Decagon AI Startup Funding Round: Details on Series C and Customer Service AI Valuation

Estimated reading time: 9 minutes

Key Takeaways

- Decagon, a leader in the AI-powered customer service space, has successfully closed a significant Series C funding round.

- This Decagon AI startup funding round raised a substantial $100 million.

- The Series C round propelled the Decagon customer service AI valuation to an impressive $1.5 billion.

- The funding is earmarked for accelerating growth, expanding product capabilities, and scaling operations, reinforcing Decagon’s position in the competitive AI market.

- Decagon’s valuation is driven by strong revenue growth, *demonstrated efficiency gains* for major enterprise clients, and a focus on automating complex support interactions.

- This funding round highlights the increasing investment trend in AI agents for customer support funding as enterprises seek cost-effective, scalable solutions.

- Decagon is well-positioned to capitalize on future customer service AI market trends 2025 and beyond, given its traction with major brands and technological capabilities.

Table of contents

- Decagon AI Startup Funding Round: Details on Series C and Customer Service AI Valuation

- Key Takeaways

- Unpacking the Decagon Series C Funding Details

- Understanding the Decagon Customer Service AI Valuation

- The Bigger Picture: Funding Trends for AI Agents in Customer Support

- Looking Ahead: Customer Service AI Market Trends 2025 and Beyond

- Conclusion

- Frequently Asked Questions

The world of Artificial Intelligence is constantly evolving, with groundbreaking advancements reshaping industries at a rapid pace. Amidst this dynamic environment, a rapidly growing company in the AI-powered customer service sector, Decagon, has achieved a significant milestone that underscores the immense potential and increasing investor confidence in specialized AI solutions.

Decagon recently announced the successful completion of a major Series C funding round. This event is not just a financial transaction; it’s a clear signal of the company’s robust growth, technological prowess, and strategic importance in the burgeoning market for intelligent customer support agents.

This Decagon AI startup funding round is a critical event for several reasons. Firstly, it provides Decagon with substantial capital to accelerate its ambitious growth plans. Secondly, and perhaps more tellingly, it sets a new benchmark for the company’s valuation within the highly competitive landscape of AI-powered customer support solutions. This funding round signals a significant leap in Decagon’s market positioning and impacts its perceived value amongst peers and potential customers alike. Decagon’s success highlights transformative changes across sectors, mirroring broader trends like How AI is Transforming Businesses: A Comprehensive Guide for 2025.

In this post, we will delve into the specific details of this pivotal funding round, exploring the figures, the investors involved, and the strategic implications. Furthermore, we will analyze what this valuation means for the Decagon customer service AI valuation specifically, examining the factors that contribute to its impressive figure and its positioning within the broader customer service AI market.

Unpacking the Decagon Series C Funding Details

To fully appreciate the significance of Decagon’s recent achievement, let’s dive into the key Decagon Series C funding details. This capital infusion represents a major step forward for the company, providing the fuel needed for its next phase of expansion.

The recent capital infusion is Decagon’s Series C round. This indicates the company is in a more mature stage of growth compared to earlier seed or Series A/B rounds, having already established product-market fit and demonstrated significant traction with enterprise clients.

According to recent reports, this Decagon AI startup funding round successfully raised a substantial $100 million. This figure is a testament to the strong investor confidence in Decagon’s technology and its potential to capture a significant share of the customer service market. Securing $100 million at the Series C stage is a notable achievement, particularly in the current investment climate, reflecting the perceived high value and potential return associated with Decagon’s AI platform.

A crucial outcome of this funding round is the resulting post-money valuation. This round set Decagon’s post-money valuation at an impressive $1.5 billion. This valuation figure is based on the total capital raised and the equity stake given to investors in this latest round. A $1.5 billion valuation reflects not only the company’s rapid growth trajectory but also the market’s bullish outlook on the application of Decagon’s specialized AI technology specifically tailored for complex enterprise customer service environments. It underscores the belief that Decagon’s approach to AI agents can deliver substantial, measurable value for large organizations.

While specific individual investors leading the Series C round haven’t always been named publicly in every report, the fact that Decagon attracted such a significant investment suggests continued backing from prominent venture capital firms. Looking at previous rounds provides context for the caliber of support Decagon has received. Leading firms such as Bain Capital Ventures, Accel, Andreessen Horowitz, and Elad Gil have been involved in funding Decagon in the past. The continued investment or participation of such high-profile names lends significant credibility to Decagon’s business model and technological innovation. These firms are known for identifying and backing companies with disruptive potential and strong growth prospects.

So, what will Decagon do with this fresh capital? The planned use of funds obtained in the Series C round centers around accelerating key areas of the business. The primary goals are to aggressively accelerate Decagon’s growth, significantly expand its product capabilities (which will likely involve further sophisticated AI development, potentially leveraging recent advancements in generative AI), and bolster hiring efforts across engineering, sales, and customer success teams. These strategic investments are aimed at maintaining Decagon’s technological edge in the competitive AI landscape and scaling up operations significantly to meet growing enterprise demand. The capital will enable Decagon to invest more heavily in R&D, expand its market reach, and build the infrastructure necessary to support a rapidly growing customer base.

Decagon’s success in attracting this level of funding is underpinned by strong customer traction. The company’s customer base already features major, recognizable names from various industries. Listing these names demonstrates strong enterprise adoption and validation of Decagon’s platform. Prominent clients include Notion, Duolingo, Rippling, Bilt, Eventbrite, and Substack. The fact that these major players trust Decagon with their customer service operations speaks volumes about the platform’s effectiveness and reliability. Landing and retaining such high-profile clients provides a strong foundation for future growth and helps justify the high valuation.

Understanding the Decagon Customer Service AI Valuation

The most talked-about number emerging from the recent funding round is the post-money valuation. The recent Series C round specifically propelled the Decagon customer service AI valuation to an impressive $1.5 billion. But what factors justify such a valuation for a company in the customer service AI space? The answer lies in a combination of Decagon’s performance metrics, its technological capabilities, and the dynamics of the market it operates within.

This $1.5 billion valuation is driven by several key factors that collectively demonstrate Decagon’s success and future potential in the highly competitive customer service AI market. Investors are clearly betting on Decagon’s ability to continue its steep growth trajectory and capture a significant portion of the market opportunity.

- Revenue Growth: One of the most compelling drivers of Decagon’s valuation is its robust revenue growth. Decagon has shown a dramatic increase in its Annual Recurring Revenue (ARR), jumping from $0.6M ARR in 2023 to an estimated $6M ARR by December 2024. This represents a phenomenal 900% year-over-year growth rate. Such explosive revenue growth is a strong indicator of market demand for Decagon’s solution and its ability to scale its sales and operations effectively. Investors often use ARR growth as a primary metric to value SaaS companies, and Decagon’s figures are exceptional. Source: Sacra

- Efficiency Gains for Clients: Decagon’s AI agents are not just performing tasks; they are delivering significant, measurable efficiency gains for their enterprise clients. The company highlights that its platform can often reduce the workload on human support teams by up to 80%. This level of demonstrated return on investment (ROI) is highly attractive to large organizations constantly looking for ways to optimize costs and improve productivity in their customer service operations. By automating a large percentage of support interactions, Decagon frees up human agents to handle more complex or sensitive issues, improving both efficiency and potentially customer satisfaction. The discussion around efficiency gains and potential workforce impact is explored further in analyses like whether Is Amazon Generative AI Workforce Reduction a Reality?

- Focus on Complex Interactions: Unlike many basic chatbots, Decagon’s AI is designed to handle complex customer interactions. This strategic focus is a key differentiator and a highly valuable capability for enterprises dealing with intricate products, services, or support processes. By successfully automating these more challenging scenarios, Decagon unlocks greater potential for efficiency and delivers a higher quality of automated support, which is crucial for maintaining brand reputation. Source: Sacra

Beyond Decagon’s internal performance, broader market factors significantly contribute to its high valuation. The market for customer service AI is enormous and rapidly expanding, providing a fertile ground for companies like Decagon to grow.

- Market Size: The global customer support market is estimated to be a massive $445 billion. This represents a colossal addressable market for AI-powered solutions. Decagon operates within a segment of this market focused on large enterprises and complex support, but even a small percentage of this overall market represents a multi-billion dollar opportunity. This vast market size provides immense headroom for Decagon’s continued growth and justifies a premium valuation based on future potential. Source: ainvest.com

- Cost Reduction Potential: Decagon’s AI agents have a profound impact on per-contact costs for businesses. Reports indicate they can achieve up to a 95% reduction in the cost of handling a customer interaction compared to traditional human agents. In a cost-conscious business environment, this level of savings is incredibly compelling. It makes Decagon’s solution highly attractive and potentially more resilient even in challenging economic climates, as businesses prioritize investments that offer clear and significant cost efficiencies. Source: ainvest.com

- Growth Potential: The combination of a massive market and demonstrated cost-saving capabilities translates into significant growth potential. As mentioned, even capturing a small fraction (say, 1%) of the $445 billion global customer support market would represent a multi-billion dollar annual revenue opportunity for Decagon. This potential for exponential scaling underlines the substantial growth potential that helps justify the company’s $1.5 billion valuation. Investors are valuing Decagon based not just on its current revenue, but on the expectation that it can capture a meaningful share of this vast market over time. Source: ainvest.com

Adding to the appeal for investors is Decagon’s monetization strategy. Decagon approaches monetization via a per-conversation and per-resolution pricing model. This model is highly scalable and aligns Decagon’s success directly with the value it delivers to clients by handling customer interactions efficiently. This model supports predictable and scalable revenue streams, which is attractive for investors looking for stable, growth-oriented businesses. Source: Sacra

In essence, the $1.5 billion valuation is a reflection of Decagon’s proven technology, rapid revenue growth, ability to deliver tangible ROI to major clients, and its strategic positioning within a massive and growing market that is ripe for AI-driven disruption. It’s a valuation based on strong current performance and immense future potential.

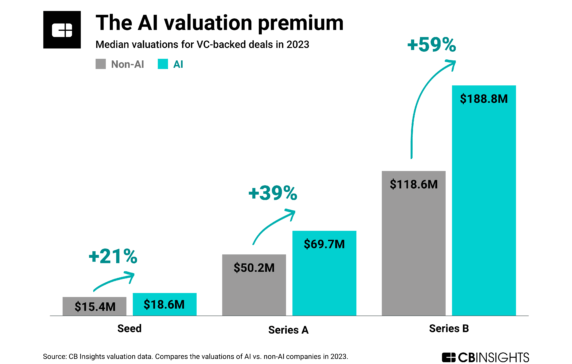

The Bigger Picture: Funding Trends for AI Agents in Customer Support

Decagon’s substantial Series C round is certainly a major event for the company itself, but it’s also indicative of a much broader and more significant trend occurring across the tech investment landscape: aggressive investment in AI agents for customer support funding. This isn’t an isolated incident; it’s part of a wave of capital flowing into companies that are building sophisticated AI solutions to automate and enhance customer interactions. The increasing sophistication and capability of conversational AI, explored in areas like the Future of AI chatbots in Customer Service: Revolutionary AI Chatbots, is a key factor driving this investment surge.

This trend is happening because enterprises across virtually every industry are increasingly seeking advanced automation and cost-efficiency solutions for their support operations. Manual customer support is expensive, difficult to scale, and can struggle to keep up with high volumes of inquiries while maintaining quality. AI agents offer a path to handle a larger volume of requests, provide instant responses, operate 24/7, and potentially offer more consistent service quality. This intense demand from the enterprise sector is directly fueling the influx of capital into the sector.

Relevant research on enterprise priorities further solidifies this trend. For example, a Gartner survey found that a significant 70% of CIOs are prioritizing AI-driven cost efficiency in 2025. This finding is highly relevant to the **AI agents for customer support funding** sector, as AI agents are a prime example of technology designed explicitly to reduce operational costs in a critical business function. This strategic priority among IT leaders directly translates into demand for and investment in companies offering these solutions. The momentum around enterprise AI agents is also underscored by developments like Decoding Microsoft AI Agent News 2025: Breakthroughs, Impact of AI Agents on Business, and the Future of AI Agents in Work, highlighting the widespread focus on this technology for business applications.

To illustrate this trend beyond Decagon, we can look at other notable funding activities in the space. While not directly in the customer support *agent* space, related areas also see significant investment. For instance, Bilt’s $200 million raise, while focused on a loyalty program tech, signals intense investor interest in technologies that streamline and automate customer interaction and operational processes, which often includes significant support components. (Note: Bilt is also listed as a Decagon customer, suggesting integration of advanced tech is a priority for them). This level of investment in adjacent areas further signals the perceived value and potential of technologies that enhance customer experiences and operational efficiency through automation. Source: ainvest.com

The strong funding momentum seen in AI agents for customer support funding speaks to two main points: first, the increasing maturity and scalability of the AI solutions being developed, and second, the increasing pressure on companies across industries to enhance customer experiences while simultaneously managing costs effectively. Investors see this confluence of factors as a significant market opportunity, and companies like Decagon are well-positioned to capitalize on it. The demand signal from enterprises is loud and clear, driving capital towards the most promising solutions in this space.

Looking Ahead: Customer Service AI Market Trends 2025 and Beyond

Looking beyond the immediate news of Decagon’s funding round, it’s important to consider the future trajectory of the customer service AI market. Industry analysts predict continued, rapid expansion in the customer service AI market trends 2025 and well into the future. While the market faces Critical AI Challenges Tech Industry 2025: Future Trends and Upcoming Regulations, such as ethical considerations, data privacy, and the need for sophisticated integration, the underlying demand for AI-powered efficiency and enhanced customer experience remains incredibly strong, suggesting robust continued growth.

This expansion is driven by multiple factors. The increasing enterprise adoption of AI across all business functions is a major catalyst, making AI in customer support a natural extension. Furthermore, the transformative impact of generative AI specifically on workflow automation within support departments is a key driver. Generative AI can create more human-like conversations, summarize long customer histories, draft responses for human agents, and even autonomously resolve more complex issues than previous generations of chatbots. These capabilities unlock new levels of efficiency and effectiveness in customer service. Source: ainvest.com

Decagon is strategically positioned to capitalize on these future customer service AI market trends 2025. Why? Because the company has already demonstrated early traction with major enterprises – the very organizations that are leading the charge in AI adoption. Its existing partnerships with large, complex businesses validate its ability to handle demanding use cases. Crucially, Decagon has already shown a demonstrated ability to drive substantial cost savings and productivity improvements for these clients, proving the tangible value of its technology. Source: Sacra, Source: Decagon Resources.

The company’s latest funding round, the $100M Series C, provides a strong capital foundation. This is crucial because staying at the forefront of AI innovation, especially in a rapidly moving field like generative AI, requires continuous investment in research and development. This significant capital infusion positions Decagon to continue advancing its AI capabilities specifically in customer support, enabling it to handle even more complex tasks, integrate with a wider range of enterprise systems, and potentially expand its service offerings. With this capital, Decagon is well-equipped to compete effectively and is positioned to potentially claim a significant share of the evolving $445 billion global market by staying ahead of the curve in technological development and market penetration. Source: ainvest.com

As AI agents become more capable and trusted – a key trend in customer service AI market trends 2025 – their integration is expected to fundamentally redefine customer service roles, shifting human agents towards more complex problem-solving and relationship building. This integration is also expected to lead to significantly improved response times, 24/7 availability for basic inquiries, and ultimately unlock new levels of efficiency and customer satisfaction across various industries. Decagon’s success and continued investment highlight that this future is not distant, but rapidly becoming a reality.

Conclusion

In summary, Decagon’s $100 million Series C funding round is undeniably a landmark event for the company and a significant indicator for the broader AI market. This substantial investment has not only provided Decagon with considerable resources but has also catapulted its Decagon customer service AI valuation to an impressive $1.5 billion. Source: ainvest.com, Source: Goldsea.

This infusion of capital, backed by confidence from leading investors who have participated in previous successful tech ventures, strategically positions Decagon for its next phase of expansion. The funds will empower Decagon to accelerate its enterprise capabilities, invest heavily in product development, scale operations rapidly, and compete even more effectively in the fiercely competitive and rapidly developing customer service AI market. Its existing traction with major enterprise clients provides a strong foundation for leveraging this new capital. Source: Sacra.

More broadly, the Decagon AI startup funding round is also a significant signal for the broader trend of increasing investment in AI agents for customer support funding. It underscores that investors see enormous potential and demand for AI solutions that can automate, optimize, and enhance customer interactions at scale. This sector is clearly poised for significant transformation and continued growth as organizations globally prioritize scalable, high-efficiency solutions heading into customer service AI market trends 2025 and beyond. Source: ainvest.com.

Decagon’s trajectory, powerfully highlighted by this funding round and the resulting valuation, not only demonstrates its potential to become an industry leader but also signals further disruption and innovation ahead for customer service worldwide as AI technology continues its relentless advance. The success of companies like Decagon shows that specialized, high-impact AI applications are attracting serious investment and are set to reshape how businesses interact with their customers.

Frequently Asked Questions

- What is the primary news about Decagon AI?

Decagon, a company specializing in AI for customer service, recently completed a significant Series C funding round.

- How much funding did Decagon raise in its Series C round?

Decagon raised $100 million in its latest Series C funding round. Source: Goldsea.

- What is Decagon’s valuation after the Series C funding?

Following the Series C funding round, Decagon’s post-money valuation is $1.5 billion. Source: Goldsea.

- What drives Decagon’s high valuation?

Decagon’s valuation is driven by factors such as its explosive revenue growth (900% YoY to $6M ARR), demonstrated efficiency gains for clients (up to 80% reduction in support team workload, up to 95% cost reduction per contact), focus on complex customer interactions, and the large size and growth potential of the customer service AI market. Source: Sacra, Source: ainvest.com.

- Who are some of Decagon’s notable customers?

Decagon serves major enterprises including Notion, Duolingo, Rippling, Bilt, Eventbrite, and Substack. Source: Sacra.

- How will Decagon use the funds from the Series C round?

The funds will be used to accelerate growth, expand product capabilities (likely further AI development), and support hiring efforts to maintain technological edge and scale operations. Source: Goldsea.

- What does this funding round signify for the AI customer support market?

This funding round is a strong signal of increasing investor confidence and significant momentum in the AI agents for customer support funding sector, driven by enterprise demand for cost-efficiency and advanced automation. Source: ainvest.com.