“`html

The Unseen Battle: Why Power, Land, and Cooling Define the AI Arms Race

The public narrative of the Artificial Intelligence revolution often centers on algorithmic breakthroughs, trillion-parameter models, and the race for superior GPU chips. However, beneath the surface of this incredible innovation lies a much grittier, physical competition: the struggle for physical infrastructure. Training today’s frontier Large Language Models (LLMs) doesn’t just require software genius; it demands enormous, uninterrupted power, acres of secure land, complex water management, and cutting-edge cooling solutions for racks that hum at 30-70kW or more. The current AI boom is rapidly encountering hard physical limitations, making megawatts the new metric of power.

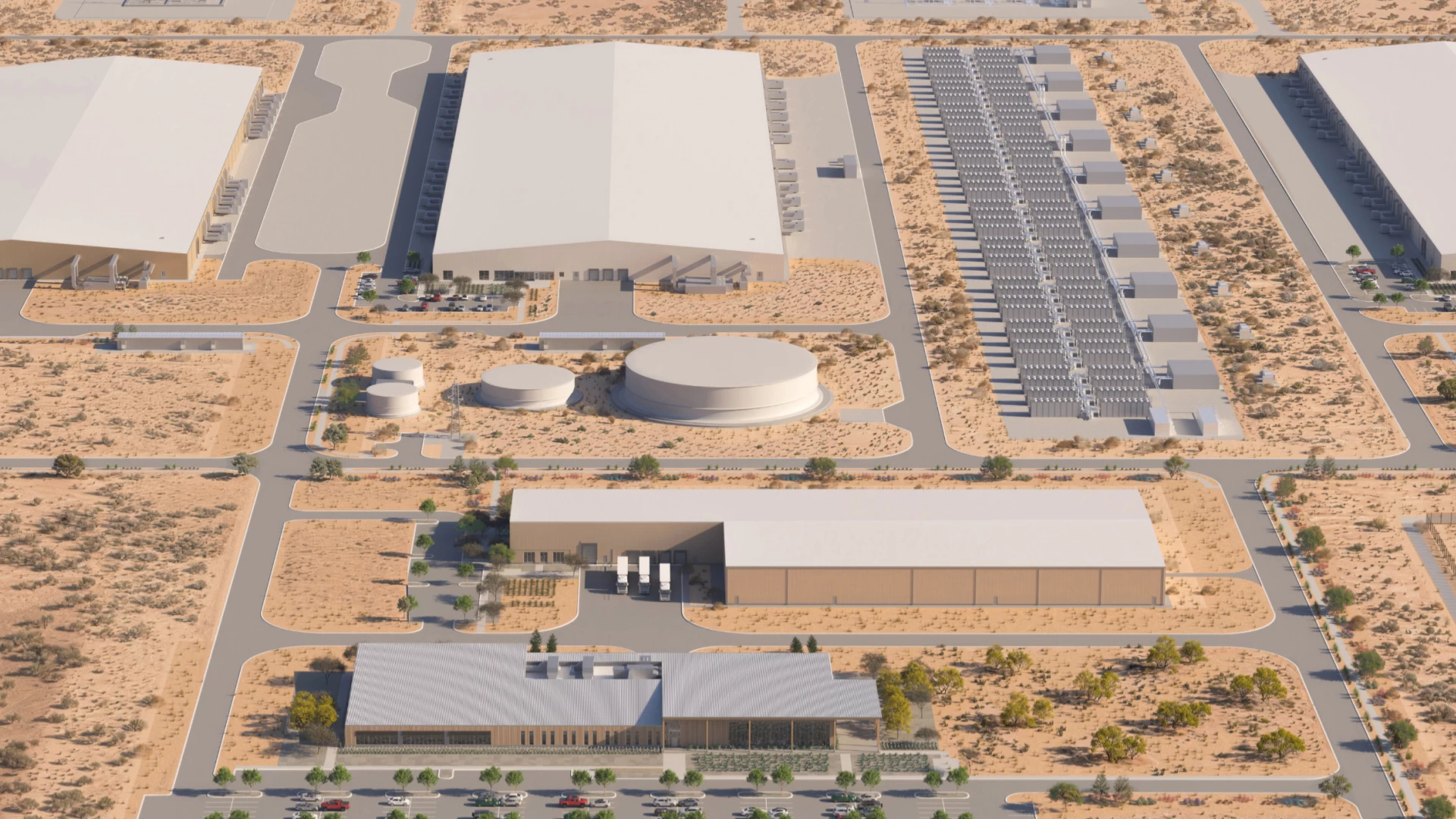

This infrastructure bottleneck is precisely where Meta is making its massive, strategic play. The focus shifts dramatically with the announcement of the flagship meta ai infrastructure investment el paso. This isn’t just another data center; it is a dedicated, AI-optimized campus costing upwards of $1.5 billion, projected to scale up to 1GW of capacity. Designed explicitly to train and serve the massive models powering Meta AI, Facebook, Instagram, and WhatsApp, this project is a concrete declaration that the future of large language model data centers is transforming into highly powered, specialized “AI factories.”

This deep dive will unpack the scale of this El Paso commitment, explore the strategic reasons behind this choice, examine the staggering financial implications for AI hardware versus physical infrastructure, and contrast Meta’s strategy with that of its peers. For those seeking the ground truth behind the algorithmic hype, the details of Meta’s physical investment speak volumes.

The meta ai infrastructure investment el paso is a powerful indicator of how vital energy access and site selection have become in determining who leads the next wave of AI deployment.

Unpacking the Scale of Meta’s El Paso AI Data Center

The El Paso commitment stands as a monument to Meta’s commitment to AI supremacy. This single project represents a seismic shift in data center priorities, moving away from general-purpose computing toward massive, singular power sinks dedicated to AI workloads.

The core facts of the build reveal its massive ambition:

- Physical Footprint: The campus is slated to cover almost 1.2 million-square-foot in El Paso, Texas. This sheer physical size indicates the substantial supporting infrastructure required for AI operations [source: https://news.constructconnect.com/meta-announces-plans-for-1.5b-texas-data-center-in-el-paso][source: https://datacenters.atmeta.com/2025/10/hello-el-paso/][source: https://about.fb.com/news/2025/10/metas-new-ai-optimized-data-center-el-paso/].

- Power Capacity: Crucially, the facility is designed to scale to 1 gigawatt (GW) of capacity. This staggering figure is what truly defines it as an “AI factory,” as this level of consistent power draw is necessary for running thousands of high-end GPU clusters continuously [source: https://news.constructconnect.com/meta-announces-plans-for-1.5b-texas-data-center-in-el-paso][source: https://datacenters.atmeta.com/2025/10/hello-el-paso/].

- Capital Investment: The initial capital outlay exceeds more than $1.5 billion. This investment covers not just the building shell, but the necessary electrical and cooling infrastructure upgrades [source: https://news.constructconnect.com/meta-announces-plans-for-1.5b-texas-data-center-in-el-paso][source: https://datacenters.atmeta.com/2025/10/hello-el-paso/].

- Economic Impact: The project provides significant local stimulus, supporting roughly 1,800 construction jobs at peak, while creating about 100 long-term operational roles [source: https://news.constructconnect.com/meta-announces-plans-for-1.5b-texas-data-center-in-el-paso][source: https://datacenters.atmeta.com/2025/10/hello-el-paso/].

- Network Role: This facility will act as a crucial component of Meta’s “highly advanced infrastructure”, essential for both the massive training runs required for foundation models and the enormous inference tasks needed to serve billions of daily users across its platforms [source: https://datacenters.atmeta.com/2025/10/hello-el-paso/][source: https://about.fb.com/news/2025/10/metas-new-ai-optimized-data-center-el-paso/].

This project cements the meta ai infrastructure investment el paso as a flagship endeavor, prioritizing density and raw computational throughput above traditional efficiency metrics.

Why El Paso? Key Advantages for AI Infrastructure

Choosing a location for a 1GW power consumer is rarely accidental. El Paso offers a specific combination of resources and strategic positioning that makes it ideal for housing the next generation of AI hardware. It’s a decision balancing power availability, scalability, and public commitment.

The key advantages underpinning Meta’s choice include:

- Grid Strength and Investment: El Paso boasts a robust electrical grid capable of handling concentrated, high-demand loads. Furthermore, Meta is securing 100% clean and renewable energy via agreements with El Paso Electric. Critically, Meta is funding the new transmission lines and substations required for this capacity, promising this crucial grid hardening will be done without raising retail consumer rates [source: https://news.constructconnect.com/meta-announces-plans-for-1.5b-texas-data-center-in-el-paso][source: https://datacenters.atmeta.com/2025/10/hello-el-paso/].

- Scalability Headroom: Land availability and streamlined regulatory processes allow the site to be designed from day one to scale up to 1GW. This is vital for AI development, which requires immediate, massive headroom for rapidly expanding GPU clusters [source: https://news.constructconnect.com/meta-announces-plans-for-1.5b-texas-data-center-in-el-paso][source: https://energydigital.com/news/how-meta-plans-to-power-its-superintelligence-data-centre][source: https://about.fb.com/news/2025/10/metas-new-ai-optimized-data-center-el-paso/].

- Workforce and Community Support: The region offers a supportive environment, including a skilled local workforce and strong backing from city, county, and regional economic-development partners, ensuring smooth, long-term operations [source: https://datacenters.atmeta.com/2025/10/hello-el-paso/].

- Environmental Stewardship: Demonstrating a commitment to responsible growth, the facility is pursuing LEED Gold certification. A major focus is water use, utilizing a closed-loop liquid-cooling system that consumes zero water from the local source most of the year. Beyond that, Meta pledges to restore 200% of water consumption to local watersheds through partnerships with organizations like DigDeep and the Texas Water Action Collaborative [source: https://datacenters.atmeta.com/2025/10/hello-el-paso/][source: https://news.constructconnect.com/meta-announces-plans-for-1.5b-texas-data-center-in-el-paso][source: https://datacenters.atmeta.com/2025/10/hello-el-paso/].

These factors show that site selection is now deeply intertwined with long-term sustainability goals and proactive grid management, features that will define the future of large language model data centers.

AI-Optimized Design: Beyond Traditional Hyperscale

The architecture of the El Paso campus is not just about being large; it’s about being purpose-built. It represents a deliberate evolution from the energy-efficient designs of the past decade to specialized facilities capable of handling today’s intense AI processing requirements.

This facility is explicitly marketed as an “AI-optimized” data center. This signifies a fundamental redesign focusing on:

- High-Density Power: Supporting the extreme power draw needed by high-density, high-power AI hardware, which can push utilization per rack far beyond what general web servers require [source: https://news.constructconnect.com/meta-announces-plans-for-1.5b-texas-data-center-in-el-paso][source: https://datacenters.atmeta.com/2025/10/hello-el-paso/].

- Advanced Networking: Integrating specialized, low-latency networking specifically designed for synchronized training across massive GPU clusters.

- A Central Nexus for Superintelligence: This site is intended to be a central nexus capable of handling the scale of “superintelligence”-class workloads, encompassing both the training of new foundational models and the constant, large-scale inference demands of deployed generative AI services [source: https://about.fb.com/news/2025/10/metas-new-ai-optimized-data-center-el-paso/][source: https://energydigital.com/news/how-meta-plans-to-power-its-superintelligence-data-centre].

This specialization is a hallmark of the future of large language model data centers. If model science determines *what* AI can do, then infrastructure like the meta ai infrastructure investment el paso determines *how fast* and *how broadly* it can be deployed.

Meta’s Massive Financial Commitment to AI Hardware and Infrastructure

The $1.5 billion figure for El Paso is just one piece of a much larger capital expenditure puzzle driven by the AI arms race. Meta is radically adjusting its CapEx trajectory, prioritizing compute over everything else.

When considering how much meta spends on ai hardware, we must differentiate between the chips and the physical support system:

- AI Hardware CapEx: This includes the direct costs of acquiring billions of dollars worth of GPU accelerators (like NVIDIA H100s or in-house custom chips), AI-optimized servers, and the specialized, high-bandwidth interconnects (such as Infiniband or RoCE fabrics) necessary to link these accelerators into functional supercomputers [source: https://datacenters.atmeta.com/2025/10/hello-el-paso/].

- Infrastructure CapEx: This is where El Paso shines. This spending covers the physical necessities: acquiring land, constructing shells capable of housing higher-density racks, upgrading substations, and deploying advanced cooling systems to handle 30–70kW+ per rack. For AI workloads, the energy/power delivery infrastructure often becomes the primary bottleneck, overshadowing the cost of the chips themselves [source: https://news.constructconnect.com/meta-announces-plans-for-1.5b-texas-data-center-in-el-paso][source: https://datacenters.atmeta.com/2025/10/hello-el-paso/].

The El Paso site is part of a wider concentration of investment, falling within over $10 billion invested in Texas data centers, including existing facilities in Fort Worth and Temple, highlighting Texas as a central hub for Meta’s AI build-out [source: https://news.constructconnect.com/meta-announces-plans-for-1.5b-texas-data-center-in-el-paso][source: https://datacenters.atmeta.com/2025/10/hello-el-paso/][source: https://news.constructconnect.com/meta-announces-plans-for-1.5b-texas-data-center-in-el-paso][source: https://illuminaire.io/meta-bets-big-on-ai-with-new-data-centre-capable-of-one-gigawatt-in-texas/].

This spending is financially justified by the need to maintain leadership in core services like recommendation and ranking systems, but increasingly, it funds generative AI capabilities (Meta AI) and the foundational work for the AR/VR/metaverse vision. The persistence of elevated CapEx indicates that building the physical foundation for future AI scale is a non-negotiable priority, perfectly manifested in the meta ai infrastructure investment el paso.

Hyperion Data Center Joint Venture Details and Meta’s Partnership Model

Managing multi-billion dollar, high-power facilities requires innovative financial structuring. Hyperscalers increasingly rely on models that allow for massive, front-loaded capital expenditure without fully taxing their balance sheets immediately. This is often achieved through joint ventures (JVs).

The structure common to these deals involves hyperion data center joint venture details—typically an ownership arrangement where the hyperscaler partners with an infrastructure specialist or energy firm to co-fund and co-own campuses and associated power assets. The benefits are manifold:

- Risk and Capital Sharing: The upfront CapEx for land acquisition, shell construction, and crucially, dedicated renewable energy sources and substations, is shared.

- Balance Sheet Flexibility: It allows the hyperscaler to lock in long-term power capacity and space without carrying the full asset burden immediately.

- Speed and Utility Integration: Partners experienced in site acquisition, permitting, and grid integration can accelerate deployment, often securing dedicated power infrastructure faster than a single entity might achieve alone [source: https://news.constructconnect.com/meta-announces-plans-for-1.5b-texas-data-center-in-el-paso][source: https://datacenters.atmeta.com/2025/10/hello-el-paso/].

Meta’s collaboration with local entities, such as securing power agreements with El Paso Electric, fits this model perfectly. These partnerships ensure predictable, high-capacity power supply necessary for AI operations like the El Paso build, while maintaining financial agility to pursue other geographical expansion efforts.

Comparing Meta and Microsoft Data Center Strategy

While both Meta and Microsoft are engaged in intense AI development, their infrastructure strategies reveal different commercial priorities. Understanding this divergence in comparing meta and microsoft data center strategy highlights the market positioning of each giant.

The key strategic differences can be summarized:

| Dimension | Meta Strategy (e.g., El Paso) | Microsoft Strategy (e.g., Azure/OpenAI) |

|---|---|---|

| Core Objective | Primarily internal: powering Meta AI, ranking/recommendation systems for consumer apps (Facebook, Instagram) via long-lived GPU clusters [source: https://news.constructconnect.com/meta-announces-plans-for-1.5b-texas-data-center-in-el-paso][source: https://datacenters.atmeta.com/2025/10/hello-el-paso/]. | External revenue focused: powering Azure cloud services, Office/Bing integration, and supporting the commercial API for OpenAI workloads [source: https://datacenters.atmeta.com/2025/10/hello-el-paso/]. |

| Build Pattern | Concentrated build-out in specific geographic AI hubs (Texas, Midwest, Europe) focused on massive, dedicated AI campuses [source: https://news.constructconnect.com/meta-announces-plans-for-1.5b-texas-data-center-in-el-paso][source: https://datacenters.atmeta.com/2025/10/hello-el-paso/][source: https://illuminaire.io/meta-bets-big-on-ai-with-new-data-centre-capable-of-one-gigawatt-in-texas/]. | Globally distributed regions balancing AI clusters with the need for lower-latency, localized service delivery across the entire Azure footprint. |

| Ownership Bias | Strong preference for custom design/build, deeply integrating server design, networking, and facility requirements [source: https://datacenters.atmeta.com/2025/10/hello-el-paso/]. | Mix of internal builds, strategic co-location partnerships, and utility-linked power agreements, balancing control with speed-to-market. |

| Power Strategy | Aggressive 100% clean/renewable matching; proactively funding major transmission and local water mitigation (200% restoration in El Paso) [source: https://news.constructconnect.com/meta-announces-plans-for-1.5b-texas-data-center-in-el-paso][source: https://datacenters.atmeta.com/2025/10/hello-el-paso/]. | Focus on global Power Purchase Agreements (PPAs) and grid-scale renewable additions for multi-region resilience and broader decarbonization targets. |

| Customer Base | Internal talent developing proprietary models; AI is a competitive moat for consumer engagement. | External enterprise clients driving Azure revenue; AI capabilities are a direct product offering. |

Meta’s strategy, exemplified by the El Paso development, is building focused “AI factories” designed purely for the massive, power-hungry computational requirements of internal model development and serving its existing ecosystems.

Table of Contents

- Unpacking the Scale of Meta’s El Paso AI Data Center

- Why El Paso? Key Advantages for AI Infrastructure

- AI-Optimized Design: Beyond Traditional Hyperscale

- Meta’s Massive Financial Commitment to AI Hardware and Infrastructure

- Hyperion Data Center Joint Venture Details and Meta’s Partnership Model

- Comparing Meta and Microsoft Data Center Strategy

- Frequently Asked Questions

Frequently Asked Questions

What is the primary difference between a standard data center and Meta’s new “AI-optimized” campus?

A standard data center is optimized for general compute efficiency, often focusing on minimizing PUE (Power Usage Effectiveness) for web serving. An AI-optimized campus, like El Paso, prioritizes extreme power density (kW per rack) and the necessary mechanical and electrical infrastructure—like liquid cooling and massive substation capacity—to run specialized, power-hungry GPU accelerators needed for frontier model training and inference, even if the PUE isn’t perfectly optimized by traditional metrics [source: https://news.constructconnect.com/meta-announces-plans-for-1.5b-texas-data-center-in-el-paso].

Why is power availability a bigger bottleneck for AI than model science right now?

Model science continually advances, but the physical installation of reliable, massive electrical capacity (1GW scale) requires years of permitting, funding, and utility coordination. The future of large language model data centers hinges on securing this power *now*, as hardware purchases are quick, but grid upgrades take time. Meta’s investment in new transmission lines in El Paso is a direct attempt to mitigate this power bottleneck [source: https://energydigital.com/news/how-meta-plans-to-power-its-superintelligence-data-centre].

How does Meta handle the significant water usage associated with high-density cooling systems?

Meta addresses water consumption proactively in El Paso by employing a closed-loop liquid-cooling system designed to use zero local watershed water during most operational periods. Furthermore, they commit to restoring 200% of their consumption back to local watersheds via partnerships with organizations like DigDeep, turning a potential negative into a net positive for the community [source: https://datacenters.atmeta.com/2025/10/hello-el-paso/].

What is the significance of the “Hyperion Data Center Joint Venture Details” approach?

The JV model is crucial for scaling infrastructure rapidly. By structuring deals like the hyperion data center joint venture details, Meta shares the enormous, early capital risks associated with building bespoke power generation and transmission infrastructure, allowing them to deploy compute capacity faster than if they had to finance the entire energy backbone independently.

Is the $1.5 billion El Paso investment purely for AI, or does it support legacy products?

While the El Paso facility is explicitly “AI-optimized” and designed for training “superintelligence”-class models, its network infrastructure supports Meta’s broader services, including inference for serving Facebook, Instagram, and WhatsApp features. However, the design priority strongly indicates a focus on next-generation AI workloads [source: https://about.fb.com/news/2025/10/metas-new-ai-optimized-data-center-el-paso/].

“`