of our daily routines—from shopping and healthcare to how we work—consumers are grappling with a whirlwind of change. This intensifying dialogue is perfectly captured in the latest aggregated insights that form a de facto ai resistance consumer sentiment report for 2026. The data paints a picture not of uniform fear, but of a profound and nuanced divide: a growing undercurrent of skepticism flowing alongside genuine enthusiasm. To understand where we’re headed, we must explore these key trends, the divides they create, and the mixed feelings—from cautious optimism to outright resistance—shaping our relationship with technology. Research from Acxiom’s CX Trends, the BCC Research AI Sentiment Index, and Morning Consult provides the critical backbone for this analysis, revealing a consumer base at a crossroads.

The Rise of the Cautious Optimist

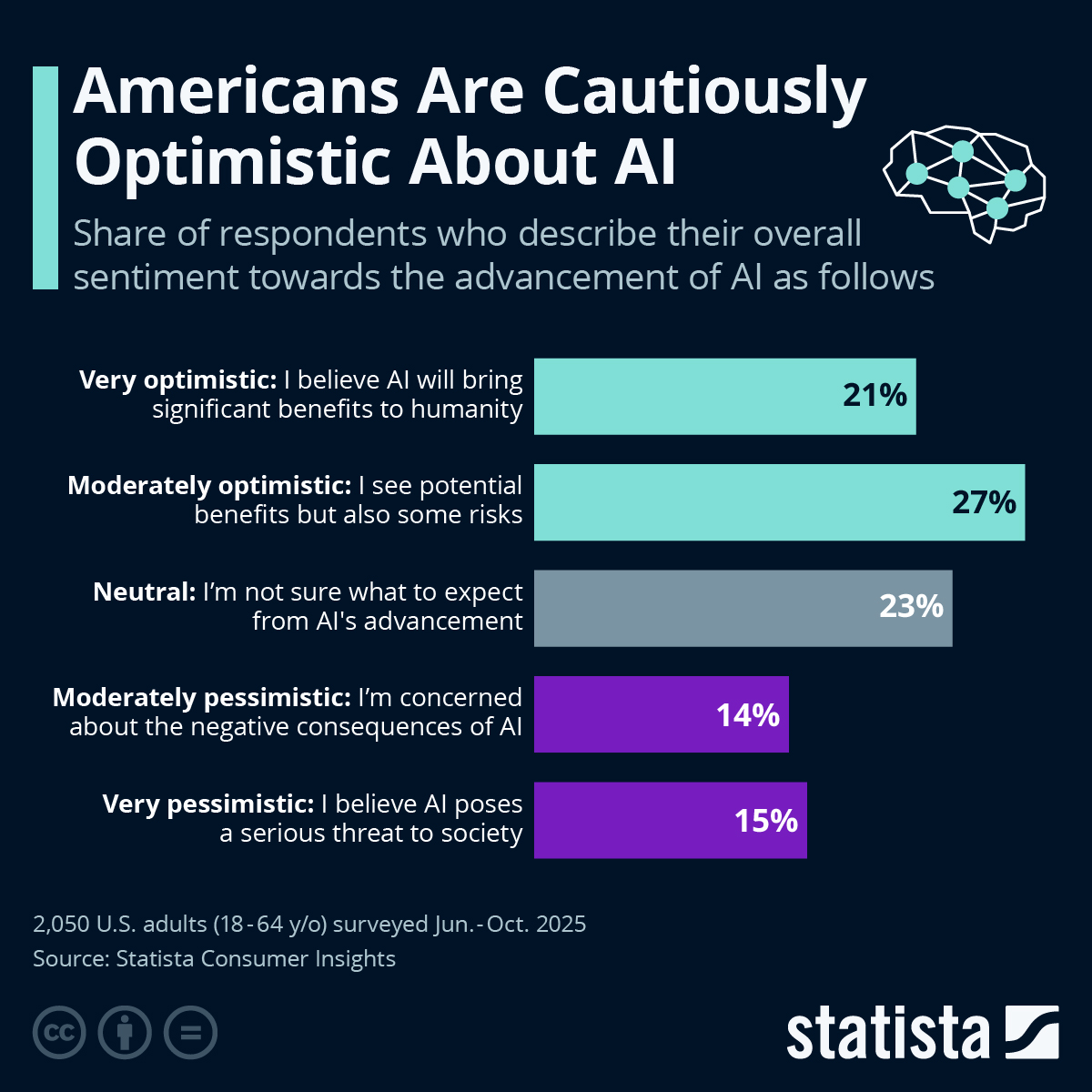

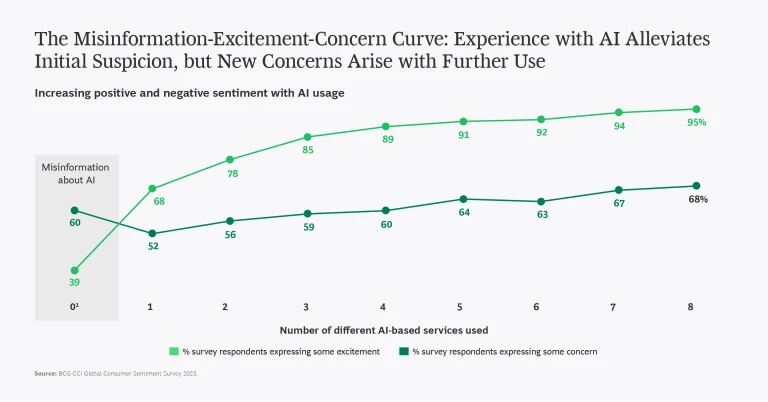

While no single, monolithic ai resistance consumer sentiment report dominates the landscape, synthesizing 2026 insights from leading analysts reveals a dominant archetype: the cautious optimist. The data shows overall AI sentiment climbing, with indices like the one from BCC Research reaching 78.97 in late 2025. Yet, this optimism is heavily tempered by a powerful and non-negotiable demand for control. Consumers are welcoming AI’s capabilities but only on their own terms.

The numbers tell a compelling story of this paradox:

- 65% of consumers reject AI that fully dictates decisions, insisting on a human-in-the-loop model. They want AI as a tool, not a boss.

- Comfort levels plummet when AI gets personal. Only 27% are comfortable with emotion-reading AI, and skepticism peaks with 38% actively opposed to AI emotional analysis, viewing it as a profound overreach.

- Even power users—those who have driven early adoption—are growing wary. There’s a palpable backlash against “technology excess,” a sentiment that the pursuit of innovation has created more complexity than it solves.

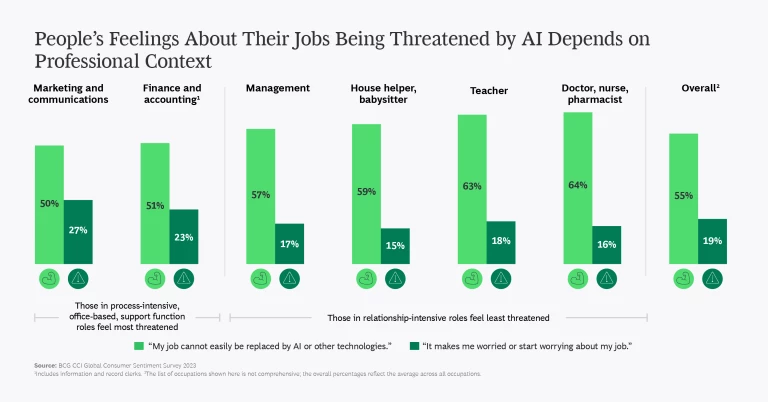

This resistance is not born in a vacuum. It’s fueled by tangible economic anxiety. As noted in Suzy’s analysis of 2026 trends, fears of AI-driven job displacement are leading to heightened price sensitivity and delayed major purchases. The consumer psyche is caught between appreciating AI’s potential and fearing its disruptive consequences. This behavioral shift—driven by psychographics more than demographics—sets the stage for very specific market actions, like the growing desire to simply opt out.

The “No AI” Preference: Simplicity as a Luxury

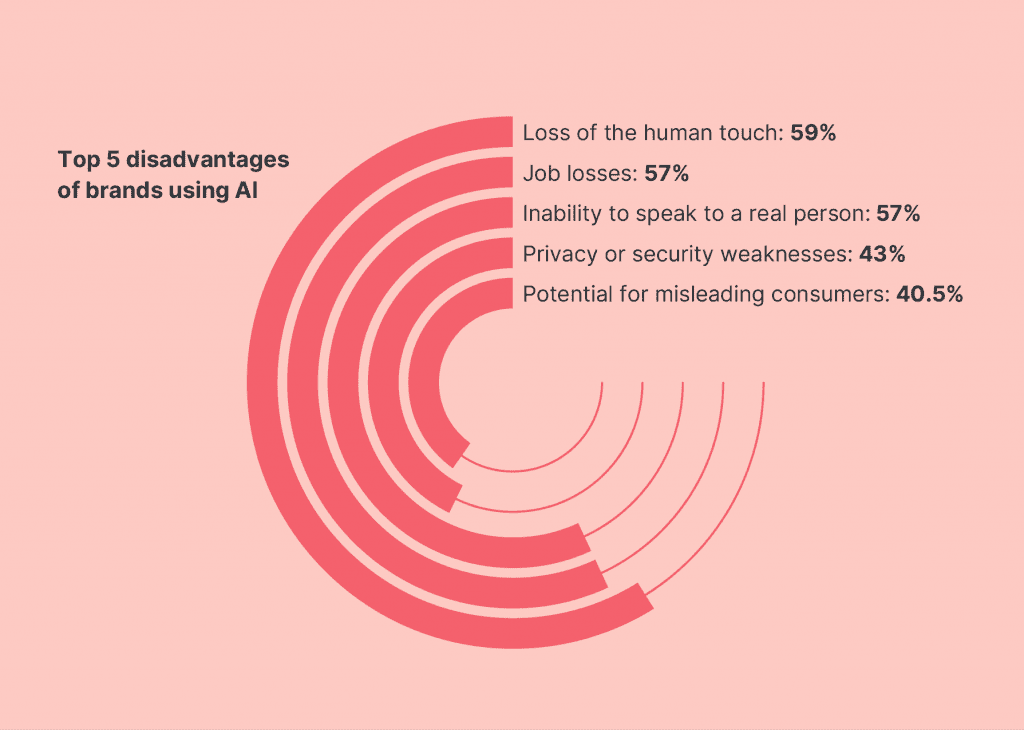

One of the most direct manifestations of the ai resistance consumer sentiment report findings is the rising preference for no AI devices. In a world buzzing with smart everything, a growing segment of consumers is seeking refuge in simplicity. They are actively favoring products and experiences that are straightforward, reliable, and free from embedded AI infrastructure they don’t fully understand or trust.

This trend, highlighted by researchers at Suzy and Acxiom, is driven by several core concerns:

- Privacy Fears: The “always-listening, always-watching” nature of some AI devices feels invasive.

- Perceived Gimmickry: Many AI features are seen as solutions in search of a problem, adding steps rather than reducing them.

- The Backlash to “Excess”: There is a growing cultural fatigue with constant digital entanglement. As Morning Consult notes, even among novelty-seeking AI users (a group 66% more likely to try new tech than the general population), enthusiasm for unchecked integration is cooling.

We see this preference for no AI devices play out in real-time. In the wearables and home tech categories, for instance, proactive health monitoring via AI is embraced by a specific, health-conscious segment. Yet, simultaneously, “dumb” alternatives—basic fitness trackers, simple kitchen appliances—are gaining traction for their reliability, longer battery life, and clear value proposition. The warning to brands is stark: ignoring this desire for analog or low-tech options risks alienating a significant customer base. In an era where trust is the ultimate currency, forcing AI where it isn’t wanted becomes a formidable barrier to entry.

The Perception Gap: Brands vs. Consumers

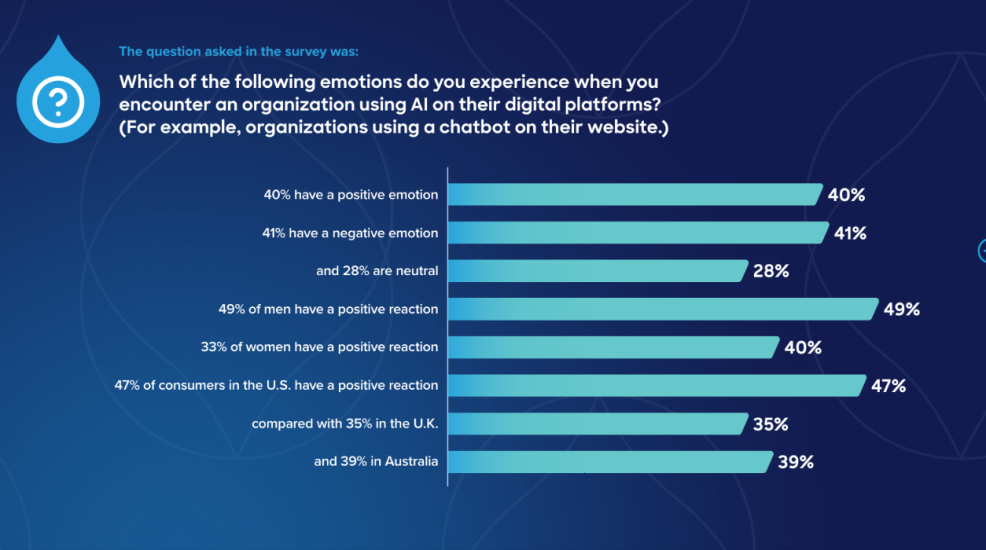

At the heart of much modern consumer frustration lies a critical clash in market perception of AI features. On one side, brands and marketers are overwhelmingly bullish. Acxiom’s report finds that 81% of business leaders see AI as transformative, capable of injecting innovation and even empathy into customer interactions. On the other side, a large portion of the public views these same features as intrusive, unnecessary, or simply overhyped.

This gap isn’t just philosophical; it’s practical. While AI promises “frictionless” experiences, 73% of consumers say they prioritize “low-effort” interactions over “frictionless” ones. The distinction is crucial. Low-effort means solving my problem quickly. Frictionless can feel like a generic, impersonal, and sometimes creepy automation of a process I’d rather control. In a telling statistic, 74% of brands worry that creating seamless, “invisible” AI will make them forgettable to customers. The very tool meant to create connection is, in some cases, eroding it.

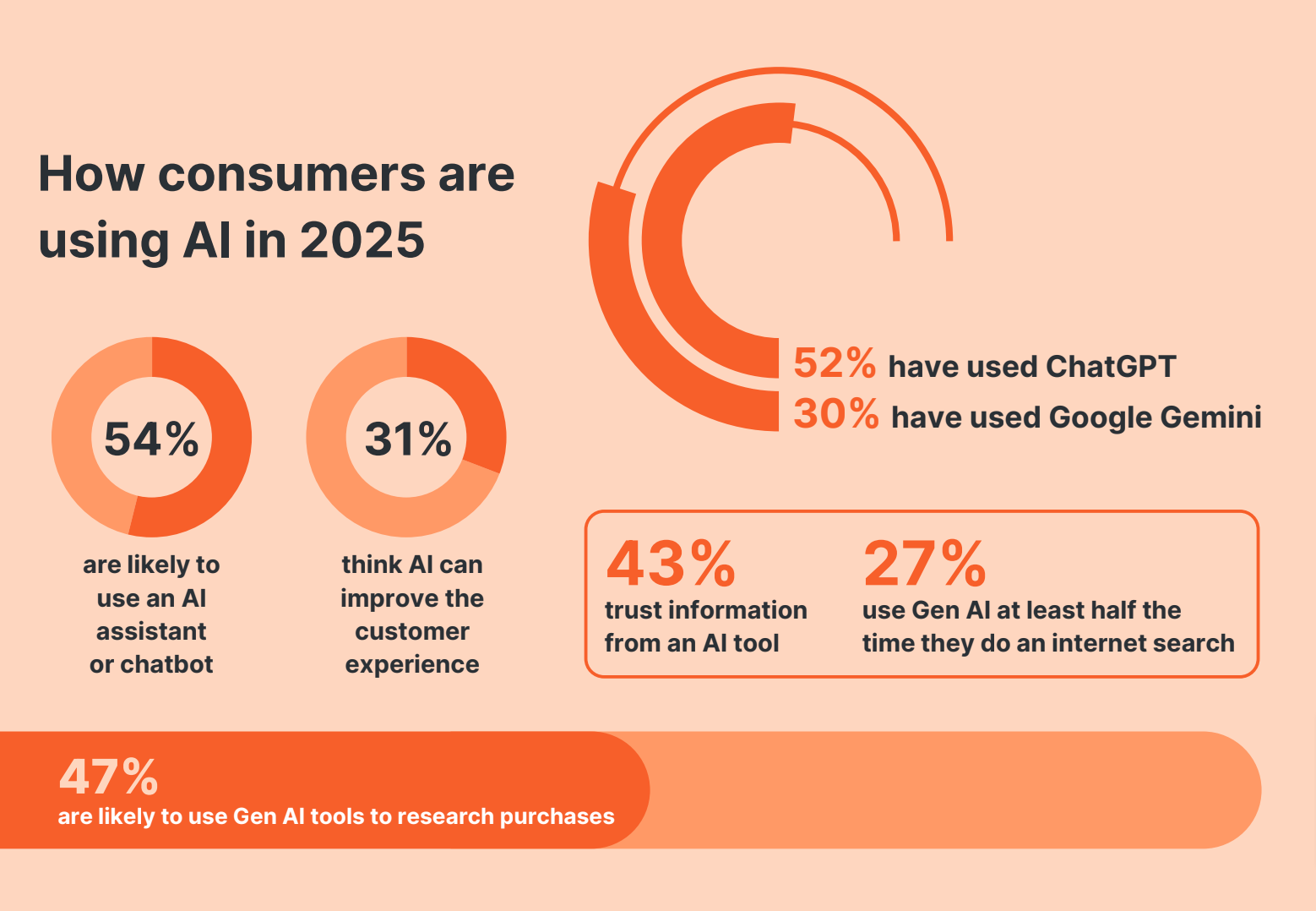

So, where does AI work? The data suggests it succeeds when it is specific, relevant, and non-dictatorial. AI that collapses a 10-step shopping funnel into a helpful chat is welcomed. AI that generically recommends products based on murky logic is ignored or distrusted. This utility-specific appreciation is why optimism remains in sectors like health and finance, where AI’s data-crunching power delivers clear, personal value. However, as Morning Consult’s tracking shows, even among active AI users, optimism has cooled over a recent six-month period, amplifying perceptions of technological excess. This cooling sentiment is a core thread running through any comprehensive ai resistance consumer sentiment report.

Mapping the User Preference Divides

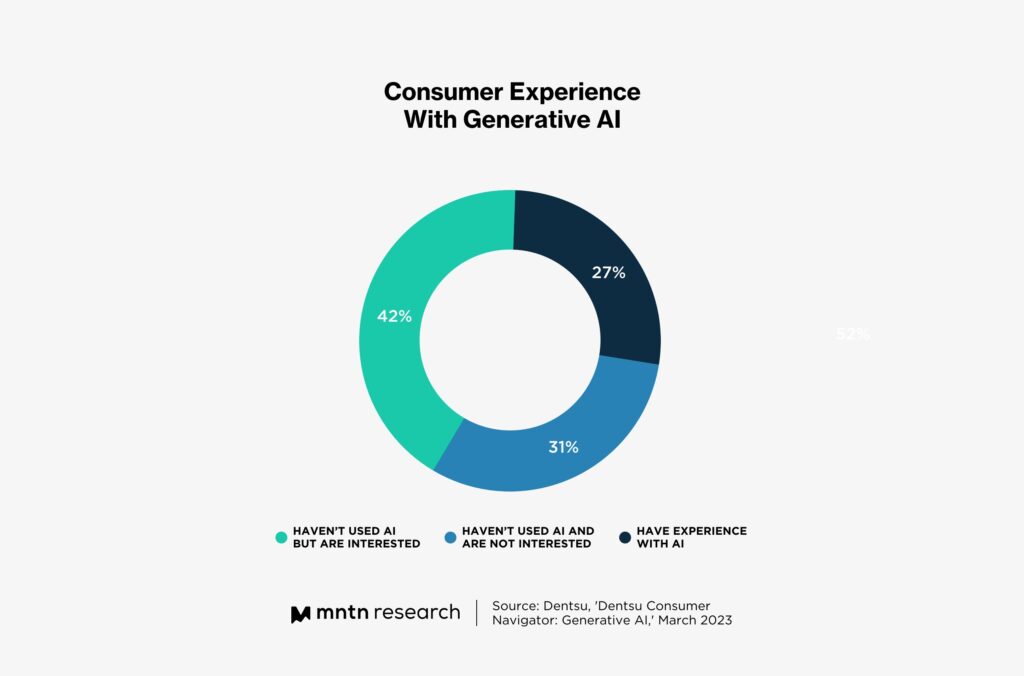

To navigate this complex landscape, we must move beyond a binary view of “for” or “against” AI. The reality is a spectrum of user preference divides. Understanding these segments is the first step for any business looking to engage meaningfully.

- The Enthusiastic Adopters (Convenience-Driven): This group, making up about 75% of certain tech-forward categories, is willing to pay a premium for AI that saves them time and effort. They are the first in line for the latest smart home gadget or AI-powered shopping assistant.

- The Resistant Avoiders (Anxiety-Driven): Driven by fears of job loss, privacy erosion, and a loss of control, this segment actively limits AI interaction. Their skepticism is rooted in a fundamental distrust of corporate motives and the pace of change.

- The Nuanced Selective Adopters (The Pragmatic Majority): This is perhaps the most important group. They are open to AI—83% believe it can be useful—but insist on human-like oversight, transparency, and clear utility. They will use an AI budgeting tool but reject an AI “friend.” They want the benefits without the baggage.

The psychographics behind these divides are telling. Novelty-seekers and status-conscious users often lead uptake, while broader economic anxiety disproportionately affects white-collar workers who feel the threat of automation most acutely. For businesses, this fragmentation isn’t a problem to solve but a reality to address. It demands:

- Tailored Product Development: Embedding AI in verticals with strong existing trust and clear utility, like health or security, rather than as a blanket feature.

- Trust-Based Marketing: Leveraging credible creators and transparent communication to bridge the empathy gap. As BCG’s Consumer AI Disruption Index implies, trust is the critical variable in adoption.

- Hybrid Offerings: Providing options that allow users to dial AI involvement up or down based on their comfort level.

Synthesizing the Trends: What’s Next for AI and Consumers?

Pulling together the threads from this aggregated ai resistance consumer sentiment report reveals overarching, interconnected trends. AI is simultaneously accelerating—supercharging discovery in shopping and personalizing health optimization—and meeting resilient friction from economic fears, control paradoxes, and sheer technology fatigue. The result is a market where purchase funnels are compressed by AI chatbots, yet consumer preferences are more fragmented than ever.

Looking ahead, the current wave of skepticism is unlikely to vanish. It may well persist as a permanent segment of the market, especially in industries deemed “breached” or heavily disrupted by AI, as highlighted by frameworks like the BCG Disruption Index. However, its intensity could fade with consistent, trust-building transparency and unambiguous demonstrations of utility. The most likely future is not an AI-dominated dystopia or a return to analog, but a coexistence. Markets will support both AI-enhanced tools that offer profound utility and reliable, “dumb” devices that offer peace of mind and simplicity. Success will belong to those who recognize these user preference divides and the underlying market perception of AI features, offering choice rather than mandate.

The critical insight from all this data is that consumers want AI to empower, not dictate. With 70% feeling AI is advancing too quickly, the mandate for businesses is clear. To win, prioritize specific, transparent use-cases. Partner with trusted voices, not just flashy tech. Most importantly, offer hybrid options and human-centric design. Replace generic marketing pages with intent-driven content that speaks directly to consumer concerns and desires. In doing so, you won’t just avoid resistance; you’ll earn the kind of authentic advocacy that no algorithm can buy.

Frequently Asked Questions

What is the main takeaway from the 2026 AI sentiment data?

The core takeaway is the rise of “cautious optimism.” While overall sentiment indices are rising, indicating acceptance, consumers are simultaneously demanding greater control, transparency, and simplicity. They are enthusiastic about AI’s potential but fiercely protective of their autonomy, leading to selective adoption and a growing preference for no AI devices in certain contexts.

Why are some consumers preferring devices without AI?

The preference for no AI devices stems from privacy concerns, a perception that many AI features are gimmicky or add unnecessary complexity, and a cultural backlash against “technology excess.” Consumers are seeking reliability, longer battery life, and products that perform a core function well without the perceived risks or annoyances of embedded, always-on AI.

How can businesses bridge the gap between brand and consumer perceptions of AI?

Bridging the market perception of AI features gap requires a shift from selling “AI” as a buzzword to demonstrating specific, low-effort utility. Focus on transparent communication about how data is used, provide clear opt-outs and human oversight, and market through trusted influencers and creators who can authentically communicate the real-world value of the feature.

Will AI resistance fade over time?

It’s more likely to evolve than fade. A segment of resistant or selective users will probably persist, forming a permanent part of the market landscape. Resistance may decrease as trust-building measures (like robust regulations and transparent corporate practices) take hold and as AI proves its utility in unambiguous ways. The future points toward a stratified market catering to different levels of the user preference divides spectrum.

What is the most important action a company can take based on this sentiment report?

The most critical action is to offer choice and control. Instead of a one-size-fits-all AI integration, develop hybrid products and services that allow users to engage with AI features at their own comfort level. Invest in building trust through transparency and ethical data practices. Ultimately, succeed by solving concrete customer problems with clarity, not by overwhelming them with technological prowess.