UK Tech Sector Valuation 2025 Growth: Reaching a $1.2 Trillion Milestone

Estimated reading time: 10 minutes

The UK tech sector valuation 2025 growth story is one of remarkable resilience and strategic acceleration. Projected to reach a staggering $1.2 trillion valuation by the middle of the year, the sector is not just growing—it’s fundamentally reshaping the UK’s economic future. This explosive growth isn’t happening in a vacuum; it’s the direct result of powerful, interconnected forces including rapid AI integration in UK businesses 2025, pivotal new regulations, and evolving investment dynamics. For a deep dive into the key drivers behind this valuation surge, explore our detailed analysis.

Key Takeaways

- The UK tech sector is on track for a $1.2 trillion valuation by mid-2025, cementing its status as Europe’s leading digital economy.

- AI integration is the primary growth engine, attracting billions in investment and driving productivity across fintech, health tech, and robotics.

- New regulations like the Cyber Security Resilience Bill 2025 are boosting investor confidence by mandating robust security standards.

- Despite the headline growth, UK startup funding challenges 2025 persist, with regional disparities and longer times to secure later-stage capital.

- The Digital Markets Act 2025 enforcement is fostering a fairer competitive landscape, encouraging innovation and attracting major international partnerships.

Table of contents

- UK Tech Sector Valuation 2025 Growth: Reaching a $1.2 Trillion Milestone

- Key Takeaways

- Market Snapshot: The $1.2 Trillion Milestone

- Driver 1: AI Integration in UK Businesses 2025

- Driver 2: Cyber Security Resilience Bill 2025 Impact

- Challenge: UK Startup Funding Challenges 2025

- Regulatory Framework: Digital Markets Act 2025 Enforcement

- Future Trajectory and Strategic Implications

- Frequently Asked Questions

Market Snapshot: The $1.2 Trillion Milestone

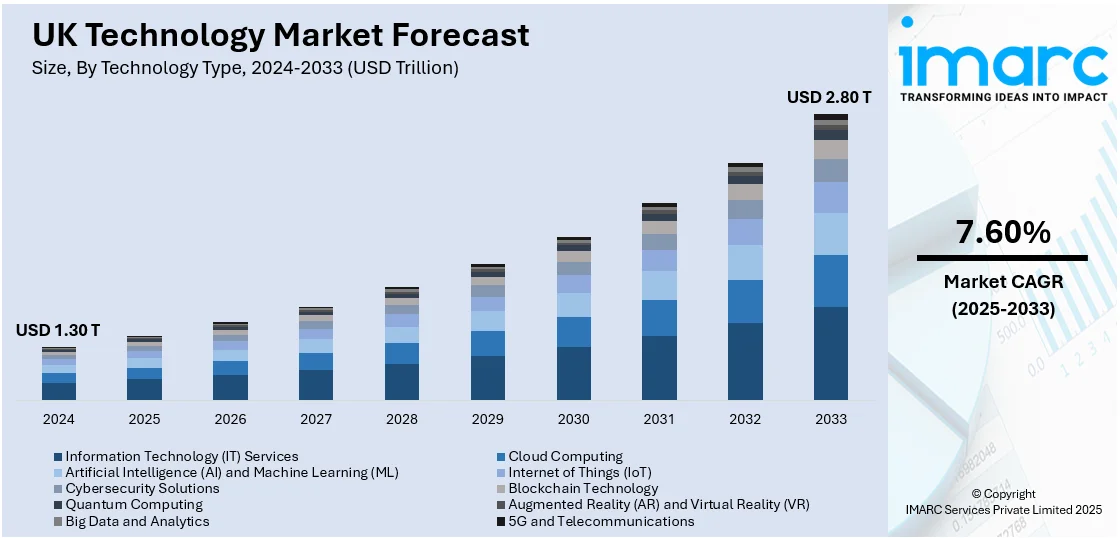

The headline figure is compelling: the UK tech sector is valued at $1.2 trillion (£886 billion) in the first half of 2025, achieving a compound annual growth rate (CAGR) of 12.5% that outpaces European peers like Germany and France combined [1]. This growth is not just a number—it represents the collective ambition of over 34,000 high-growth tech firms that have collectively raised an impressive £121 billion in equity since 2020 [2].

However, this prosperity is geographically concentrated. London accounts for a dominant $693.7 billion, or 59% of the total UK tech valuation [1], highlighting both the capital’s powerhouse status and a significant challenge of regional disparity.

Beneath the surface, the composition of this $1.2 trillion valuation reveals a strategic shift towards foundational innovation. The deep tech segment—encompassing AI, quantum computing, and biotechnology—now holds a combined value of $155 billion, a figure that has skyrocketed 4.8 times since 2019 [3]. With over 50 unicorns and capturing a remarkable 31% of all UK venture capital in 2025, deep tech is the robust, high-value core of the sector’s growth. To understand the broader market trends shaping this growth, including robotics, AI investment, and XR adoption, read our UK tech market forecast.

Driver 1: AI Integration in UK Businesses 2025

If one force can be singled out as the primary engine of the UK’s tech valuation surge, it is the widespread and sophisticated AI integration in UK businesses 2025. This isn’t mere adoption; it’s a fundamental rewiring of how companies operate, innovate, and compete.

- Investment Magnet: Generative AI alone has attracted £1.1 billion in investment, with deep tech sectors benefiting from the highest concentration of VC funds [4].

- Sectoral Transformation:

- Fintech: Bolstered by £3.1 billion in VC investment, AI is enhancing everything from real-time fraud detection to hyper-personalized financial services [4].

- Health Tech: With £2.6 billion in VC funding, AI is powering advanced diagnostics and pioneering personalized medicine [4].

- Robotics: Experiencing an 83% compound annual growth rate from 2020-2024, driven largely by AI-powered automation solutions [4].

The valuation multiplier effect is clear. AI-driven productivity gains and breakthrough innovations attract larger, later-stage funding rounds, which directly inflate company valuations. The largest VC rounds in 2025 are overwhelmingly targeting AI and deep tech companies [1]. This activity culminates in significant global exits, with $20 billion in M&A activity in 2025 driven by the desire to acquire advanced AI capabilities, positioning UK tech firms as both prime targets and active acquirers [3]. For more on how AI is transforming the UK workforce and business productivity, see our analysis.

Driver 2: Cyber Security Resilience Bill 2025 Impact

While innovation fuels growth, stability and trust secure it. The Cyber Security Resilience Bill 2025 impact is a masterclass in how smart regulation can catalyze investor confidence. The bill establishes a mandatory framework requiring tech companies to meet stringent security standards and undergo regular compliance audits.

This regulatory clarity reduces perceived risk for institutional investors, who now have government-backed assurance that portfolio companies meet baseline security standards.

This confidence is directly linked to capital allocation. The bill’s introduction aligns with a 1.5% rise in business investment in Q3 2025, heavily influenced by growing ICT investments [5]. Compliant companies now command a valuation premium, as they become more attractive to risk-averse capital from pension funds and insurance companies. Evidence of this restored confidence is seen in the £7 billion in VC raised in H1 2025 [1], signaling a strong recovery from the subdued post-2021 funding environment [2].

Explore the essential cybersecurity trends and market forecasts for UK businesses in our dedicated guide.

Challenge: UK Startup Funding Challenges 2025

Acknowledging the headwinds is crucial to understanding the full picture. Despite the sector’s overall growth, significant UK startup funding challenges 2025 create a complex landscape for emerging companies.

- The Long Road to Scale: The time for a startup to reach Series C funding has doubled to 9.6 years compared to 2019 levels, indicating a much slower progression through growth stages [1].

- Founder Sentiment: A stark 75% of founders identify access to growth capital as their top barrier to scaling [4].

- The Geographic Divide: Startups outside London receive, on average, 7 times less funding than those in the capital, creating a pronounced geographic equity problem [4].

Yet, within these challenges lie signals of a maturing market. H1 2025 still saw £5.6 billion in VC funding, with median Seed-to-Series A deals reaching £1.6 million—indicating that while the total number of deals may be down, the rounds that do happen are larger and more substantial [4]. The market continues to recalibrate from the corrections of 2023 [2]. The impact on valuation is dual-edged: delayed funding rounds mean a slower path to higher valuations for many startups, but those that successfully navigate this gauntlet often command premium valuations upon exit.

Regulatory Framework: Digital Markets Act 2025 Enforcement

Complementing cybersecurity mandates, the Digital Markets Act 2025 enforcement is proactively shaping a healthier, more competitive ecosystem. By preventing dominant “gatekeeper” platforms from engaging in unfair practices, the Act empowers the UK’s 17,000+ VC-backed startups to compete on a more level playing field [4].

This fair competition framework is a key enabler of major deal activity. It helps create the predictable, trustworthy environment that attracts monumental international partnerships, such as Microsoft’s £22 billion commitment to UK tech infrastructure [4]. The innovation effect is powerful: when smaller players face reduced barriers to entry and fair treatment, they can innovate faster and attract venture capital more readily, boosting the overall sector’s health and valuation [2].

Future Trajectory and Strategic Implications

The UK tech sector valuation 2025 growth is underpinned by a powerful synergy of forces: relentless AI adoption, cybersecurity-led trust, evolving funding models, and pro-competition regulation. The future trajectory points toward resilience, particularly in deep tech, where the UK has raised $43.7 billion since 2019—positioning it third globally as a deep tech leader [3].

Sustained business investment in information and communication technology will continue to be a fundamental fuel for sector expansion [5]. Addressing the regional funding disparity is a critical next step, with government support and emerging clusters like the Oxford-Cambridge corridor poised to unlock significant latent value outside London [3]. For a comprehensive analysis of UK technology trends, including AI, cybersecurity, and emerging tech, read our 2025 outlook.

Frequently Asked Questions

What is driving the UK tech sector to a $1.2 trillion valuation in 2025?

The growth is driven by four interconnected forces: massive AI integration across industries, investor confidence boosted by the Cyber Security Resilience Bill 2025, a evolving but substantial venture capital landscape, and a fairer market enabled by Digital Markets Act enforcement.

How does the Cyber Security Resilience Bill 2025 actually help tech companies grow?

By mandating strict security standards, the bill reduces operational and reputational risk. This makes UK tech firms more attractive to institutional investors (like pension funds) who prioritize stability, leading to increased investment and higher valuations for compliant companies.

Are UK startups still struggling to get funding in 2025?

Yes, challenges remain, particularly for startups outside London and those seeking later-stage (Series C+) funding. While total capital is flowing, it’s taking longer to secure, and 75% of founders cite access to growth capital as a top barrier. However, the rounds that do close are often larger in size.

What role is deep tech playing in the UK’s tech valuation?

Deep tech is the high-value core of the growth. Valued at $155 billion and having grown 4.8x since 2019, it captures nearly one-third of all UK VC investment. This segment, including AI, biotech, and quantum, is creating durable, defensible companies that attract major investment and drive the valuation upward.

How will the Digital Markets Act 2025 affect smaller tech companies?

The Act is designed to benefit smaller companies by curbing anti-competitive practices by tech “gatekeepers.” This means fairer access to users, app stores, and data, lowering barriers to market entry and growth, which in turn stimulates innovation and makes the UK a more attractive place to build and scale a tech business.