UK Smartphone Ownership 2025 Statistics: Key Trends in Adoption, 5G, Apps & More

Estimated reading time: 8 minutes

Key Takeaways

- In 2025, 95% of UK residents aged 16 and over own a smartphone, equating to around 53 million people, setting the stage for deep analysis of interconnected trends.

- 5G access reaches 58% of Brits, with 93% having 4G or 5G, fueling device upgrades and reshaping the UK smartphone market.

- UK users average 3 hours 21 minutes daily on smartphones, with app downloads projected to hit 8.5 billion in 2025, driven by gaming and social media.

- Brand preferences shift, with Apple ownership down 6 percentage points since 2023 and Samsung gaining loyalty via 5G features and value pricing.

- The UK smartphone app market revenue is projected at £28.3 billion in 2025, with overall device market revenue nearing £11 billion by 2029, sustained by high ownership rates.

- Cross-topic analysis reveals how near-universal ownership amplifies 5G growth, app usage, brand competition, and economic impact, creating a mature, data-driven ecosystem.

Table of contents

- UK Smartphone Ownership 2025 Statistics: Key Trends in Adoption, 5G, Apps & More

- Key Takeaways

- Introduction: The 95% Ownership Revolution

- UK Smartphone Ownership 2025 Statistics: Deep Dive

- 5G Growth UK Smartphone Market 2025: The Connectivity Leap

- App Usage Trends UK 2025: The Digital Daily Grind

- Smartphone Brand Preferences UK 2025: The Loyalty Shift

- Projected UK Smartphone Market Revenue 2025: The Economic Engine

- Cross-Topic Analysis: How Everything Connects

- Future Outlook: Challenges, Opportunities, and Call to Action

- Frequently Asked Questions

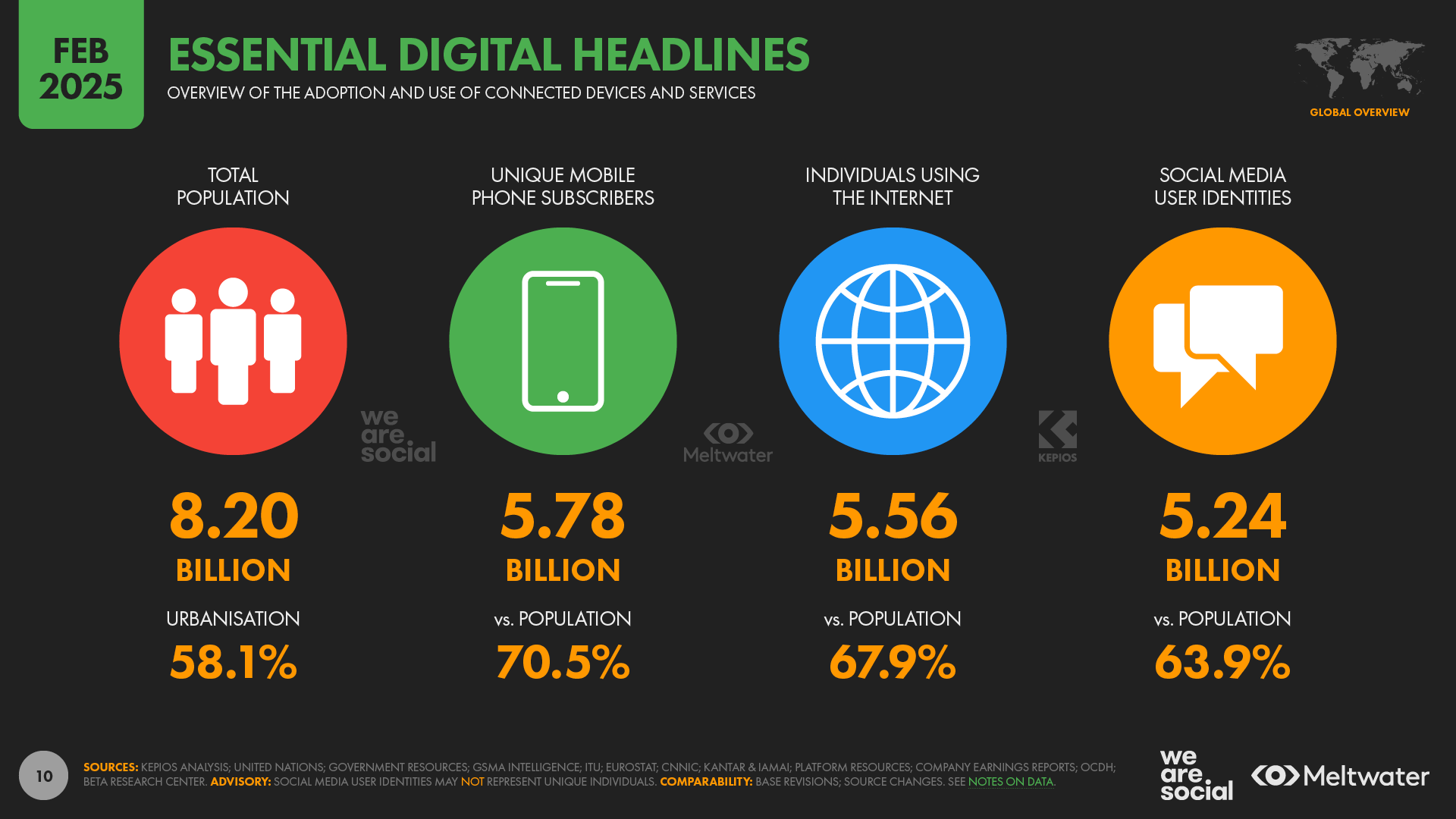

In 2025, 95% of UK residents aged 16 and over own a smartphone, equating to around 53 million people, a staggering figure that hooks us into a world where connectivity is nearly universal. This post delivers comprehensive data on adoption rates, 5G growth UK smartphone market 2025, app usage trends UK 2025, smartphone brand preferences UK 2025, and projected UK smartphone market revenue 2025, drawing from reputable sources to satisfy your informational needs. As high ownership rates fuel rapid advancements, we explore how this near-ubiquity reshapes daily life, work, and entertainment across the UK.

Introduction: The 95% Ownership Revolution

The UK’s smartphone landscape has reached a tipping point: with 95% adult ownership, the device is no longer a luxury but a necessity. This penetration sets the stage for every trend we discuss, from 5G rollout to app addiction. Imagine a country where almost everyone holds a portal to the internet in their pocket—this is the reality in 2025, driving innovation and economic growth. We’ll dive into the numbers, but first, consider how this saturation influences everything from social interactions to business models. The data here is sourced from authoritative reports, ensuring you get accurate insights into this dynamic market.

UK Smartphone Ownership 2025 Statistics: Deep Dive

Defining smartphone ownership as the percentage of individuals possessing a mobile device capable of internet access and apps, the UK’s figure stands at 95% of adults in 2025, up from 90% in 2023. This surge is driven by increased accessibility and multi-device trends, as noted in mobile internet statistics and mobile app market growth analyses. Let’s break down the demographics:

- Age Groups: Near-universal adoption at 98-99% for ages 16-54, while those 65+ see 82% ownership, showing digital inclusion efforts are paying off.

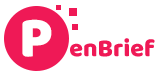

- Gender Dynamics: Women are slightly more likely to rely solely on smartphones for internet (20% vs. 14% for men), highlighting gendered usage patterns.

- Regional and Socioeconomic Variations: 31% of lower-income DE groups depend exclusively on smartphones for internet access, compared to just 7% of AB higher earners, underscoring disparities in device dependency.

This 95% penetration directly ties to 5G growth UK smartphone market 2025 and app reliance for engagement. With so many devices in use, understanding how to secure your smartphone is crucial for protecting personal data in this connected era.

5G Growth UK Smartphone Market 2025: The Connectivity Leap

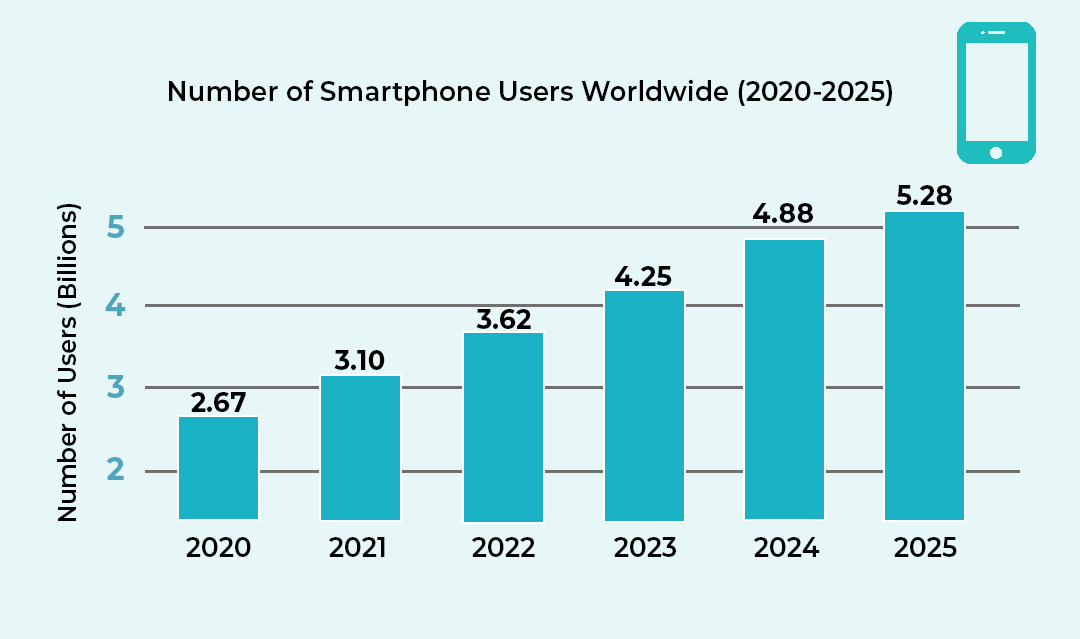

5G, the next-generation mobile network offering faster speeds and lower latency than 4G, is a key driver of upgrades amid high ownership. In 2025, 58% of Brits can access 5G services on smartphones, with 93% accessing 4G or 5G, making 5G standard in mid-tier devices and fueling demand. Sources like Finder’s mobile internet statistics and SQ Magazine’s smartphone usage data confirm this trend. Globally, 5G smartphone sales are projected to hit 153.3 million by 2025, with 35.6% annual growth, and the UK aligns toward 93% 5G connections by 2030 via coverage expansion and carrier partnerships.

Consider how this growth interplays with ownership:

- Accelerated Upgrades: The 95% ownership rate means a large installed base ripe for 5G upgrades, pushing manufacturers to innovate.

- Network Evolution: As Statista reports, UK 5G infrastructure investments are scaling, with urban areas leading but rural catch-up underway.

- User Experience: Faster speeds enable seamless streaming and real-time apps, enhancing daily smartphone use.

This section underscores that 5G isn’t just a tech buzzword; it’s a tangible force reshaping the market, backed by data from multiple UK smartphone usage studies.

App Usage Trends UK 2025: The Digital Daily Grind

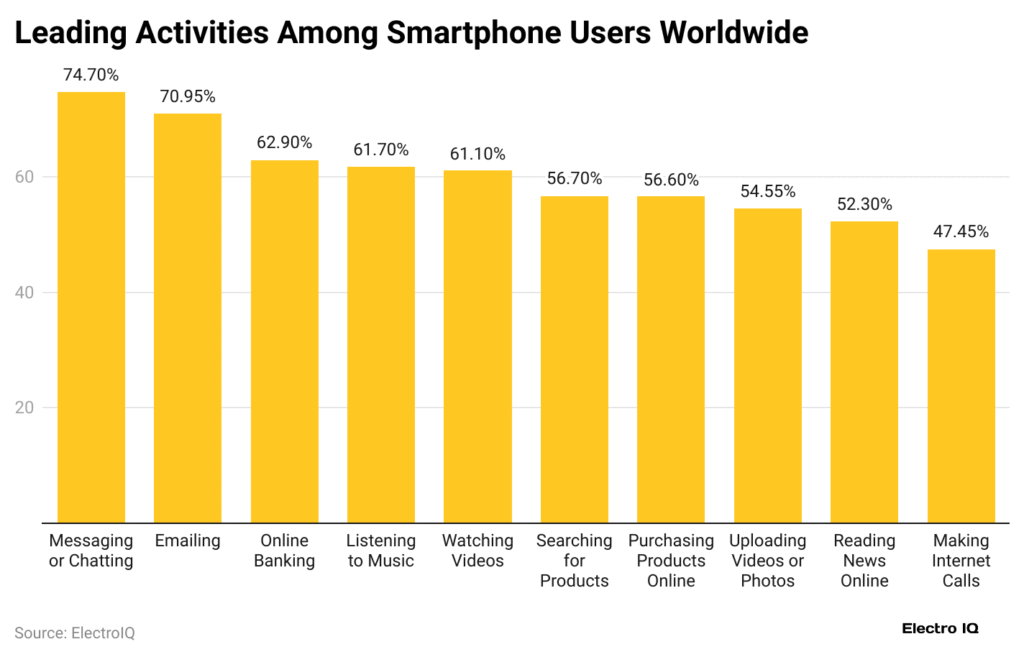

App usage trends, defined as patterns in time spent, categories, and downloads on mobile applications, are a direct outcome of high ownership and 5G speeds. UK users average 3 hours 21 minutes daily on smartphones, exceeding TV time, with 4-5 hours spent on apps split as 49% on messaging, social media, and browsing, and 15% on video. According to Finder’s research and Netguru’s app market analysis, projections show 8.5 billion app downloads in 2025, up from 2.5 billion in 2024, led by gaming which generated over £2 billion in revenue in 2024.

Demographic insights reveal that young adults (18-24) spend 4 hours 49 minutes daily on smartphones, with 81% using social networks weekly. This intense engagement is fueled by 95% ownership and enhanced by 5G growth, enabling seamless streaming and personalized experiences. For visual appeal, here’s a table comparing app categories by average daily time spent:

| App Category | Average Daily Time (Minutes) | Key Drivers |

|---|---|---|

| Social Media & Messaging | 120+ | Platforms like Instagram, WhatsApp |

| Video Streaming | 45+ | Netflix, YouTube, TikTok |

| Gaming | 60+ | Mobile esports, casual games |

| Productivity & Utilities | 30+ | Email, banking, health apps |

For hardcore gamers, this app usage underscores the need for capable hardware, as detailed in this guide to the best smartphones for gaming in 2025. To boost productivity within these usage patterns, specific apps are key, explored in this resource on best productivity apps.

Smartphone Brand Preferences UK 2025: The Loyalty Shift

Brand preferences, defined as consumer favoritism based on market share, loyalty, and features, are evolving amid 5G and app demands. Reports from Mintel’s UK smartphones market report indicate Apple ownership has fallen 6 percentage points since 2023, with 31% of owners viewing it as “overrated” (vs. 7% for Samsung). Samsung holds stronger loyalty via 5G features and competitive pricing. Additionally, 33% of owners keep devices over two years, driven by camera quality, pricing, and sustainability concerns, slowing replacement cycles.

This ties directly to prior sections: 5G growth UK smartphone market 2025 favors brands with superior 5G performance, while app usage trends UK 2025 boost those optimizing for high-engagement apps. Here’s a bolded comparison table:

| Brand | Market Share (2025 Est.) | Loyalty Driver | Key Challenge |

|---|---|---|---|

| Apple | ~40% | Ecosystem integration | Perceived overpricing |

| Samsung | ~35% | 5G innovation & value | Competition from Chinese brands |

| Xiaomi & Others | ~25% | Affordable feature sets | Brand recognition |

When considering an upgrade, recent releases provide context for these preferences, as seen in this analysis of latest smartphone releases. Battery life remains a critical factor, covered in this guide to smartphones with long battery life.

Projected UK Smartphone Market Revenue 2025: The Economic Engine

Market revenue, the total sales value from devices and related services, showcases the economic impact of all trends. The UK smartphone device market was valued at £10.2 billion in 2024, forecasted to nearly £11 billion by 2029, while the mobile app market reaches £28.3 billion in 2025, with 12.9% annual growth and a CAGR of 15.1% to 2030. According to Netguru’s app market growth report and Statista’s UK smartphone market data, this is supported by 84.3 million cellular subscriptions.

Growth drivers include:

- App Economy Boom: Revenue surged from £2.46 billion in 2021 to £3.97 billion in 2024, fueled by in-app purchases and subscriptions.

- 5G Integration: As 5G expands, it enables premium services, driving higher spending on connectivity and content.

- Market Competition: Brand rivalry, as noted in the preferences section, keeps prices dynamic and innovation high.

Compared to uk smartphone ownership 2025 statistics showing 95% penetration, this revenue stream remains robust despite longer ownership cycles, indicating that users spend more on apps and services even if they delay device upgrades.

Cross-Topic Analysis: How Everything Connects

To grasp the full picture, let’s interconnect all keywords. The 95% uk smartphone ownership 2025 statistics amplifies every other trend:

- Ownership → 5G Growth: High ownership (95%) accelerates 5G penetration (58% access), as users seek faster speeds for their ubiquitous devices, per Finder’s data.

- Ownership → App Usage: With 53 million users, app downloads hit 8.5 billion, and daily usage averages 3+ hours, driven by engagement on social and gaming apps, as Netguru highlights.

- 5G → Brand Preferences: 5G capabilities influence brand choices, with Samsung gaining over Apple due to better 5G performance, noted in Mintel’s report.

- App Usage → Revenue: Heavy app usage fuels the £28.3 billion app market revenue, with growth rates exceeding 12% annually, linking to Statista’s projections.

This interdependence creates a mature ecosystem where data-backed trends reinforce each other, making the UK market a benchmark for global smartphone evolution.

Future Outlook: Challenges, Opportunities, and Call to Action

Looking ahead, the intersection of uk smartphone ownership 2025 statistics (95%), 5G growth UK smartphone market 2025 (93% by 2030), app usage trends UK 2025 (3+ hours daily), smartphone brand preferences UK 2025 (loyalty shifts), and projected UK smartphone market revenue 2025 (£28.3B apps) paints a dynamic future. Challenges include economic pressures, device longevity (33% keep phones over 2 years), and sustainability concerns. However, opportunities abound in IoT integration, foldable devices (spurring 18% early upgrades), and sustained market expansion.

To get the most from this evolving market, the right accessories can enhance any smartphone, as detailed in this guide to essential accessories. Staying updated with the latest OS features is also key, explored in this resource on latest iOS and Android updates.

We invite you to engage further: download our 2025 UK Smartphone Market Report for interactive charts, deeper forecasts, and custom analysis. Share your predictions in the comments for uk smartphone ownership 2025 statistics and beyond—how do you see these trends shaping the next decade?

Frequently Asked Questions

What percentage of UK adults own a smartphone in 2025?

In 2025, 95% of UK residents aged 16 and over own a smartphone, equating to approximately 53 million people, based on data from mobile internet statistics and app market growth reports.

How has 5G growth impacted the UK smartphone market?

5G access has reached 58% of Brits in 2025, with 93% having 4G or 5G, driving device upgrades and enabling faster app experiences. This growth is detailed in smartphone usage statistics and is projected to hit 93% connections by 2030.

What are the most popular app categories in the UK?

Social media & messaging lead with over 120 minutes daily usage, followed by video streaming (45+ minutes) and gaming (60+ minutes). App downloads are projected at 8.5 billion in 2025, per app trend analyses.

Which smartphone brand is most preferred in the UK?

Preferences are shifting, with Samsung gaining loyalty due to 5G features and value, while Apple ownership has declined. Market reports show 31% of owners view Apple as “overrated” compared to 7% for Samsung.

What is the projected revenue for the UK smartphone market in 2025?

The mobile app market revenue is projected at £28.3 billion in 2025, with overall device market revenue near £11 billion by 2029, according to Statista data and app growth studies.