AI Startup Funding News 2026: Decoding the Unprecedented Capital Surge

Estimated reading time: 8 minutes

Key Takeaways

- The first two months of 2026 saw seventeen U.S.-based AI startups secure funding rounds exceeding $100 million each, signaling a blistering start to the year. (source)

- Capital is undergoing a macro shift from foundational model development to applied AI solutions with clear enterprise revenue pathways and domain expertise.

- Corporate Venture Capital (CVC), led by giants like Nvidia, is becoming a dominant force, validating technology-market fit and accelerating adoption. (source)

- Seed-stage AI startup valuations command a 42% premium, while Series A rounds average 30% higher than non-AI peers, reflecting intense investor appetite. (source)

- Major sectors attracting mega-funding include AI infrastructure, robotics, medical AI, and enterprise automation, with robotics and defense tech poised for disproportionate growth. (source)

Table of contents

- AI Startup Funding News 2026: Decoding the Unprecedented Capital Surge

- Key Takeaways

- The Record-Breaking Pace – Why 2026 Is Different

- The Macro Shift – From Foundation Models to Applied Solutions

- Corporate Venture Capital’s Emerging Dominance

- The Valuation Premium Reality

- Where Money Is Actually Flowing – The Sectoral Breakdown

- The Automation Tech Phenomenon – Why Investors Can’t Get Enough

- Understanding the Current Seed Funding Wave

- What Generates Seed Funding Waves – The Catalysts

- The Maturation Challenge – What Happens to Today’s Seed Companies

- The 2026 Headline-Dominating Sectors – What to Watch

- Frequently Asked Questions

The momentum in ai startup funding news 2026 isn’t just strong—it’s historic. Before the first quarter has even concluded, the venture capital landscape is being reshaped by a torrent of capital flowing into artificial intelligence. Understanding these movements is critical; the distribution of billions of dollars reveals where seasoned investors believe the next era of transformative value creation will occur. This analysis delves into the current surge, the underlying venture capital tech trends, and what they foretell for the remainder of the year.

The Record-Breaking Pace – Why 2026 Is Different

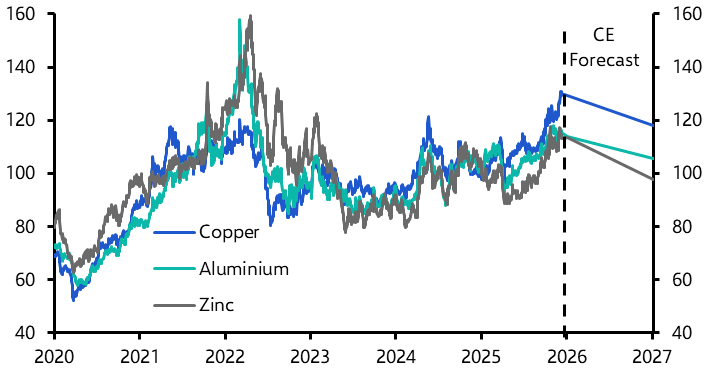

To say 2026 is off to a fast start is an understatement. The current funding trajectory isn’t merely matching 2025’s record-breaking pace—it’s threatening to eclipse it. Seventeen U.S.-based AI startups have already secured funding rounds exceeding $100 million each in the year’s first two months alone. (source) This follows a year where U.S. AI startups collectively raised over $76 billion, largely through “megarounds.” (source) (source)

But the story is deeper than headline numbers. The composition of capital reveals a fundamental reallocation. Major venture investors predict overall tech venture funding will grow 10-25% year-over-year in 2026, with capital concentrating intensely into AI and adjacent sectors like robotics and defense technology. (source) Conversely, funding is receding in areas like climate tech, crypto, and vertical AI applications that lack strong, defensible differentiation. This isn’t a broad-based boom; it’s a targeted siege on the most promising frontiers of applied intelligence.

The Macro Shift – From Foundation Models to Applied Solutions

A pivotal venture capital tech trend defining 2026 is the clear transition from funding foundational model development to backing applied AI solutions. The successful commercialization of base models has created a fertile ground for startups that leverage this technology to solve specific, high-value business problems. (source) (source)

Why does this matter? Applied solutions demonstrate immediate value capture. Instead of speculative bets on general-purpose AI, investors are now drawn to companies combining deep domain expertise—in fields like healthcare, manufacturing, or logistics—with powerful AI capabilities. These startups offer clearer revenue pathways and faster time-to-value for enterprise customers. This shift marks a maturation of the market, moving from “what can AI do?” to “how can AI solve *this* multi-billion dollar problem?”

Corporate Venture Capital’s Emerging Dominance

Another defining feature of ai startup funding news 2026 is the escalating role of Corporate Venture Capital (CVC). Strategic investors like Nvidia are appearing across multiple, high-profile funding rounds, a signal that AI has decisively transitioned from a speculative technology to a mainstream strategic asset class. (source)

Traditional VC firms are increasingly partnering with these corporate actors, who bring more than just capital. They offer distribution channels, industry credibility, and real-world testing environments. When a tech titan invests, it’s a powerful validation of technology-market fit and a strong indicator of where commercial adoption is accelerating fastest. This trend underscores that the winners in the AI race will be those backed by ecosystems, not just checkbooks.

The Valuation Premium Reality

The investor frenzy is quantifiable in stark valuation terms. Data reveals that seed-stage AI startups command a 42% premium in valuations compared to their non-AI counterparts. (source) This premium extends to later stages, with Series A funding for AI companies averaging $51.9 million—approximately 30% higher than non-AI peers. (source)

This gap reflects more than just hype. It signifies intense competition for ventures that demonstrate scalable AI solutions with early traction. Investors are increasingly prioritizing substance over speed. Key metrics now include:

- Data Moats: Unique, proprietary, or hard-to-replicate datasets.

- Algorithmic Edge: Demonstrably superior performance.

- Path to ROI: Clear models for enterprise cost savings or revenue generation, moving beyond vanity user metrics.

Where Money Is Actually Flowing – The Sectoral Breakdown

The ai startup funding news 2026 headlines are dominated by specific sectors where capital is concentrating. The clear winners are infrastructure platforms, enterprise applications, medical AI, robotics, and voice technologies. (source) High-profile rounds tell the story:

- SkildAI’s $1.4 billion Series C exemplifies the massive investor interest automation tech and “embodied AI” powering the next generation of physical robots. (source)

- OpenEvidence’s $250 million round for medical AI chatbots reflects the aggressive digitalization of healthcare, a trend detailed in analyses of revolutionary AI medical breakthroughs.

- Arena’s $150 million Series A for LLM evaluation tools highlights the critical need for infrastructure to manage and secure AI model performance. (source)

Looking ahead, analysts predict robotics and defense technology will capture a disproportionate share of capital relative to other emerging tech sectors, driven by both commercial and geopolitical imperatives. (source)

The Automation Tech Phenomenon – Why Investors Can’t Get Enough

Within the sectoral breakdown, automation technology stands out. This broad category spans from hyper-automation (combining RPA, AI, and process mining) to fully autonomous systems (vehicles, drones, robotic labs), as explored in guides on how AI is transforming businesses.

The reason for the intense investor interest automation tech commands is straightforward: it addresses concrete, costly business challenges—operational inefficiency, labor shortages, and rising costs—with a measurable return on investment (ROI). Unlike speculative consumer AI apps, automation solutions demonstrate immediate value capture and clear paths to enterprise adoption and revenue. (source) Investors are betting on companies that can move AI from the lab directly into production environments, transforming theoretical capability into bottom-line impact.

Understanding the Current Seed Funding Wave

Perhaps the most striking pattern in early 2026 is the nature of the seed funding waves. Seed-stage AI startups are not just growing; they are doing so at an unprecedented scale and valuation. (source) The very definition of a “seed round” is being rewritten.

Consider this: companies like Flapping Airplanes and Inferact, both at the seed stage, secured $180 million and $150 million rounds, respectively—sums traditionally reserved for Series B or later. (source) The characteristics of this wave are telling:

- Mega-Seeds: Early-stage rounds now regularly exceed $100 million, a previously rare phenomenon. (source)

- Pre-Revenue Unicorns: Achieving billion-dollar valuations before generating significant revenue is becoming more frequent. (source)

- Founder Evolution: Successful founders increasingly blend cutting-edge AI research with deep domain expertise (e.g., roboticists, biologists, physicians).

- Geographic Hubs & Diffusion: While Silicon Valley, San Francisco, and New York remain dominant, significant funding is broadening to other tech-forward cities.

What Generates Seed Funding Waves – The Catalysts

What fuels these massive seed funding waves? Multiple catalysts converge to create the perfect conditions for acceleration:

- Commercialization Pathways: The proven success of foundational models provides a clear template for product-market fit, de-risking applied AI ventures.

- Competitive FOMO: Intense competition among venture firms to secure a position in the next big thing is driving up deal sizes and valuations at record speed. (source)

- Regulatory Tailwinds: Growing clarity in key sectors (like healthcare or finance) reduces perceived regulatory risk, making investors more comfortable writing large checks early. (source)

Historically, such waves are generated by technological breakthroughs, regulatory changes, or a highly successful exit that creates “copycat” investor enthusiasm. Understanding these triggers is key to predicting when the current wave might crest and capital becomes more selective.

The Maturation Challenge – What Happens to Today’s Seed Companies

The current cohort of lavishly funded seed companies will face a critical juncture in late 2026 and 2027 as they seek Series A and B funding. The competition for follow-on capital will intensify dramatically, and the bar for raising will rise in tandem.

The central risk is a looming “capital cliff.” Companies that raised at inflated seed valuations without demonstrating proportional progress in revenue, enterprise adoption, or proprietary technology advancement will find the next round incredibly difficult. The market’s patience for pure user growth without a monetization path is waning.

The companies poised to thrive are those that use their seed capital to build not just a product, but a defensible business—showcasing early enterprise traction, strong unit economics, and a data or algorithmic moat. They will command premium valuations, while others may face down-rounds or consolidation.

The 2026 Headline-Dominating Sectors – What to Watch

Synthesizing the venture capital tech trends and funding data, several sectors are poised to dominate ai startup funding news 2026 headlines beyond the initial frenzy:

- AI-Native Cybersecurity: As AI capabilities grow, so do AI-powered threats. Startups building autonomous defense systems will see massive demand.

- Industrial Robotics & Autonomy: Beyond warehouse robots, expect funding for AI-driven manufacturing, construction, and agricultural robots that operate in complex, unstructured environments.

- Biotech & Computational Drug Discovery: AI’s ability to model biological systems and accelerate R&D will continue to attract billions from both VCs and pharma giants.

- AI for Climate & Energy: While general climate tech funding may cool, applied AI for grid optimization, carbon capture, and sustainable materials science will remain hot.

- Enterprise AI Agents: The next evolution beyond chatbots—autonomous AI agents that can execute multi-step workflows across business software—will become a major funding category.

Frequently Asked Questions

What is the single biggest trend in AI funding for 2026?

The dominant trend is the macro shift from foundational models to applied AI solutions. Investors are pouring capital into startups that use established AI capabilities to solve specific, high-value problems in sectors like healthcare, manufacturing, and enterprise software, prioritizing clear revenue pathways over speculative research.

Why are seed-stage AI valuations so much higher than other startups?

Seed-stage AI startups command a ~42% valuation premium due to intense investor competition (FOMO), the perceived high growth potential of scalable AI solutions, and the significant upfront capital often required for AI talent and computing resources. Investors are betting earlier and larger to secure a stake in potential category leaders.

Is corporate venture capital (CVC) involvement a good sign for AI startups?

Generally, yes. Involvement from CVCs like Nvidia or major enterprise software companies is a strong signal of technology validation and market fit. Beyond capital, these partners offer strategic advantages: access to distribution channels, industry expertise, and early-adopter customers, which can significantly accelerate a startup’s path to commercialization.

Which AI sector is attracting the most investor interest in 2026?

While several sectors are hot, automation technology and robotics are capturing disproportionate attention. This includes everything from software hyper-automation to physical embodied AI. The driver is tangible ROI—these technologies address acute business pain points like labor costs and operational efficiency, offering investors clearer and faster paths to returns.

What is the biggest risk for the AI startups raising huge seed rounds now?

The greatest risk is the “maturation challenge.” Startups that raise at peak seed valuations must demonstrate extraordinary progress to justify even higher valuations in their next round. Those that fail to convert capital into robust technology, revenue growth, or sustainable unit economics may face a severe “down round” (raising at a lower valuation) or struggle to raise again, leading to consolidation or failure.