UK Tech Sector Valuation 2025: Explosive Growth to $1.2 Trillion and Beyond

Estimated reading time: 10 minutes

Key Takeaways

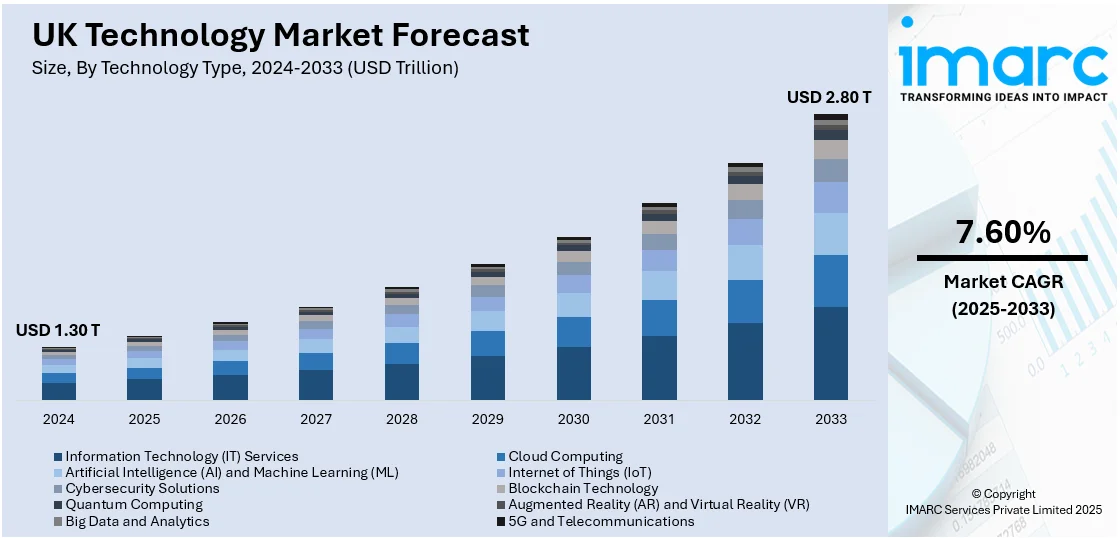

- The UK tech sector valuation 2025 growth has surged, reaching a combined market valuation of $1.2 trillion (£886 billion) in the first half of 2025, growing at a compound annual growth rate (CAGR) of 12.5% and outpacing European peers.

- This growth is driven by interconnected factors: AI integration in UK businesses 2025, regulatory shifts like the Cyber Security Resilience Bill 2025 impact and Digital Markets Act 2025 enforcement, and navigating UK startup funding challenges 2025.

- London dominates with a $693.7 billion ecosystem, but regional hubs are emerging, supported by record exits and deep tech investments exceeding $43.7 billion since 2019.

- The future outlook remains positive, with sustained growth reliant on late-stage capital, policy alignment, and innovation in AI and cybersecurity.

Table of Contents

- UK Tech Sector Valuation 2025: Explosive Growth to $1.2 Trillion and Beyond

- Key Takeaways

- Introduction: The UK Tech Boom

- Snapshot of Current Trends: Valuation and Investment

- AI Integration in UK Businesses 2025: The Engine of Growth

- Cyber Security Resilience Bill 2025 Impact: Building Digital Trust

- UK Startup Funding Challenges 2025: Navigating the Hurdles

- Digital Markets Act 2025 Enforcement: Ensuring Fair Play

- Synthesis: How Drivers Interconnect to Fuel Growth

- Future Outlook and Strategic Recommendations

- Frequently Asked Questions

Introduction: The UK Tech Boom

The UK tech sector valuation 2025 growth is a phenomenon capturing global attention, with the sector reaching a combined market valuation of $1.2 trillion (£886 billion) in the first half of 2025, growing at a compound annual growth rate (CAGR) of 12.5% and outpacing European peers like Germany and France. This positions the UK as Europe’s leading tech ecosystem, as highlighted by reports from Start Grow Improve, Dealroom, Tech Nation, and the Royal Academy of Engineering. For a deeper dive, explore our analysis in Unlocking the Phenomenal UK Tech Sector Valuation 2025: Essential Drivers for Explosive Growth and Unlocking the Future: A Comprehensive UK Technology Trends 2025 Analysis.

But what exactly is UK tech sector valuation 2025 growth? It refers to the rapid increase in combined company valuations driven by resilient investment, AI advancements, and regulatory shifts, despite funding challenges. This growth is crucial for the UK economy as a key driver of innovation, jobs, and global competitiveness. In this post, we’ll analyze the key drivers: AI integration in UK businesses 2025, Cyber Security Resilience Bill 2025 impact, UK startup funding challenges 2025, and Digital Markets Act 2025 enforcement—all interconnected forces propelling the sector forward.

Snapshot of Current Trends: Valuation and Investment

The UK’s tech valuation surged to $1.2 trillion by mid-2025, more than double the combined value of Germany and France’s sectors, according to UK Tech News and Tech Nation. This expansion is part of broader shifts captured in UK Tech Market Trends 2025: A Comprehensive Forecast of Booming Robotics, AI, Cybersecurity, and XR Adoption.

- Investment Influx: Startups raised over $7 billion (£5 billion) in venture capital (VC) in H1 2025, with Q1 as the strongest first quarter in three years. Deep tech accounted for 31% of VC, totaling $43.7 billion since 2019, as per the Royal Academy of Engineering.

- London’s Dominance: London’s ecosystem is valued at $693.7 billion (59% of the total), growing at a 12% CAGR, with over 34,000 high-growth firms by Q3 2025 raising £121 billion in equity since 2020, based on data from Deloitte and UK Government.

- Record Exits: There were $20 billion in M&A deals and five $1 billion+ deals in 2025, mostly to international buyers, linking directly to UK tech sector valuation 2025 growth, as noted by Start Grow Improve.

This sets the stage for examining how AI integration in UK businesses 2025 and other drivers sustain this momentum.

AI Integration in UK Businesses 2025: The Engine of Growth

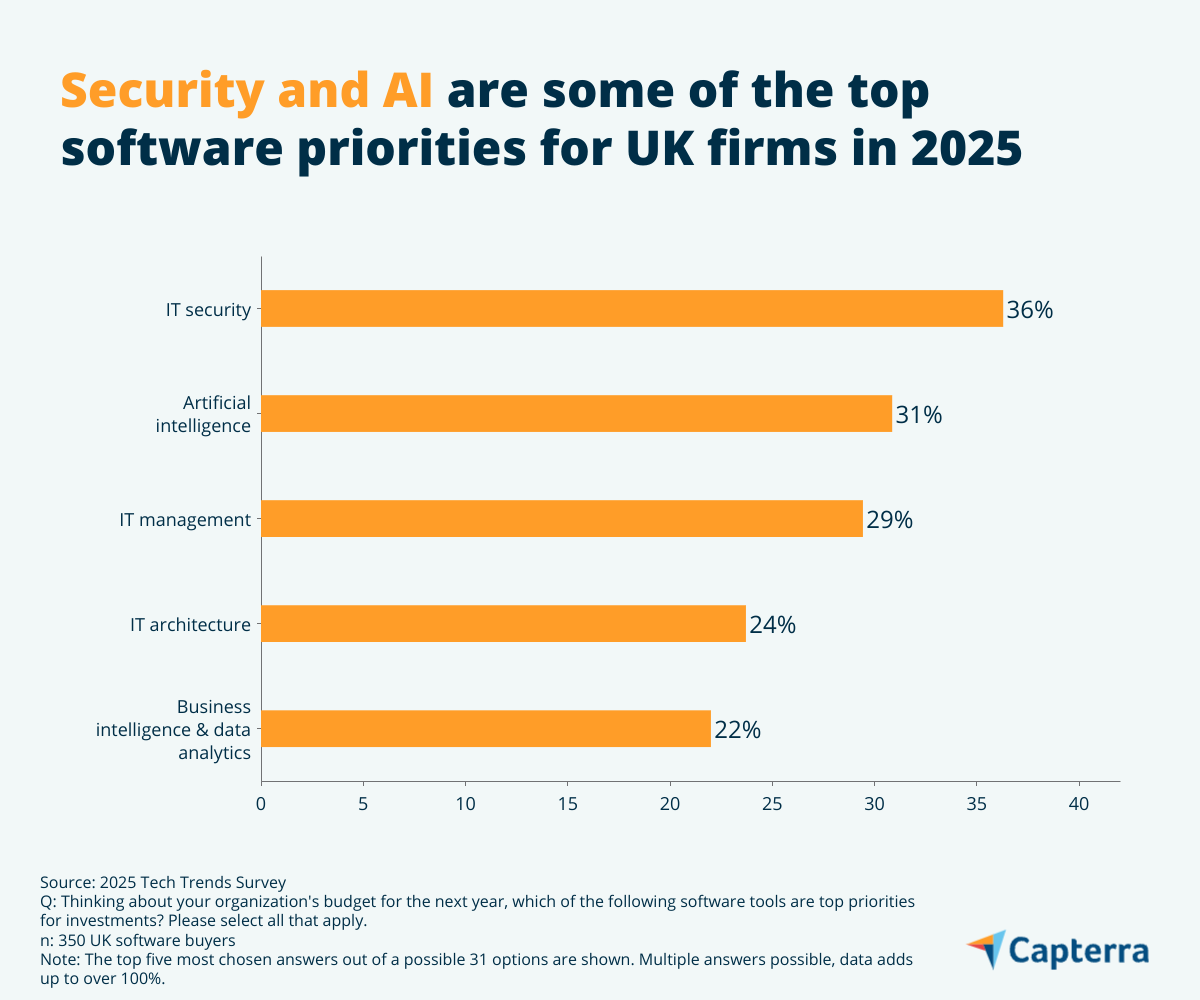

AI integration in UK businesses 2025 refers to the adoption of AI technologies like generative AI, automation, and data analytics to drive efficiency, scalability, and new revenue streams in sectors such as fintech, health tech, and robotics. The transformative effect is explored in Navigating the Profound Impact of AI on UK Jobs, while regulations are detailed in Mind-Blowing AI Regulations in the UK.

How does AI fuel valuation growth?

- Investment Surge: £1.1 billion investments in generative AI and deep tech have propelled startups’ combined value to $155 billion (up 4.8x since 2019), with over 50 deep tech firms exceeding $1 billion valuations, supported by UK research excellence, per the Royal Academy of Engineering.

- Sectoral Impact: The largest funding rounds target AI and deep tech, enabling efficiency in fintech (£3.1 billion VC), health tech (£2.6 billion), and robotics (83% CAGR 2020-2024), directly boosting UK tech sector valuation 2025 growth, as reported by UK Tech News.

As one founder noted, “AI isn’t just a tool; it’s the backbone of our scalability, allowing us to compete globally.” This integration contributes significantly to the sector’s 12.5% CAGR, making it a cornerstone of UK tech sector valuation 2025 growth.

Cyber Security Resilience Bill 2025 Impact: Building Digital Trust

The Cyber Security Resilience Bill 2025 impact involves emerging legislation aimed at strengthening digital infrastructure resilience amid rising cyber threats, though no direct 2025 details exist yet. It aligns with the sector’s focus on cybersecurity demands driven by AI and deep tech growth, as discussed in Deloitte’s insights and UK Tech News. This aligns with trends in Unlocking the Future: Essential UK Cybersecurity Market Trends 2025.

Key implications include:

- Enhanced Trust: By reducing vulnerabilities, the bill fosters digital trust, creating opportunities for cybersecurity startups and attracting investment to secure innovations.

- Countering Funding Pressures: It helps counter subdued funding from regulatory pressures, indirectly supporting valuations by building investor confidence.

In essence, the Cyber Security Resilience Bill 2025 impact provides regulatory stability that underpins the ecosystem’s 12.5% CAGR, making it a silent enabler of UK tech sector valuation 2025 growth.

UK Startup Funding Challenges 2025: Navigating the Hurdles

UK startup funding challenges 2025 persist despite recovery, with time to Series C doubling to 9.6 years since 2019, and 75% of founders citing growth capital as the top barrier, especially outside London, according to UK Tech News and Start Grow Improve.

Digging deeper:

- Regional Disparities: London raised 7x more than other areas, yet median early-stage rounds grew to £1.6 million (from £880,000 five years ago), providing longer runways. High-growth firms raised £13.3 billion in Q1-Q3 2025, but year-over-year declines highlight access issues.

- Innovation Spur: These challenges incentivize efficiency and acquisitions, with 98% of 291 exits being acquisitions, as per Deloitte.

Thus, UK startup funding challenges 2025 are a double-edged sword: they slow some growth but spur innovation and consolidation, ultimately contributing to UK tech sector valuation 2025 growth through strategic adaptations.

Digital Markets Act 2025 Enforcement: Ensuring Fair Play

The Digital Markets Act 2025 enforcement (referencing UK adaptations like the Digital Markets, Competition and Consumers Act) promotes fair competition, protects consumer data, and stabilizes the market amid investment corrections, as analyzed by Deloitte. The broader context is covered in Mind-Blowing AI Regulations in the UK.

Why does it matter?

- Support for Startups: It supports over 17,000 VC-backed startups, aiding public listings and attracting commitments like Microsoft’s £22 billion and Google’s £5 billion, bolstering investor trust.

- Countering Challenges: This enforcement helps counter UK startup funding challenges 2025 by fostering a stable environment for scaled expansion.

By ensuring fair play, the Digital Markets Act 2025 enforcement directly links to UK tech sector valuation 2025 growth, creating a predictable landscape for innovation.

Synthesis: How Drivers Interconnect to Fuel Growth

The drivers are deeply interconnected: AI integration in UK businesses 2025 drives investment (31% VC share), while the Cyber Security Resilience Bill 2025 impact and Digital Markets Act 2025 enforcement ensure trust and fair play. Meanwhile, UK startup funding challenges 2025 spur consolidation, leading to record M&A activity. Regional hubs like the Golden Triangle amplify scale, with deep tech’s $155 billion value and London’s dominance exemplifying synergy that outstrips Europe, based on data from UK Tech News, the Royal Academy of Engineering, Start Grow Improve, Deloitte, and the UK Government.

Together, these elements—AI integration in UK businesses 2025, Cyber Security Resilience Bill 2025 impact, overcoming UK startup funding challenges 2025, and Digital Markets Act 2025 enforcement—collectively propel UK tech sector valuation 2025 growth to new heights.

Future Outlook and Strategic Recommendations

The future outlook points to sustained 12.5% CAGR, emphasizing needs for late-stage capital, regional clusters, and policy alignment, as highlighted by UK Tech News and the Royal Academy of Engineering.

Strategic recommendations include:

- For Investors: Target AI and deep tech sectors, leveraging the momentum from AI integration in UK businesses 2025.

- For Startups: Prioritize acquisition paths and London networks to navigate UK startup funding challenges 2025.

- For Policymakers: Enhance non-London funding and align regulations like the Cyber Security Resilience Bill 2025 impact and Digital Markets Act 2025 enforcement to support growth.

This forward-looking context reinforces how all keywords—UK tech sector valuation 2025 growth, AI integration in UK businesses 2025, Cyber Security Resilience Bill 2025 impact, UK startup funding challenges 2025, and Digital Markets Act 2025 enforcement—will continue to shape the ecosystem.

Frequently Asked Questions

What is the current valuation of the UK tech sector in 2025?

The UK tech sector reached a combined market valuation of $1.2 trillion (£886 billion) in the first half of 2025, growing at a 12.5% CAGR, as reported by UK Tech News and others.

How does AI integration drive UK tech sector growth?

AI integration in UK businesses 2025 fuels growth through investments in generative AI and deep tech, with startups’ value hitting $155 billion, contributing to efficiency in fintech, health tech, and robotics, as detailed in deep tech reports.

What is the impact of the Cyber Security Resilience Bill 2025?

The Cyber Security Resilience Bill 2025 impact aims to strengthen digital trust and reduce vulnerabilities, indirectly supporting valuations by attracting investment to cybersecurity innovations, aligning with insights from Deloitte.

What are the main funding challenges for UK startups in 2025?

UK startup funding challenges 2025 include elongated funding cycles, regional disparities, and growth capital barriers, but they also spur innovation and consolidation, as noted by Start Grow Improve.

How does the Digital Markets Act 2025 enforcement affect the tech sector?

The Digital Markets Act 2025 enforcement promotes fair competition and market stability, supporting VC-backed startups and attracting large investments, thereby fostering UK tech sector valuation 2025 growth, per Deloitte’s analysis.