Google Wallet Crypto Integration: The 2026 Catalyst for Mainstream Adoption

Estimated reading time: 8 minutes

Key Takeaways

- Google Wallet Crypto Integration is predicted to launch in 2026, bringing cryptocurrency access to billions via familiar apps, as highlighted by industry forecasts.

- This move signals the mainstream adoption of blockchain finance tools, transforming digital wallets into hubs for payments, investments, and DeFi, based on insights from unified wallet analyses and trend reports.

- The integration underscores the growing need for effective digital asset management to track diverse assets in one place, as discussed in ecosystem contexts.

- Future advancements will include ai financial insights, offering predictive analytics and personalized financial advice, per digital wallet trends and blockchain trends.

- Security and regulatory compliance, such as FinCEN MSB registration until June 30, 2026, will play a crucial role in the rollout, as noted in compliance reports and Google Play policies.

Table of contents

Introduction

Imagine a world where billions of users can access cryptocurrency as easily as sending a text message. That future is closer than you think, with predictions pointing to 2026 as the year a major Big Tech player like Google launches crypto wallet features, seamlessly integrating digital assets into everyday apps. This google wallet crypto integration is set to be the headline-making development that signals mainstream adoption, as highlighted by industry forecasts.

Google wallet crypto integration refers to Google’s anticipated move to add cryptocurrency support to its Wallet app, transforming it into a hub for blockchain finance. Although not yet live as of early 2026, this evolution is part of a broader finance tech trend that users are eagerly tracking, as seen in discussions about Google Wallet’s expansion.

This integration represents a key moment for blockchain finance tools, which are entering everyday use and turning digital wallets into comprehensive platforms for payments, investments, DeFi, and more. Insights from experts and trend reports underscore this shift.

In this post, we’ll unpack what google wallet crypto integration means, its place in the rising ecosystem of blockchain finance tools, the growing need for better digital asset management, and the future role of ai financial insights. Our goal is to satisfy your informational intent on the evolution of finance technology.

What is Google Wallet Crypto Integration?

Google wallet crypto integration is defined as Google’s predicted addition of cryptocurrency features to its Wallet app (formerly Google Pay). This would allow users to hold, view balances, and potentially transact with over 65 cryptocurrencies and stablecoins across multiple blockchains. Users could access DeFi and CeFi services for staking and lending, and benefit from secure key management with social recovery options. All this would be brought to non-crypto-native users via a familiar app, as described in analyses of unified wallets and crypto wallets for beginners.

Practically, users could expect features such as:

- Holding 65+ cryptocurrencies and stablecoins.

- Viewing multi-blockchain balances in one interface.

- Staking and lending via integrated DeFi and CeFi platforms.

- Managing keys securely with social recovery options, emulating emerging unified wallets.

These capabilities are based on trends in unified wallet development and mobile crypto wallets.

The adoption significance is monumental. Dragonfly’s Haseeb Qureshi predicts that Big Tech companies like Google will onboard billions of users by simplifying storage, swaps, and integrating with Google Pay-compatible crypto cards, targeting massive non-crypto audiences. This is supported by crypto wallet guides and Big Tech predictions.

Security is a critical aspect. With multi-biometric authentication (e.g., facial recognition, palm vein, voiceprint) and blockchain identity verification, fraud can be reduced. However, convenience improvements over traditional apps must balance with regulatory hurdles. For instance, Google’s Play Store requires FinCEN MSB registration until June 30, 2026, which could delay rollout, as noted in compliance reports and Google Play policies. As with any digital finance tool, understanding general digital security principles is crucial for users.

The competitive landscape is shifting. Google Wallet’s integration challenges players like PayPal and Stripe by merging fiat-crypto rails with automatic stablecoin conversions and low-fee P2P transactions. However, custodial models may limit flexibility compared to self-custody options like Trust Wallet, as discussed in unified wallet analyses and crypto wallet comparisons. It also enters a market where alternatives like Apple Wallet have explored different regional strategies and user workarounds.

This integration exemplifies how blockchain finance tools are making a practical shift to mainstream apps.

The Rise of Blockchain Finance Tools

Using google wallet crypto integration as a springboard, let’s explore the wider ecosystem of blockchain finance tools. These are platforms that merge traditional finance with blockchain technology, creating seamless bridges between fiat and digital assets. This evolution is part of the broader explosive Web3 revolution redefining the internet’s infrastructure.

The bigger picture involves traditional platforms like JPMorgan’s private blockchains or fintechs adding stablecoin gateways, enabling instant swaps (speed), on-chain verification (transparency), and reduced intermediary costs. This is detailed in unified wallet insights, Big Tech trends, and blockchain trends reports.

Other examples of blockchain finance tools include:

- DigiPay.Guru’s hybrid rails for fiat, CBDC, and crypto transactions.

- Trustee Plus’s Google Pay-linked crypto cards, creating superapps for commerce, remittances, and investments.

These are highlighted in digital wallet trends and crypto wallet features.

User benefits are significant: unified asset views reduce friction for everyday transactions. To illustrate, here’s a table comparing key platforms:

| Platform/Example | Key Integration | User Benefit |

|---|---|---|

| Trust Wallet [source] | 50+ blockchains, Binance swaps | Simple retail access |

| PayPal/Stripe analogs [source] | Fiat-stablecoin rails, virtual cards | Fraud reduction, controls |

| Fortune 100 blockchains [source] | Private TradFi-DeFi bridges | Enterprise-scale efficiency |

Throughout this discussion, blockchain finance tools are naturally reinforced as integral to the financial evolution.

Digital Asset Management: A New Challenge

The convergence of google wallet crypto integration and blockchain finance tools creates new challenges, spotlighting the critical role of digital asset management. This is defined as the unified tracking of diverse assets like cryptocurrency, loyalty points, and tickets in one dashboard amid a fragmented ecosystem, as explained in unified wallet contexts.

Challenges include:

- Tracking assets across multiple wallets and exchanges.

- Ensuring wallet compatibility and interoperability.

- Maintaining security in a multi-asset world.

Solutions involve portfolio tracking tools, single sign-on systems, and non-custodial keys with recovery options, despite regulatory hurdles. These are covered in unified wallet solutions, self-custody wallets, and licensing compliance issues.

Integrated Google Wallet is positioned as a step toward simplified digital asset management hubs. Best practices, such as secure key management, are essential for users to adopt these tools effectively.

AI Financial Insights: The Next Frontier

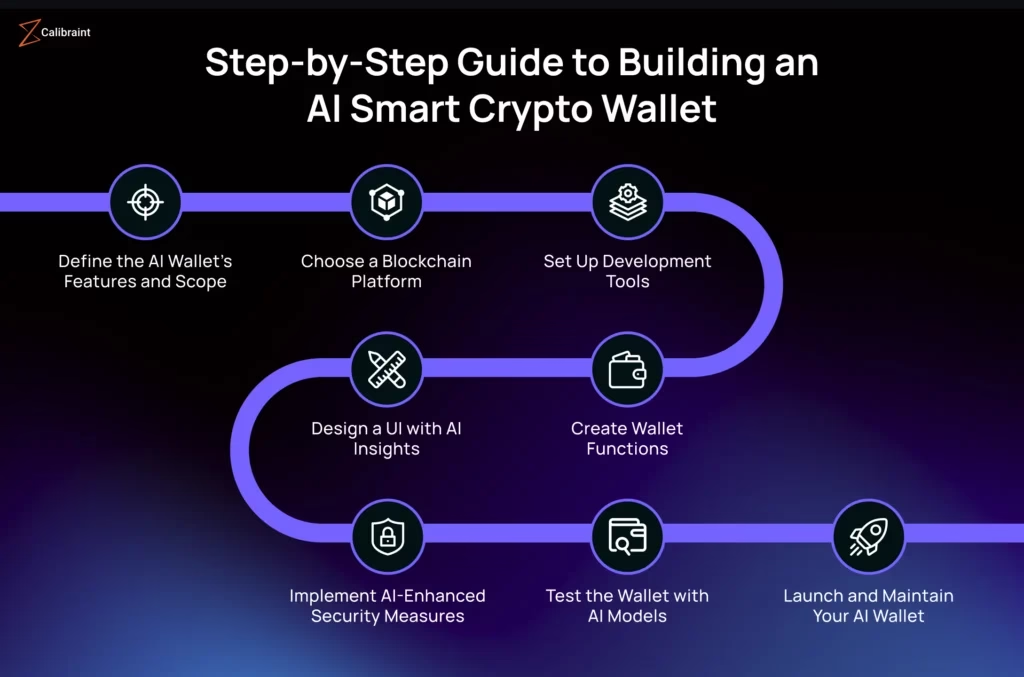

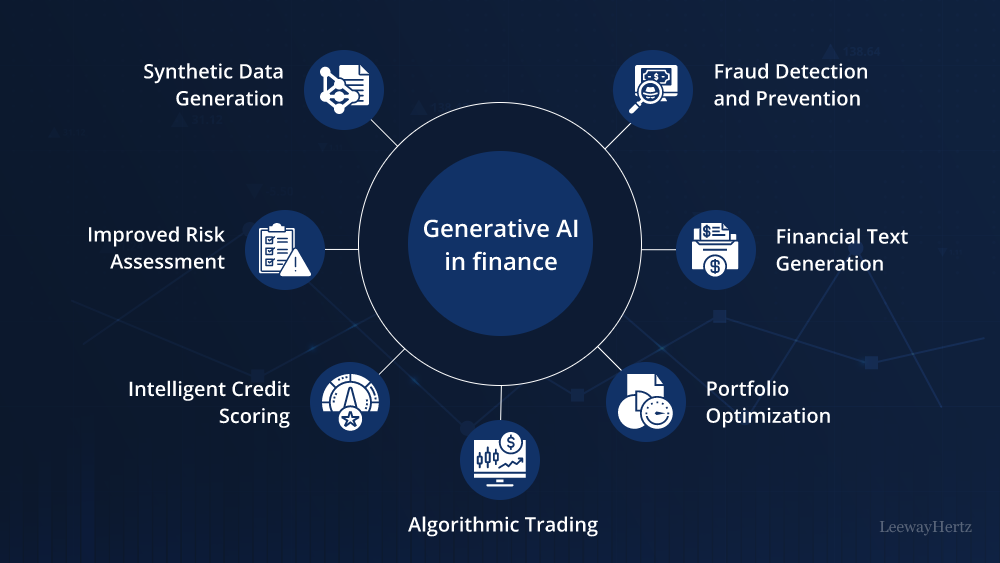

Looking forward, ai financial insights are set to revolutionize finance. Defined as GenAI embedded in 2026 wallets for predictive analytics on spending, crypto performance, and market trends across fiat and digital holdings, they offer personalized advice, automated crypto tax calculations, and portfolio rebalancing. This is based on digital wallet trends and blockchain trends. This mirrors how AI is revolutionizing finance through advanced detection and analytics.

Future features for Google Wallet could include:

- Real-time fraud detection using AI algorithms.

- Natural language budget planning assistants.

- Loyalty personalization based on spending patterns.

These features converge AI and blockchain for proactive finance management, as described in trend reports. The underlying hardware powering such AI, like advanced chips from industry leaders, is a key enabler, as noted in AI growth insights.

This builds on google wallet crypto integration, blockchain finance tools, and digital asset management to optimize financial experiences. Ai financial insights represent the next frontier in this evolution.

Frequently Asked Questions

Q: What is Google Wallet crypto integration?

A: Google Wallet crypto integration is the predicted addition of cryptocurrency support to Google’s Wallet app, allowing users to hold, transact, and manage digital assets seamlessly. It’s expected to launch around 2026, as per industry forecasts.

Q: How will blockchain finance tools benefit everyday users?

A: Blockchain finance tools merge traditional and digital finance, offering benefits like instant swaps, transparency, and reduced costs. They enable unified asset views and access to DeFi services, as detailed in unified wallet analyses.

Q: Why is digital asset management important?

A: With the proliferation of digital assets, managing them in one place reduces friction and enhances security. Integrated wallets like Google Wallet aim to simplify this, but challenges remain, as discussed in digital asset management contexts.

Q: What role will AI financial insights play?

A: AI financial insights will provide predictive analytics, personalized advice, and automated tasks like tax calculations. They represent the next layer of intelligence in finance tools, as seen in future trends.

Q: Are there security concerns with Google Wallet crypto integration?

A: Security is a priority, with multi-biometric authentication and blockchain verification. However, regulatory compliance, such as FinCEN MSB registration, may impact rollout. Users should follow digital security principles to stay safe.