UK Public Sector SITS Suppliers: Trends and Forecasts for 2025

Estimated reading time: 12 minutes

Key Takeaways

- The UK public sector’s reliance on Software and IT Services (SITS) is critical for modern service delivery, making an understanding of its suppliers and market dynamics essential.

- Over £26 billion is spent annually on digital technology in the UK public sector, highlighting the scale of this market.

- Persistent challenges include fragmented procurement, organizational silos, and a significant skills gap, with only 28% of organizations feeling equipped to manage supplier performance.

- Key trends for 2025 and beyond include accelerating cloud adoption, the integration of AI and advanced analytics, heightened cybersecurity risks, and a growing demand for agile IT delivery.

- The market is characterized by both consolidation among major players and increasing competition from innovators, with evolving criteria for strategic supplier status.

- Procurement spending is projected to grow by approximately 10% in 2024/25, influenced by the new Procurement Act and regional devolution.

- Strategic recommendations focus on cohesive digital sourcing, upskilling, leveraging new procurement tools, and prioritizing cybersecurity for public sector organizations, while suppliers must adapt to evolving frameworks, demonstrate social value, and embrace innovation.

- Staying informed through **new research UK public sector SITS suppliers** is vital for navigating this dynamic landscape.

Table of contents

- UK Public Sector SITS Suppliers: Trends and Forecasts for 2025

- Key Takeaways

- The Shifting Sands: Understanding the Current Public Sector IT Landscape

- The Driving Forces: Key Trends Shaping Public Sector IT in 2025 and Beyond

- Navigating the Ecosystem: An UK Government Strategic Suppliers Analysis

- Gazing into the Crystal Ball: Trends and Forecasts for 2025

- Charting the Course: Implications and Strategic Recommendations

- Frequently Asked Questions

Software and IT Services (SITS) are the invisible backbone of modern UK public sector operations. From healthcare to defense, and from education to citizen services, the effective delivery of these services hinges on robust, innovative, and secure technology solutions. Understanding the intricate landscape of **UK public sector SITS suppliers trends and forecasts 2025** is not merely an academic exercise; it is a strategic imperative for ensuring efficiency, resilience, and continuous improvement in public service delivery.

This post aims to provide a comprehensive analysis of the current SITS environment within the UK public sector. We will delve into the prevailing challenges, identify the key trends shaping the market, analyze the dynamics among major suppliers, and offer forward-looking forecasts for 2025. Expect insights drawn from **new research UK public sector SITS suppliers**, detailed **trends and forecasts 2025 public sector IT**, an in-depth **UK government strategic suppliers analysis**, and an overview of overarching **public sector software and IT services market trends**.

The Shifting Sands: Understanding the Current Public Sector IT Landscape

The UK public sector represents a colossal market for digital technology. In 2025, annual spending on digital technology surged past the £26 billion mark, employing nearly 100,000 professionals in crucial digital roles. This significant investment underscores the indispensable nature of IT in government operations. However, beneath this substantial expenditure lies a complex web of structural challenges that impede optimal performance and innovation.

Fragmented procurement processes remain a persistent headache. Organizational silos often lead to duplicated efforts and missed opportunities for synergy. Furthermore, a pervasive skills gap affects both digital and commercial teams, hindering the ability to effectively manage and leverage technology investments. This gap is starkly illustrated by the fact that *only 28% of public sector organizations* feel they possess sufficient capability to monitor and drive supplier performance effectively.

The extent of fragmentation is staggering. Consider the National Health Service (NHS), where an estimated *209 separate entities* independently negotiate IT contracts. Similarly, over *320 local councils* manage their own distinct IT agreements. This decentralization, while sometimes offering local flexibility, severely limits the UK public sector’s ability to leverage consolidated buying power and secure better commercial terms. The universal adoption of central procurement frameworks, designed to streamline and optimize such efforts, remains limited, leading to significant missed opportunities.

In this intricate environment, the value of **new research UK public sector SITS suppliers** cannot be overstated. Resources such as TechMarketView’s 2025 rankings and forecasts are indispensable, offering critical data on leading providers, identifying areas of rapid growth, and illuminating the competitive dynamics at play. These insights, sourced from publications like TechMarketView and TechUK, are crucial for understanding who is shaping the public sector’s technological future and how. This research helps to illuminate leading players, pinpoint innovation hotspots, and map out the collaborative efforts that are defining the trajectory of public sector technology.

The Driving Forces: Key Trends Shaping Public Sector IT in 2025 and Beyond

Digital transformation continues to be a defining objective for the UK public sector, yet it is a journey fraught with challenges. In 2025, a significant *70% of public sector organizations* reported difficulties in accessing real-time data, leading to a concerning rise in manual data exports. This highlights a persistent gap between aspiration and execution.

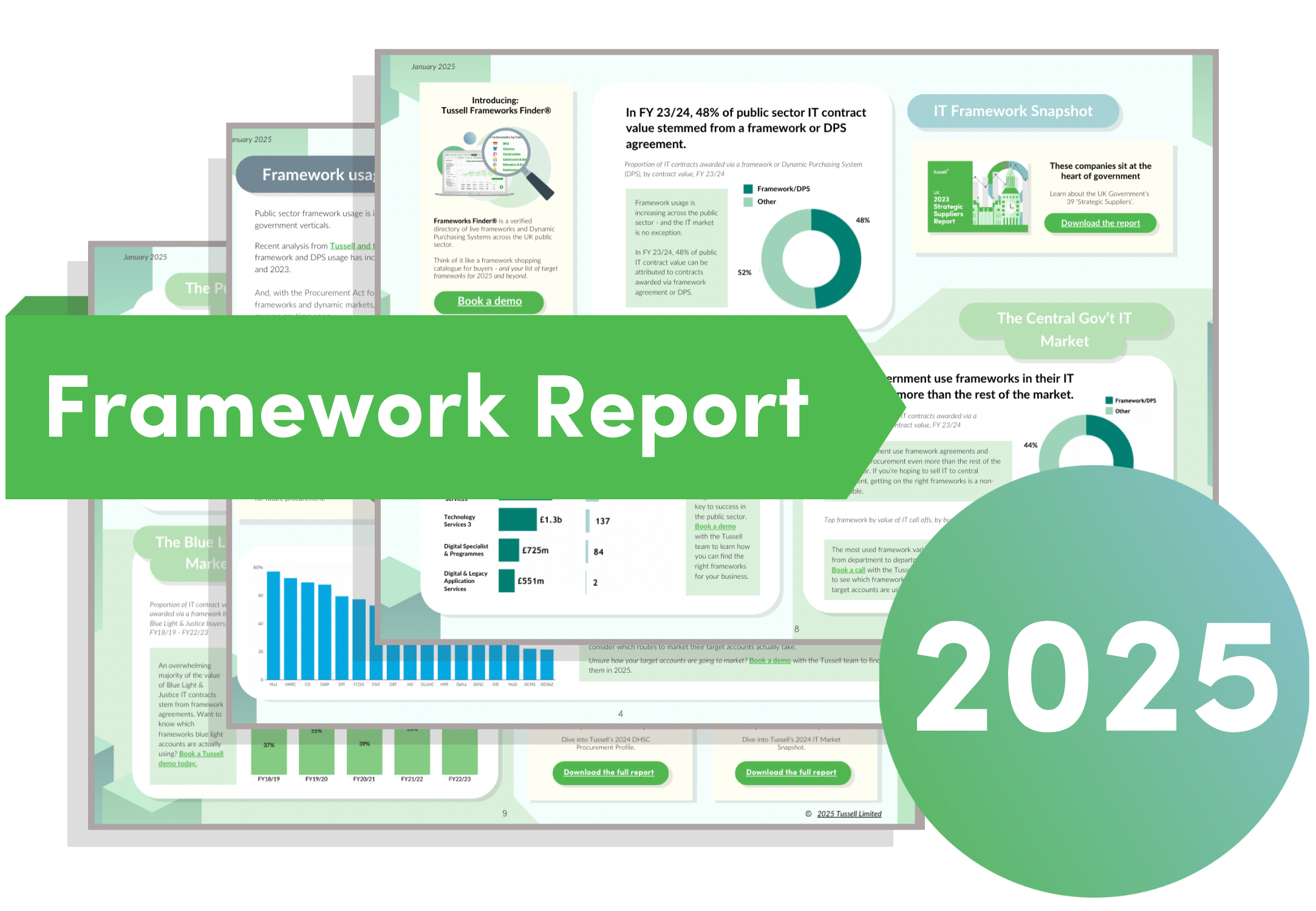

A prominent trend is the accelerating adoption of cloud and hybrid models. By 2024, three global “hyperscalers” had already captured over *60% of the cloud market*. As subscription-based services proliferate and market consolidation intensifies, a more strategic government approach to cloud procurement becomes imperative. This necessitates careful consideration of long-term vendor lock-in and the ability to adapt to evolving cloud technologies.

The integration of Artificial Intelligence (AI), machine learning, and advanced analytics into service delivery and decision-making is no longer a futuristic concept but a present reality. However, the path to widespread adoption is often obstructed by legacy systems, persistent skills shortages, and the inherent complexities of public sector procurement processes. These hindering factors, as noted by the NAO and government digital reports, require concerted efforts to overcome.

Concurrently, heightened cybersecurity risks are a major concern. As digital reliance deepens, public sector bodies face increasing pressure to modernize their security infrastructure to protect critical national infrastructure and sensitive citizen data from sophisticated threats. This is a constant arms race, demanding continuous vigilance and investment.

The demand for agile and flexible IT delivery models is also on the rise. This shift is being driven by more dynamic and open procurement frameworks that encourage collaboration and rapid response to evolving public needs. Understanding these **trends and forecasts 2025 public sector IT** is crucial for both public bodies seeking effective solutions and suppliers aiming to align their offerings with government priorities.

Navigating the Ecosystem: An UK Government Strategic Suppliers Analysis

The **UK government strategic suppliers analysis** reveals a market in a state of dynamic flux. It is a landscape characterized by a simultaneous push towards consolidation among established giants and a growing diversification driven by innovative newcomers. While major players, consistently highlighted in rankings such as TechMarketView’s Top 20, continue to command a significant portion of the market share, competition is intensifying. This surge in competition is partly fueled by the increasing accessibility of public sector frameworks, which allows a broader range of suppliers, including agile innovators and smaller firms, to engage.

The criteria for achieving and maintaining strategic supplier status are evolving rapidly. Historically, scale, capability, and security were paramount. Today, however, these are augmented by increasingly important factors: the demonstrable ability to deliver social value, a commitment to supporting local small and medium-sized enterprises (SMEs), and the agility to adapt to rapidly changing procurement regulations. The introduction of the 2025 Procurement Act, for instance, has significantly reshaped the landscape, demanding a new level of commercial and digital acumen from all participants.

In response to these shifting demands, suppliers are strategically pivoting their operations. A strong emphasis is placed on forming partnerships focused on cloud migration and comprehensive digital transformation initiatives. Significant investments are being channeled into robust security protocols and ensuring unwavering compliance with stringent government standards. Furthermore, suppliers are increasingly adopting more collaborative and transparent client engagement models, moving away from traditional transactional relationships towards true partnerships.

Analyzing the competitive dynamics, it becomes clear that success in this arena is increasingly contingent on several key factors. Suppliers must adeptly navigate the complexities of public sector procurement frameworks, which can often be labyrinthine. Crucially, they need to demonstrate tangible social value outcomes, aligning their services with broader government objectives beyond mere technological delivery. Finally, the ability to consistently deliver innovative, scalable, and future-proof solutions is essential for standing out in a crowded market. This intricate interplay of factors defines the current **public sector software and IT services market trends**.

Gazing into the Crystal Ball: Trends and Forecasts for 2025

Looking ahead, the UK public sector IT market is poised for continued growth. Procurement spending within the sector is anticipated to see an approximate *10% increase in 2024/25*. This expansion is largely propelled by the ongoing imperative for digital transformation and the continuous drive for modernization across all government departments and services.

A significant catalyst for change is the recently implemented Procurement Act, which came into force in February 2025. This legislation is fundamentally reshaping public procurement practices. New tools and procedures, such as the *Competitive Flexible Procedure* and the development of *Dynamic Markets*, are designed to introduce greater flexibility and efficiency. However, these innovations also necessitate enhanced commercial and digital expertise from both buyers and suppliers to fully capitalize on their potential.

The ongoing trend of English devolution is also playing a crucial role. As procurement power increasingly consolidates into fewer, larger regional contracts, this presents both opportunities and challenges. Larger, established suppliers may find these consolidated contracts more attractive and manageable. Conversely, there is a discernible risk that SMEs could be sidelined unless specific accessibility measures are robustly implemented and enforced. This trend requires careful monitoring to ensure a balanced and inclusive market.

Despite policy intentions to boost SME participation, current data suggests a stall in SME spending within public sector contracts. This disparity highlights a critical need for renewed focus on creating and promoting accessible procurement pathways specifically designed to accommodate and encourage smaller businesses. Ensuring that innovation from SMEs can reach the public sector remains a key objective.

These evolving dynamics underscore the critical importance of staying abreast of **trends and forecasts 2025 public sector IT**. For strategic planning and operational success, a deep understanding of the **UK public sector SITS suppliers trends and forecasts 2025** is paramount. The market is not static; it is a constantly shifting landscape shaped by policy, technology, and economic factors.

Charting the Course: Implications and Strategic Recommendations

For Public Sector Organizations:

- Develop cohesive digital sourcing strategies. This is crucial for combating fragmentation and maximizing the benefits derived from collective purchasing power, as advised by government digital strategy reports.

- Invest strategically in digital and commercial skills. Cultivating a cadre of “intelligent clients” is essential, empowering them to drive better outcomes from technology contracts. Both NAO and digital government reports emphasize this need.

- Embrace and strategically utilize new procurement tools. Frameworks like Dynamic Markets and Open Frameworks offer enhanced access to innovation and promote greater supplier diversity, as highlighted by market analysis firms.

- Prioritize cybersecurity and robust data governance. These must be treated as foundational pillars for all digital transformation initiatives, ensuring the protection of critical infrastructure and citizen data.

For SITS Suppliers:

- Continuously monitor evolving procurement frameworks. Ensure your offerings align precisely with current government priorities, including explicit commitments to social value and fostering local economic impact, a key aspect of market trends.

- Invest in partnership models. Offer comprehensive, end-to-end support to public sector clients throughout their complex digital transformation journeys.

- Differentiate through demonstrable innovation. Focus on high-demand areas such as AI, automation, and real-time data analytics to provide cutting-edge solutions.

- Actively advocate for and implement inclusive procurement practices. This is vital for maintaining competitive pathways for SMEs and emerging technology providers, ensuring a dynamic and diverse supply chain.

Across both groups, the persistent need to stay informed through **new research UK public sector SITS suppliers** and detailed market analysis cannot be overstated. Staying ahead of the curve requires continuous learning and adaptation.

Frequently Asked Questions

What is the estimated annual spending on digital technology in the UK public sector?

In 2025, the UK public sector spent over £26 billion annually on digital technology.

What are the primary challenges facing public sector IT?

Key challenges include fragmented procurement processes, organizational silos, and a significant skills gap in both digital and commercial teams. Limited capability to monitor supplier performance is a notable symptom of this skills gap.

How is the Procurement Act of 2025 impacting IT procurement?

The Act is reshaping practices with new tools like the Competitive Flexible Procedure and Dynamic Markets, promoting greater flexibility but requiring enhanced commercial and digital acumen from all parties involved.

What is the projected growth for public sector IT spending?

Procurement spending in the UK public sector is anticipated to grow by approximately 10% in 2024/25, driven by ongoing digital transformation and modernization initiatives.

Why is understanding SITS supplier trends important for the public sector?

Understanding these trends is critical for ensuring efficiency, resilience, and continuous improvement in public service delivery, enabling better strategic planning and procurement decisions.

What role do cloud and AI play in current public sector IT?

Cloud adoption is accelerating, with hyperscalers dominating the market. AI, machine learning, and advanced analytics are increasingly being integrated into service delivery, though adoption is hindered by legacy systems and skills shortages.